We Think Shareholders May Want To Consider A Review Of Kiddieland International Limited's (HKG:3830) CEO Compensation Package

Kiddieland International Limited (HKG:3830) has not performed well recently and CEO Kenneth Lo will probably need to up their game. At the upcoming AGM on 30 September 2022, shareholders can hear from the board including their plans for turning around performance. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

View our latest analysis for Kiddieland International

How Does Total Compensation For Kenneth Lo Compare With Other Companies In The Industry?

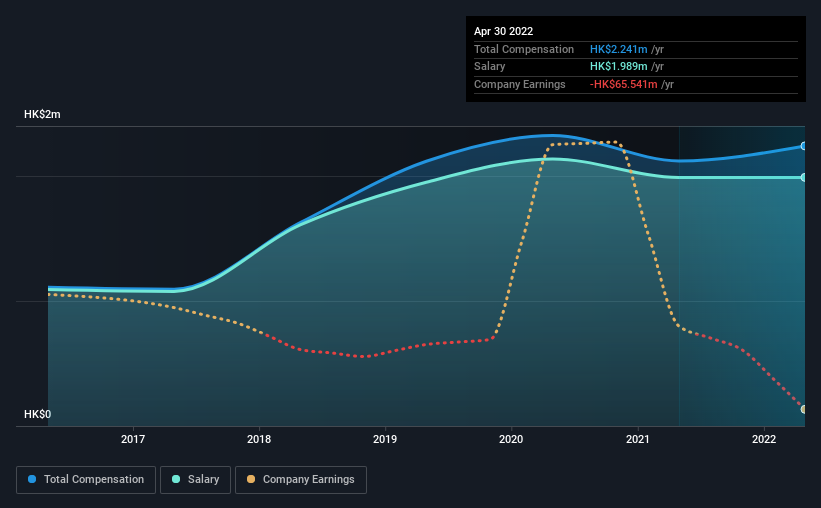

Our data indicates that Kiddieland International Limited has a market capitalization of HK$100m, and total annual CEO compensation was reported as HK$2.2m for the year to April 2022. That's a modest increase of 5.7% on the prior year. We note that the salary portion, which stands at HK$1.99m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.3m. So it looks like Kiddieland International compensates Kenneth Lo in line with the median for the industry.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | HK$2.0m | HK$2.0m | 89% |

| Other | HK$252k | HK$132k | 11% |

| Total Compensation | HK$2.2m | HK$2.1m | 100% |

On an industry level, roughly 89% of total compensation represents salary and 11% is other remuneration. Our data reveals that Kiddieland International allocates salary more or less in line with the wider market. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Kiddieland International Limited's Growth

Kiddieland International Limited has reduced its earnings per share by 41% a year over the last three years. In the last year, its revenue is down 19%.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Kiddieland International Limited Been A Good Investment?

Given the total shareholder loss of 16% over three years, many shareholders in Kiddieland International Limited are probably rather dissatisfied, to say the least. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Kiddieland International that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Kiddieland International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3830

Kiddieland International

An investment holding company, manufactures and distributes plastic toy products and laboratory equipment in the United States, Europe, the Asia Pacific and Oceania, and the People's Republic of China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives