3 Value Stock Picks Estimated To Be Trading At Up To 49.6% Discount

Reviewed by Simply Wall St

As global markets navigate the uncertainties of the incoming Trump administration's policies, investors are witnessing a mix of sector performances and fluctuating indices. Amidst this volatility, identifying undervalued stocks can be a prudent strategy for those looking to capitalize on potential market inefficiencies. In this context, assessing company fundamentals and market positioning becomes crucial in determining which stocks may offer value opportunities despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet Rhodiola Pharmaceutical Holding (SHSE:600211) | CN¥38.49 | CN¥76.93 | 50% |

| Cambi (OB:CAMBI) | NOK15.10 | NOK30.20 | 50% |

| Wuhan Keqian BiologyLtd (SHSE:688526) | CN¥14.57 | CN¥29.09 | 49.9% |

| Insyde Software (TPEX:6231) | NT$464.50 | NT$927.39 | 49.9% |

| SeSa (BIT:SES) | €75.50 | €150.49 | 49.8% |

| Zhaojin Mining Industry (SEHK:1818) | HK$11.58 | HK$23.06 | 49.8% |

| CS Wind (KOSE:A112610) | ₩41150.00 | ₩82262.52 | 50% |

| Advanced Energy Industries (NasdaqGS:AEIS) | US$109.84 | US$219.25 | 49.9% |

| Intellian Technologies (KOSDAQ:A189300) | ₩44450.00 | ₩88757.99 | 49.9% |

| St. James's Place (LSE:STJ) | £8.21 | £16.37 | 49.9% |

Let's review some notable picks from our screened stocks.

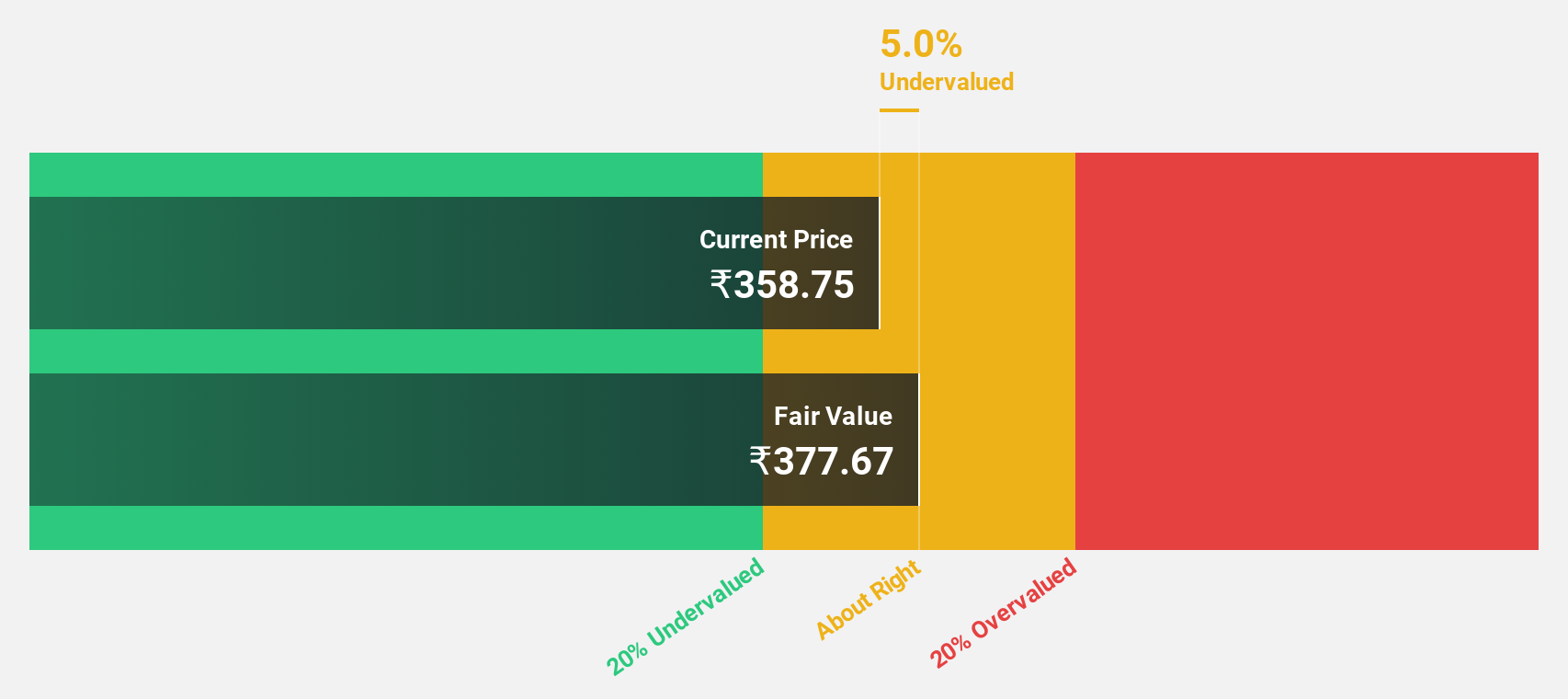

Delhivery (NSEI:DELHIVERY)

Overview: Delhivery Limited offers supply chain solutions across various sectors in India, including e-commerce, retail, and manufacturing, with a market cap of ₹242.50 billion.

