The Bull Case For Bosideng International Holdings (SEHK:3998) Could Change Following Steady EPS And Higher Dividend

Reviewed by Sasha Jovanovic

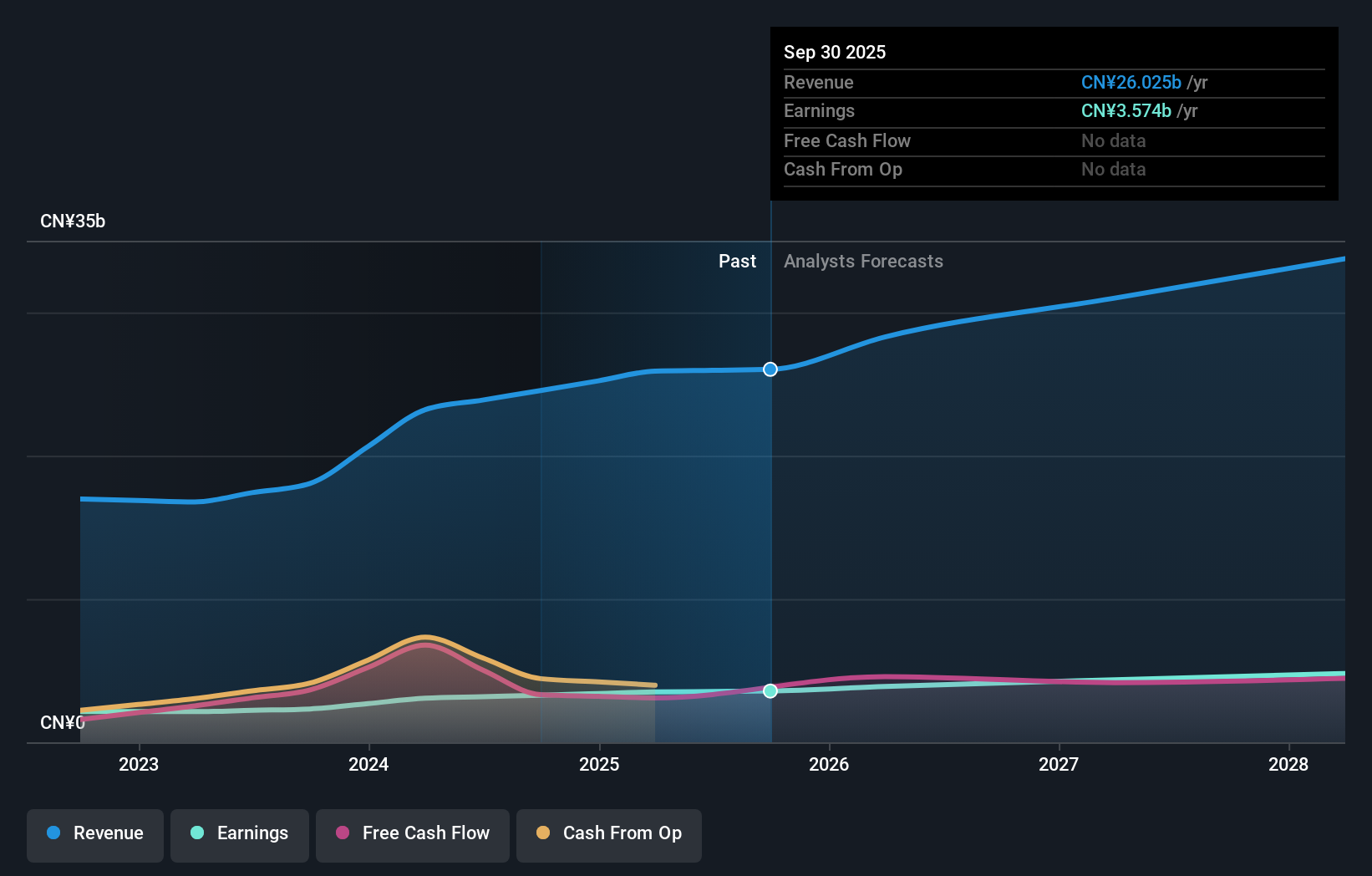

- Bosideng International Holdings reported half-year results for the period ended September 30, 2025, with sales of CNY 8,927.64 million and net income of CNY 1,189.37 million, and its board recommended an interim dividend of HK$0.063 (approximately CNY 0.057) per share, payable in January 2026.

- While basic earnings per share were unchanged year on year at CNY 0.1035, the slight improvement in diluted earnings per share highlights incremental profitability gains even after factoring in potential share dilution.

- Next, we’ll examine how Bosideng’s combination of steady earnings and a higher interim dividend shapes its broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Bosideng International Holdings' Investment Narrative?

For someone considering Bosideng, the core belief is that its down-wear brand can keep converting strong consumer recognition into consistent earnings, even as competition and fashion cycles shift. The latest half-year numbers, with slightly higher sales and net profit, broadly back that view without really moving the dial on near-term catalysts. The more interesting signal is the board’s decision to lift the interim dividend again, despite earnings per share being flat. That reinforces the story of Bosideng as an income-and-quality play, but it also sharpens existing questions around dividend sustainability given free cash flow coverage concerns. With the share price already up strongly this year and the stock screening as relatively expensive on earnings multiples, the balance between generous payouts, cash generation and future growth investment becomes even more central to the risk-reward trade-off.

However, dividend generosity may be running ahead of Bosideng’s underlying cash generation, which investors should note. Our expertly prepared valuation report on Bosideng International Holdings implies its share price may be too high.Exploring Other Perspectives

Explore 4 other fair value estimates on Bosideng International Holdings - why the stock might be worth 26% less than the current price!

Build Your Own Bosideng International Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bosideng International Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bosideng International Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bosideng International Holdings' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bosideng International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3998

Bosideng International Holdings

Engages in the apparel business in the People’s Republic of China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026