Most Shareholders Will Probably Agree With Kingdom Holdings Limited's (HKG:528) CEO Compensation

Key Insights

- Kingdom Holdings to hold its Annual General Meeting on 14th of June

- Total pay for CEO Weiming Ren includes CN¥2.00m salary

- The overall pay is comparable to the industry average

- Kingdom Holdings' total shareholder return over the past three years was 5.1% while its EPS grew by 63% over the past three years

Performance at Kingdom Holdings Limited (HKG:528) has been reasonably good and CEO Weiming Ren has done a decent job of steering the company in the right direction. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 14th of June. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Kingdom Holdings

How Does Total Compensation For Weiming Ren Compare With Other Companies In The Industry?

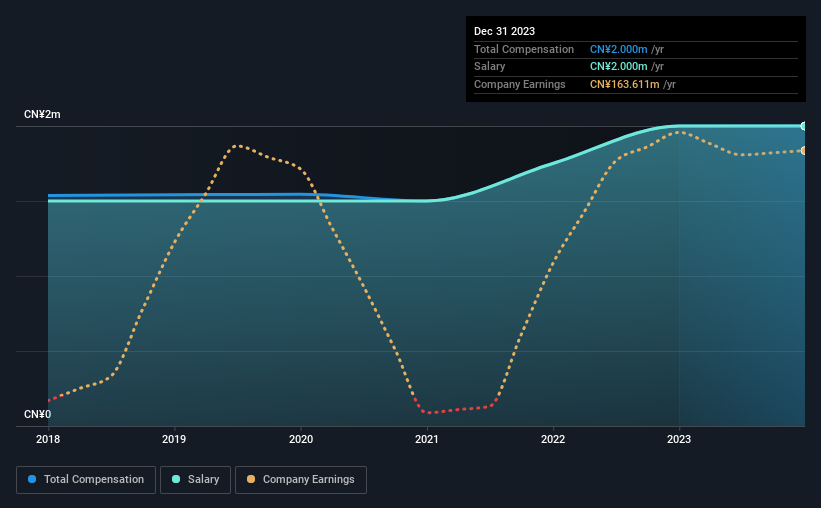

Our data indicates that Kingdom Holdings Limited has a market capitalization of HK$734m, and total annual CEO compensation was reported as CN¥2.0m for the year to December 2023. There was no change in the compensation compared to last year. Notably, the salary of CN¥2.0m is the entirety of the CEO compensation.

On comparing similar-sized companies in the Hong Kong Luxury industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was CN¥1.9m. So it looks like Kingdom Holdings compensates Weiming Ren in line with the median for the industry. What's more, Weiming Ren holds HK$14m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CN¥2.0m | CN¥2.0m | 100% |

| Other | - | - | - |

| Total Compensation | CN¥2.0m | CN¥2.0m | 100% |

Talking in terms of the industry, salary represented approximately 94% of total compensation out of all the companies we analyzed, while other remuneration made up 6% of the pie. On a company level, Kingdom Holdings prefers to reward its CEO through a salary, opting not to pay Weiming Ren through non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Kingdom Holdings Limited's Growth Numbers

Over the past three years, Kingdom Holdings Limited has seen its earnings per share (EPS) grow by 63% per year. In the last year, its revenue is up 21%.

Shareholders would be glad to know that the company has improved itself over the last few years. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Kingdom Holdings Limited Been A Good Investment?

Kingdom Holdings Limited has not done too badly by shareholders, with a total return of 5.1%, over three years. It would be nice to see that metric improve in the future. As a result, investors in the company might be reluctant about agreeing to increase CEO pay in the future, before seeing an improvement on their returns.

In Summary...

Kingdom Holdings pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Kingdom Holdings that investors should be aware of in a dynamic business environment.

Important note: Kingdom Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Kingdom Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:528

Kingdom Holdings

An investment holding company, engages in the manufacture and sale of linen yarns in Mainland China, the European Union, and internationally.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026