Operations: The company's revenue from logistics services amounts to ₹86.32 billion.

Estimated Discount To Fair Value: 11.1%

Delhivery's recent earnings report shows a turnaround with a net income of INR 102.04 million for the second quarter, compared to a loss last year. The stock trades at INR 344.25, slightly below its estimated fair value of INR 387.29, suggesting it may be undervalued based on cash flows despite not being significantly so. Earnings are expected to grow substantially at 78.3% annually, although revenue growth is forecasted to be moderate at 13.7%.

- In light of our recent growth report, it seems possible that Delhivery's financial performance will exceed current levels.

- Click here to discover the nuances of Delhivery with our detailed financial health report.

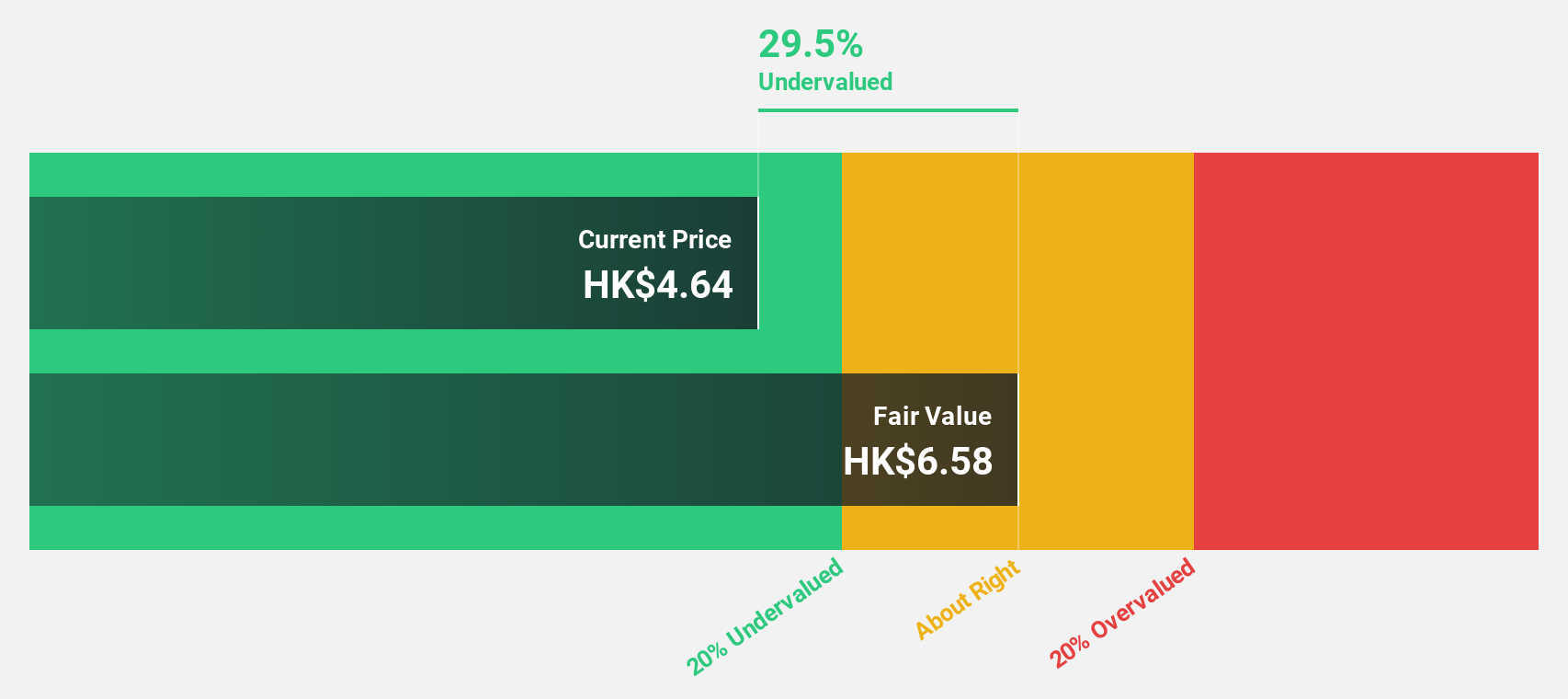

Bosideng International Holdings (SEHK:3998)

Overview: Bosideng International Holdings Limited operates in the apparel business in the People's Republic of China with a market cap of HK$46.96 billion.

Operations: The company's revenue is derived from Down Apparels (CN¥19.54 billion), Ladieswear Apparels (CN¥819.80 million), Diversified Apparels (CN¥235.33 million), and Original Equipment Manufacturing Management (CN¥2.70 billion).

