- Hong Kong

- /

- Consumer Durables

- /

- SEHK:464

China Overseas Nuoxin International Holdings (HKG:464) Is Making Moderate Use Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that China Overseas Nuoxin International Holdings Limited (HKG:464) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for China Overseas Nuoxin International Holdings

What Is China Overseas Nuoxin International Holdings's Net Debt?

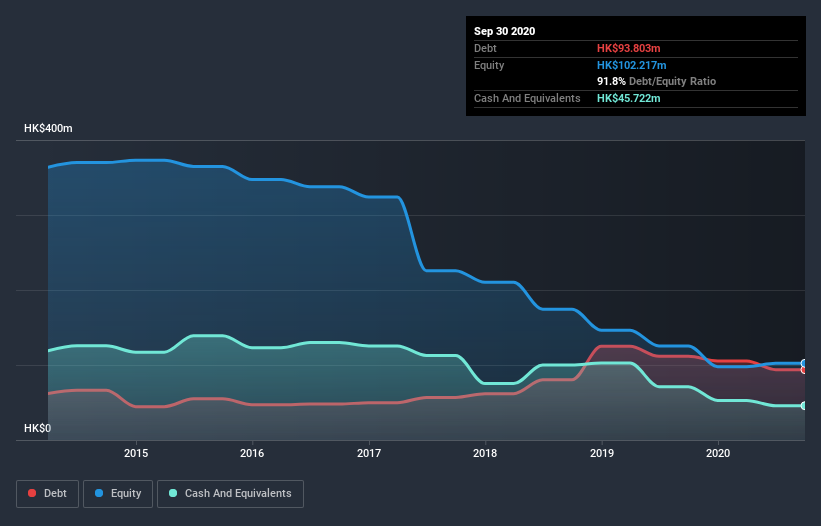

As you can see below, China Overseas Nuoxin International Holdings had HK$93.2m of debt at September 2020, down from HK$111.5m a year prior. However, it does have HK$45.7m in cash offsetting this, leading to net debt of about HK$47.4m.

How Strong Is China Overseas Nuoxin International Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that China Overseas Nuoxin International Holdings had liabilities of HK$234.8m due within 12 months and liabilities of HK$15.1m due beyond that. On the other hand, it had cash of HK$45.7m and HK$122.1m worth of receivables due within a year. So its liabilities total HK$82.1m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of HK$127.0m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since China Overseas Nuoxin International Holdings will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, China Overseas Nuoxin International Holdings made a loss at the EBIT level, and saw its revenue drop to HK$396m, which is a fall of 16%. That's not what we would hope to see.

Caveat Emptor

Not only did China Overseas Nuoxin International Holdings's revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable HK$25m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled HK$6.8m in negative free cash flow over the last twelve months. So in short it's a really risky stock. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with China Overseas Nuoxin International Holdings (at least 1 which doesn't sit too well with us) , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade China Overseas Nuoxin International Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:464

China In-Tech

An investment holding company, designs, manufactures, and sells electrical haircare and healthcare products, and other small household electrical appliances in Asia, Europe, North and South America, and Australia.

Excellent balance sheet very low.

Market Insights

Community Narratives