Texwinca Holdings (SEHK:321) EPS Rebound in H1 2026 Challenges Bearish Earnings Narratives

Reviewed by Simply Wall St

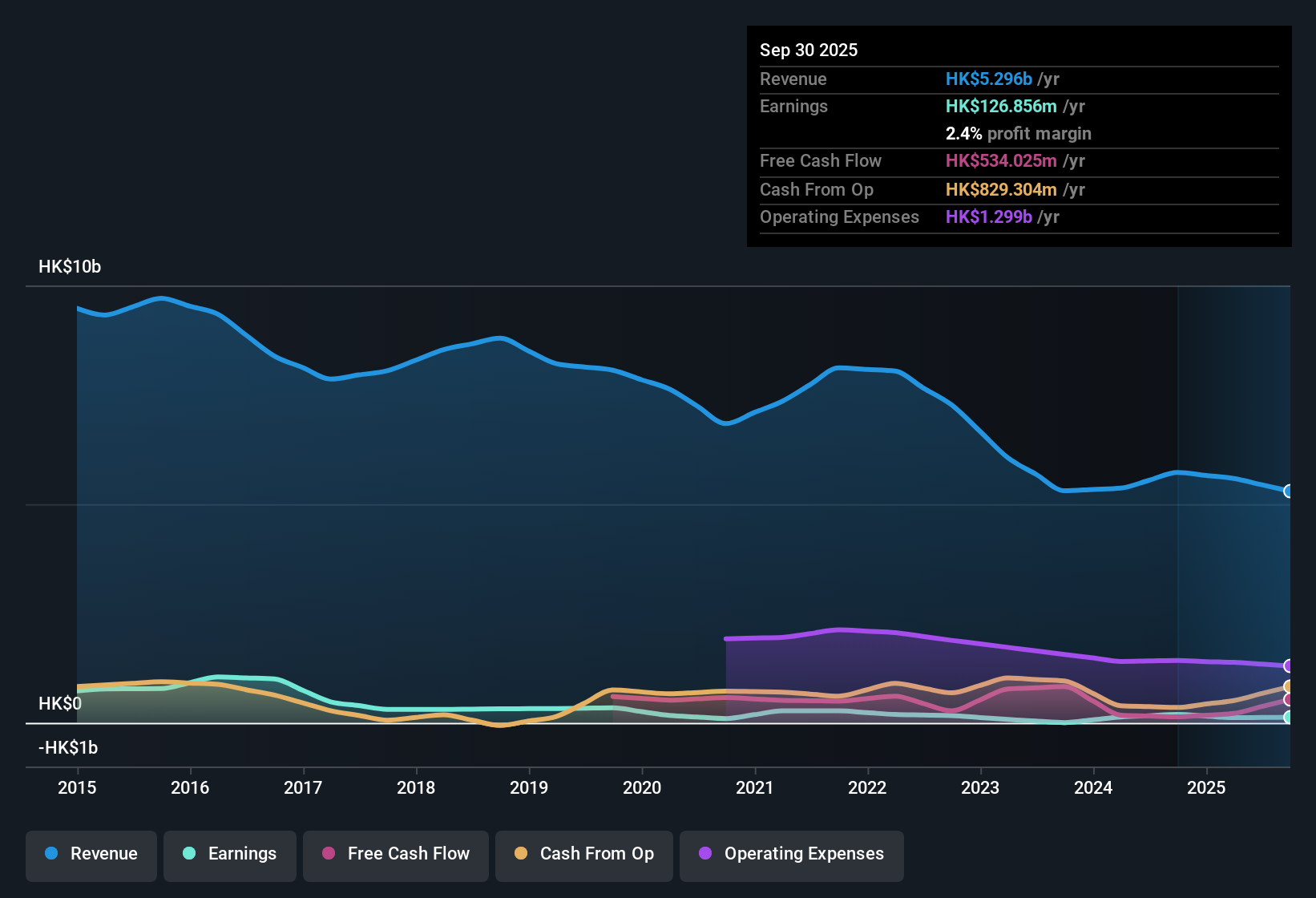

Texwinca Holdings (SEHK:321) has posted its H1 2026 numbers with revenue of HK$2.7 billion and net income of HK$112 million, translating to EPS of HK$0.08 as the market weighs what that means for the rest of the year. The company has seen revenue move from HK$3.0 billion in H1 2025 to HK$2.7 billion in H1 2026, while net income shifted from HK$102 million to HK$112 million over the same periods, creating a mixed backdrop for how investors read the latest margin profile. All told, the release puts the spotlight firmly on how sustainable the current level of profitability and margins really is for shareholders.

See our full analysis for Texwinca Holdings.With the headline numbers on the table, the next step is to see how they compare with the dominant narratives around Texwinca, highlighting where the data backs the story and where it starts to push back.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Under Pressure At 2.4 Percent

- Over the last 12 months, Texwinca converted HK$5,295.9 million of revenue into HK$126.9 million of net income, which works out to a 2.4 percent net margin versus 3.3 percent a year earlier.

- Critics highlight a bearish backdrop of thinning profitability, and the margin data largely backs them up:

- The trailing 2.4 percent margin, down from 3.3 percent, lines up with the view that the core business is struggling to defend profitability.

- On top of that, a HK$69.6 million one off loss hit the last 12 months, reinforcing concerns that reported profits are vulnerable to negative surprises.

Five Year Earnings Slide Of 14.4 Percent

- Looking beyond this half year, earnings have fallen at an average rate of 14.4 percent per year over the past five years, despite H1 2026 net income of HK$112.3 million being above the HK$14.5 million booked in H2 2025.

- Bears argue that the long run trend matters more than one better half, and the numbers give their case real weight:

- The trailing 12 month EPS of HK$0.09 is well below the HK$0.14 recorded in the earlier 2025 period, which fits the story of a shrinking profit base over time.

- Even with H1 2026 basic EPS of HK$0.08 improving from the very weak HK$0.01 in H2 2025, the multi year decline rate shows that any recovery still has a lot of ground to make up.

DCF Suggests Upside Despite 11.4x P/E

- At a share price of HK$1.05, Texwinca trades on an 11.4x P/E, above both the 9.2x peer average and the 10.2x Hong Kong Luxury industry, while a DCF fair value of about HK$4.42 sits far above the current price.

- What is surprising is how a bearish operational picture coexists with a valuation model that flags potential upside:

- The premium P/E relative to peers looks hard to justify against a 14.4 percent annual earnings decline and a 2.4 percent net margin, which usually argue for a discount rather than a premium.

- Yet the roughly 76 percent gap between the HK$1.05 share price and the HK$4.42 DCF fair value implies that if profits stabilize or improve from today’s depressed levels, value focused investors could see this as a mispriced name.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Texwinca Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Texwinca’s shrinking margins, long term earnings decline and premium valuation suggest operational headwinds that may limit reliable profit growth from here.

If you want businesses with more predictable expansion instead of battling profitability trends, use our stable growth stocks screener (2092 results) to quickly focus on companies delivering steadier earnings momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Texwinca Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:321

Texwinca Holdings

Engages in the production, dyeing, and sale of knitted fabrics, yarns, and garments in Hong Kong, the United States, Mainland China, Japan, and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion