Shareholders Will Probably Be Cautious Of Increasing Weiqiao Textile Company Limited's (HKG:2698) CEO Compensation At The Moment

The underwhelming performance at Weiqiao Textile Company Limited (HKG:2698) recently has probably not pleased shareholders. At the upcoming AGM on 16 July 2021, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

See our latest analysis for Weiqiao Textile

How Does Total Compensation For Jiakun Wei Compare With Other Companies In The Industry?

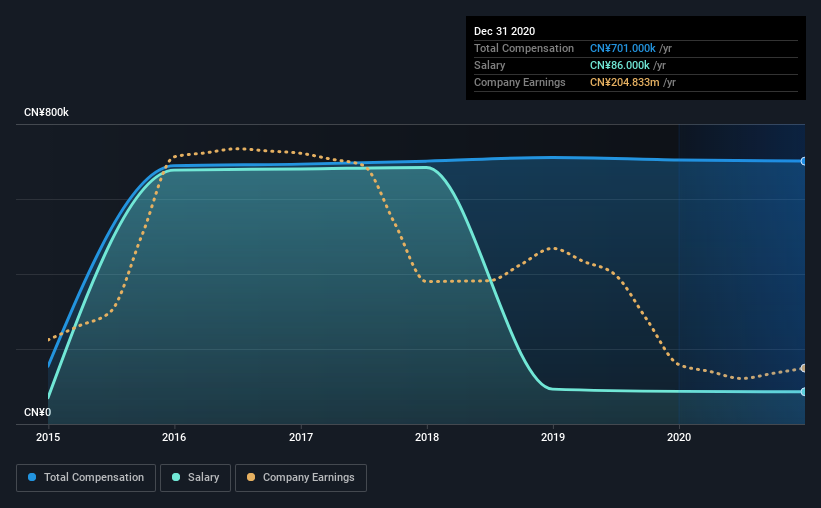

Our data indicates that Weiqiao Textile Company Limited has a market capitalization of HK$3.2b, and total annual CEO compensation was reported as CN¥701k for the year to December 2020. That's mostly flat as compared to the prior year's compensation. We think total compensation is more important but our data shows that the CEO salary is lower, at CN¥86k.

On examining similar-sized companies in the industry with market capitalizations between HK$1.6b and HK$6.2b, we discovered that the median CEO total compensation of that group was CN¥4.6m. This suggests that Jiakun Wei is paid below the industry median.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥86k | CN¥87k | 12% |

| Other | CN¥615k | CN¥617k | 88% |

| Total Compensation | CN¥701k | CN¥704k | 100% |

Speaking on an industry level, nearly 93% of total compensation represents salary, while the remainder of 7% is other remuneration. Weiqiao Textile sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Weiqiao Textile Company Limited's Growth

Over the last three years, Weiqiao Textile Company Limited has shrunk its earnings per share by 27% per year. It saw its revenue drop 16% over the last year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Weiqiao Textile Company Limited Been A Good Investment?

Since shareholders would have lost about 6.6% over three years, some Weiqiao Textile Company Limited investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for Weiqiao Textile (of which 1 makes us a bit uncomfortable!) that you should know about in order to have a holistic understanding of the stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Weiqiao Textile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2698

Weiqiao Textile

Weiqiao Textile Company Limited, together with its subsidiaries, engages in the manufacture and sale of cotton yarns, grey fabrics, and denims in Mainland China, Hong Kong, East Asia, Southeast Asia, South Asia, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives