- Hong Kong

- /

- Consumer Durables

- /

- SEHK:526

Hong Kong's Hidden Treasures Three Promising Small Caps To Consider

Reviewed by Simply Wall St

As global markets experience varied performances, with the Hang Seng Index in Hong Kong recently facing a decline, attention is turning to small-cap stocks that may offer unique opportunities amid broader market fluctuations. In this context, identifying promising small caps involves looking for companies with strong fundamentals and growth potential that can thrive despite economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Hong Kong

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 16.91% | 14.33% | 10.15% | ★★★★★★ |

| PW Medtech Group | 0.06% | 22.33% | -17.56% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Changjiu Holdings | NA | 11.84% | 2.46% | ★★★★★★ |

| Sundart Holdings | 0.92% | -2.32% | -3.94% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| S.A.S. Dragon Holdings | 60.96% | 4.62% | 10.02% | ★★★★★☆ |

| Carote | 2.36% | 85.09% | 92.12% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| Chongqing Machinery & Electric | 27.77% | 8.82% | 11.12% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai INT Medical Instruments (SEHK:1501)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shanghai INT Medical Instruments Co., Ltd. focuses on the development, manufacturing, and sale of medical devices with a market capitalization of HK$5.24 billion.

Operations: The primary revenue stream for Shanghai INT Medical Instruments comes from its Cardiovascular Interventional Business, generating CN¥718.71 million. The company has a market capitalization of HK$5.24 billion.

Shanghai INT Medical Instruments showcases a compelling profile with its earnings growth of 5.3% over the past year, outpacing the Medical Equipment industry's -4.3%. The company reported sales of CNY 392.32 million for the first half of 2024, up from CNY 339.76 million a year prior, and net income rose to CNY 100.54 million from CNY 80.5 million. Trading at roughly 46% below estimated fair value suggests potential undervaluation while maintaining more cash than total debt indicates financial stability despite an increase in its debt-to-equity ratio from zero to three percent over five years.