Estimated Discount To Fair Value: 33.5%

Bosideng International Holdings is trading at HK$4.4, significantly below its estimated fair value of HK$6.61, indicating potential undervaluation based on cash flows. Analysts forecast revenue growth of 11.4% annually, outpacing the Hong Kong market average of 7.7%. Recent strategic partnership with Moose Knuckles could enhance global market presence, although Bosideng's dividend track record remains unstable despite a recent increase to 20 HK cents per share approved in August 2024.

- Our comprehensive growth report raises the possibility that Bosideng International Holdings is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Bosideng International Holdings stock in this financial health report.

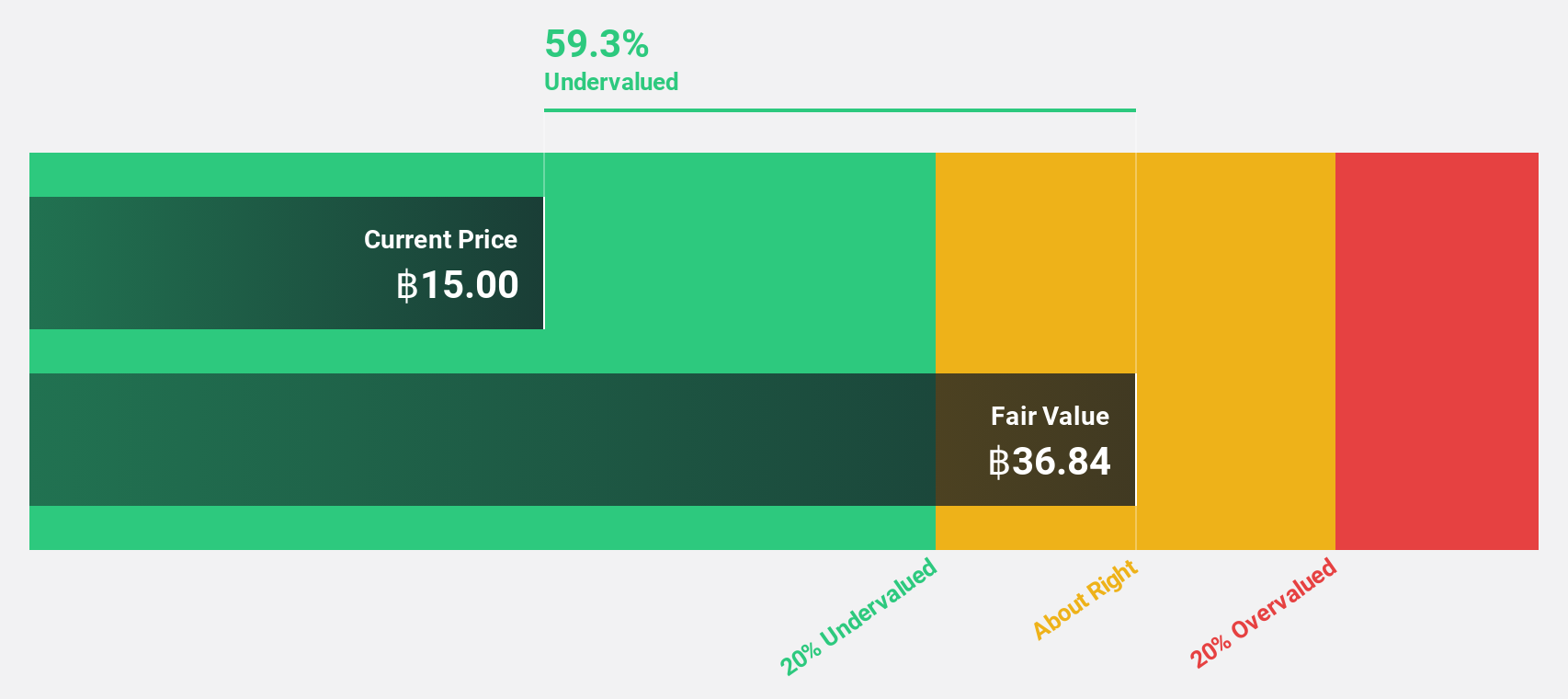

SISB (SET:SISB)

Overview: SISB Public Company Limited offers educational services and has a market cap of THB29.38 billion.

Operations: The company's revenue is primarily derived from its international school segment, amounting to THB2.20 billion.

Estimated Discount To Fair Value: 49.6%

SISB is trading at THB32, well below its estimated fair value of THB63.45, highlighting potential undervaluation based on cash flows. Earnings are expected to grow significantly at 23.8% annually, outpacing the Thai market's 16.9%. Revenue growth is projected at 15% per year, surpassing the market average of 6.6%. Analysts agree on a potential price rise by 38.3%, supported by a strong forecasted return on equity of 31.4% in three years.

- The growth report we've compiled suggests that SISB's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in SISB's balance sheet health report.

Seize The Opportunity

- Explore the 933 names from our Undervalued Stocks Based On Cash Flows screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DELHIVERY

Delhivery

Provides supply chain solutions to e-commerce marketplaces, direct-to-consumer e-tailers, enterprises, FMCG, consumer durables, consumer electronics, lifestyle, retail, automotive and manufacturing industries in India.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives