China Fordoo Holdings (HKG:2399) Has Rewarded Shareholders With An Exceptional 558% Total Return On Their Investment

For many, the main point of investing in the stock market is to achieve spectacular returns. While not every stock performs well, when investors win, they can win big. Just think about the savvy investors who held China Fordoo Holdings Limited (HKG:2399) shares for the last five years, while they gained 504%. And this is just one example of the epic gains achieved by some long term investors. It's also good to see the share price up 86% over the last quarter.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for China Fordoo Holdings

Because China Fordoo Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last half decade China Fordoo Holdings' revenue has actually been trending down at about 32% per year. This is in stark contrast to the strong share price growth of 43%, compound, per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

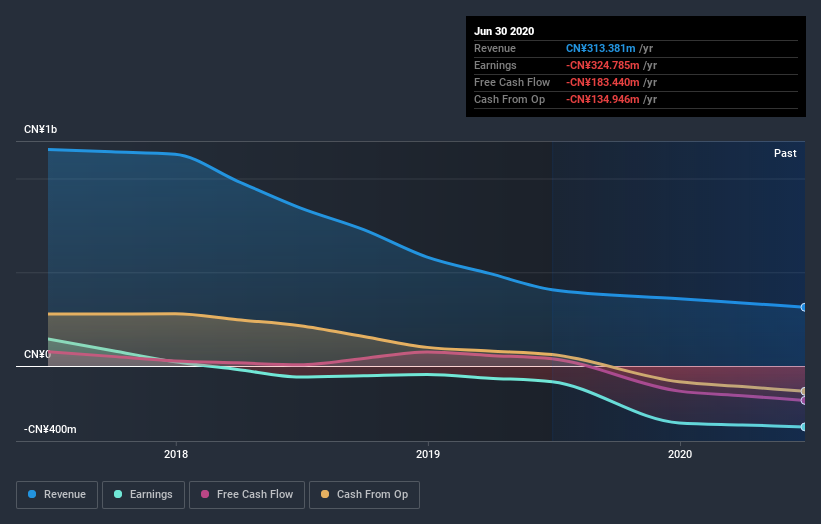

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on China Fordoo Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between China Fordoo Holdings' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for China Fordoo Holdings shareholders, and that cash payout contributed to why its TSR of 558%, over the last 5 years, is better than the share price return.

A Different Perspective

It's nice to see that China Fordoo Holdings shareholders have received a total shareholder return of 93% over the last year. That's better than the annualised return of 46% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand China Fordoo Holdings better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for China Fordoo Holdings you should be aware of, and 2 of them can't be ignored.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading China Fordoo Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2399

China Anchu Energy Storage Group

Designs, an investment holding company, manufactures and wholesales a range of menswear products under the FORDOO brand in the People’s Republic of China, Saudi Arabia, and other Middle Eastern countries.

Worrying balance sheet minimal.

Market Insights

Community Narratives