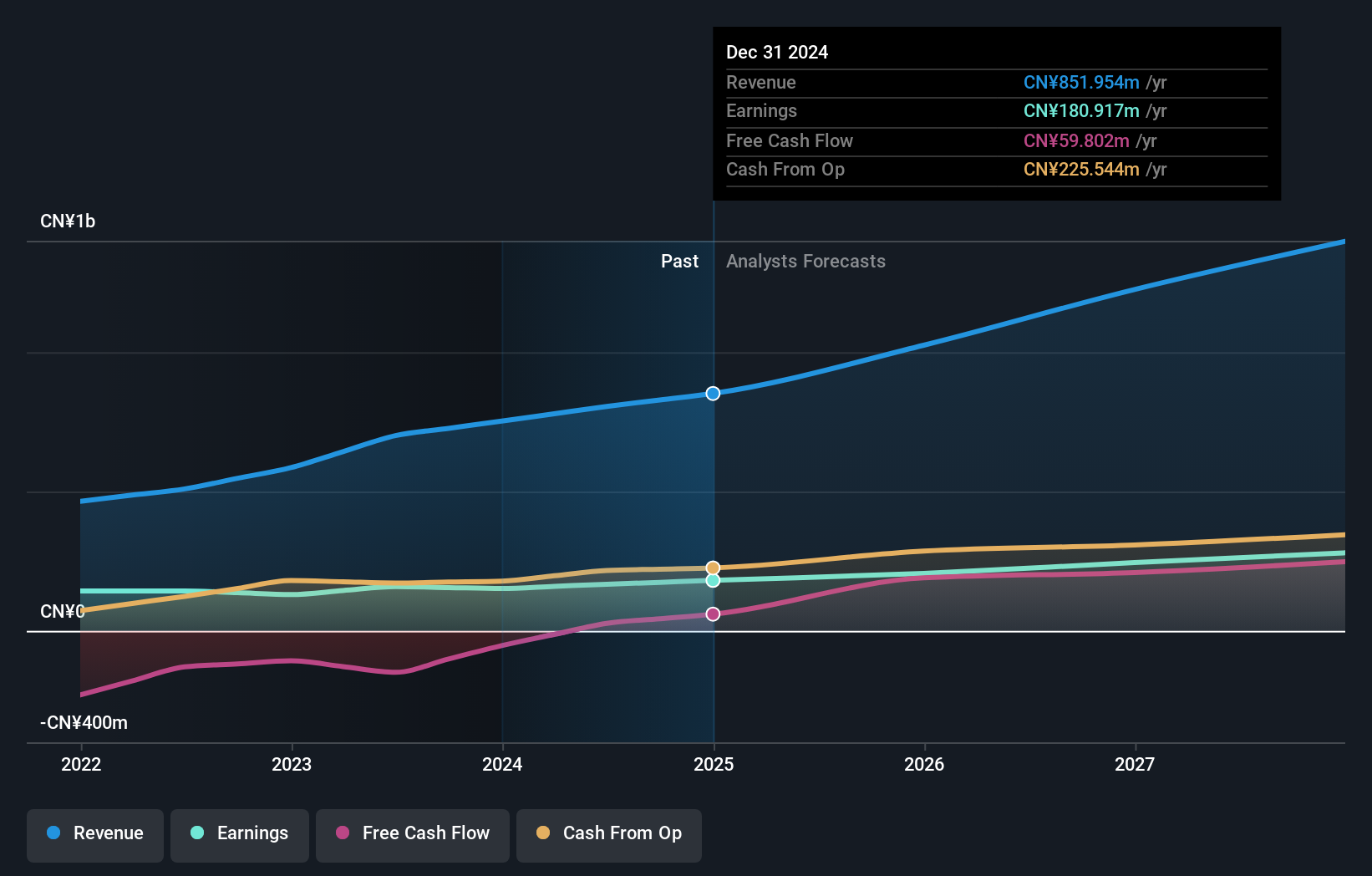

Precision Tsugami (China) (SEHK:1651)

Simply Wall St Value Rating: ★★★★★★

Overview: Precision Tsugami (China) Corporation Limited is an investment holding company that focuses on the manufacture and sale of computer numerical control machine tools in Mainland China and international markets, with a market capitalization of HK$4.23 billion.

Operations: The company generates revenue primarily from the manufacture and sale of CNC high precision machine tools, amounting to CN¥3.12 billion.

Precision Tsugami (China) is making waves with a profit boost of RMB 340 million for the recent half-year, reflecting a 54% rise from last year's RMB 221 million. With no debt on its books, this small-scale player in the machinery sector stands out by trading at 74% below estimated fair value. Despite past earnings growth challenges, future projections look promising with an expected annual growth rate of over 23%. The company's strategic focus on optimizing operations and capitalizing on increased demand for CNC machine tools seems to be paying off amidst China's economic recovery.

- Delve into the full analysis health report here for a deeper understanding of Precision Tsugami (China).

Gain insights into Precision Tsugami (China)'s past trends and performance with our Past report.

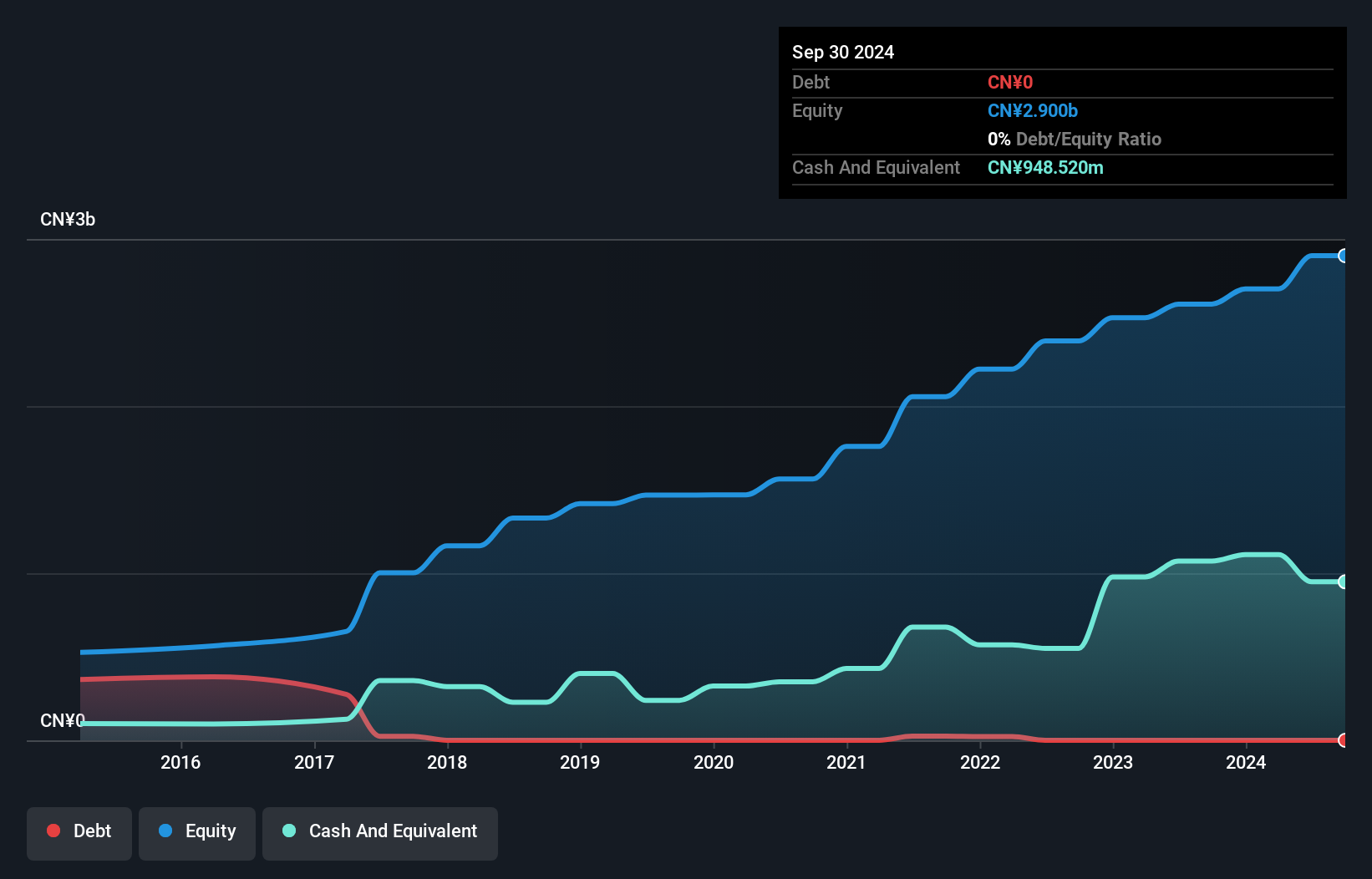

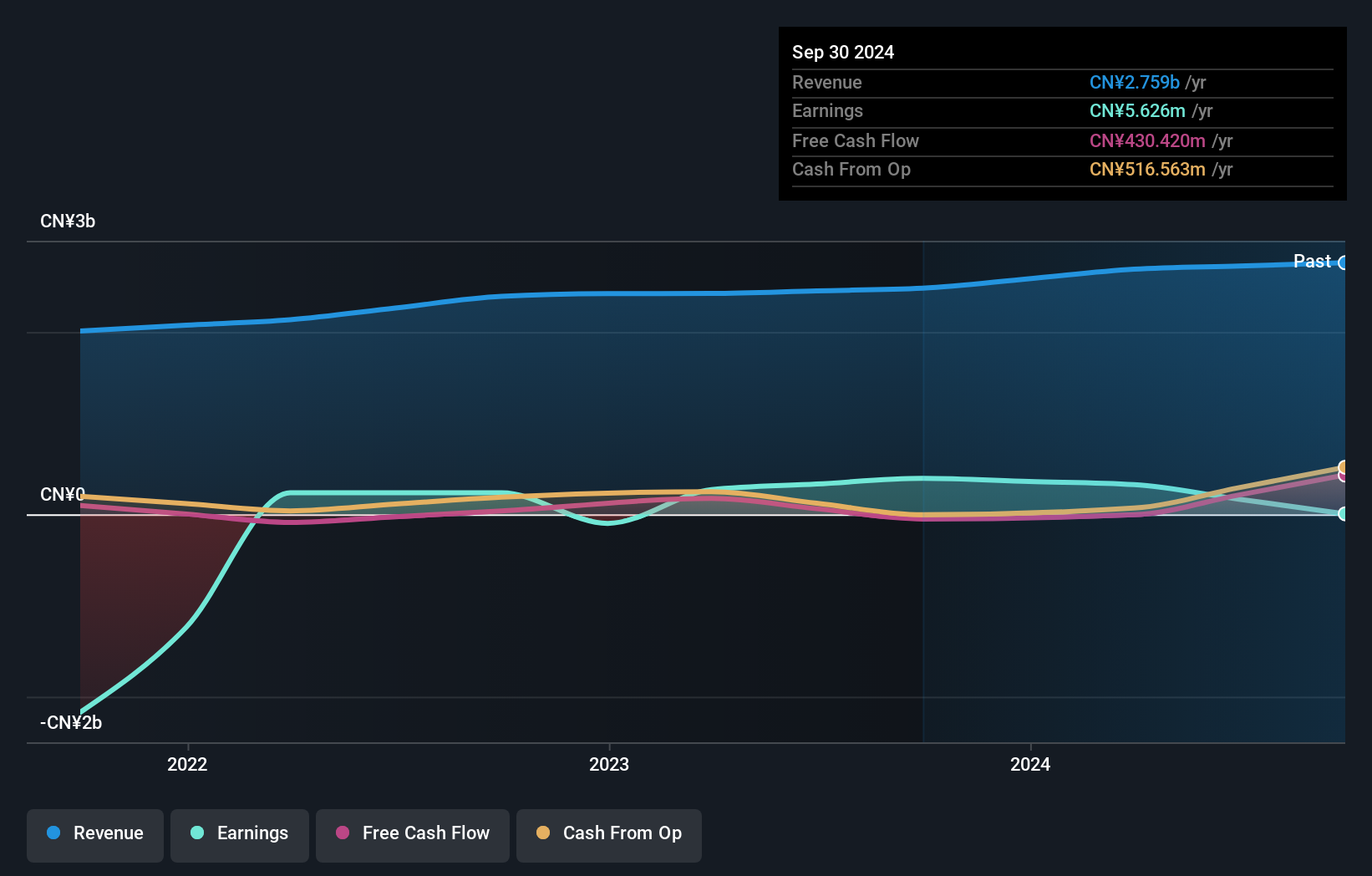

Lisi Group (Holdings) (SEHK:526)

Simply Wall St Value Rating: ★★★★★☆

Overview: Lisi Group (Holdings) Limited is an investment holding company that manufactures and trades plastic and metallic household products across Mainland China, Hong Kong, the United States, Europe, and other international markets, with a market capitalization of HK$1.95 billion.

Operations: Lisi Group generates revenue through four primary segments: Retail (CN¥332.82 million), Wholesale (CN¥953.97 million), Investments Holding (CN¥33.68 million), and Manufacturing and Trading (CN¥1.44 billion). The Manufacturing and Trading segment is the largest contributor to its revenue stream.

Lisi Group, a small player in Hong Kong's market, is showing some promising traits despite recent volatility. The company's earnings growth of 20.5% last year outpaced the Consumer Durables industry slightly, hinting at potential resilience. With a price-to-earnings ratio of 5.5x, it appears undervalued compared to the broader Hong Kong market average of 10x. Impressively, Lisi's interest payments are well covered by EBIT at 17 times over, suggesting strong financial management. Recent executive changes and an HKD 60.8 million equity offering could indicate strategic shifts aimed at enhancing long-term value and stability for shareholders.

- Click here to discover the nuances of Lisi Group (Holdings) with our detailed analytical health report.

Evaluate Lisi Group (Holdings)'s historical performance by accessing our past performance report.

Next Steps

- Access the full spectrum of 165 SEHK Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:526

Lisi Group (Holdings)

An investment holding company, manufactures and trades in plastic and metallic household products in Mainland China, Hong Kong, the United States, Europe, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives