Should Shareholders Reconsider Kam Hing International Holdings Limited's (HKG:2307) CEO Compensation Package?

Key Insights

- Kam Hing International Holdings will host its Annual General Meeting on 3rd of June

- Salary of HK$3.34m is part of CEO Chin Wen Tai's total remuneration

- The overall pay is 72% above the industry average

- Kam Hing International Holdings' three-year loss to shareholders was 50% while its EPS was down 91% over the past three years

Kam Hing International Holdings Limited (HKG:2307) has not performed well recently and CEO Chin Wen Tai will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 3rd of June. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. From our analysis, we think CEO compensation may need a review in light of the recent performance.

View our latest analysis for Kam Hing International Holdings

How Does Total Compensation For Chin Wen Tai Compare With Other Companies In The Industry?

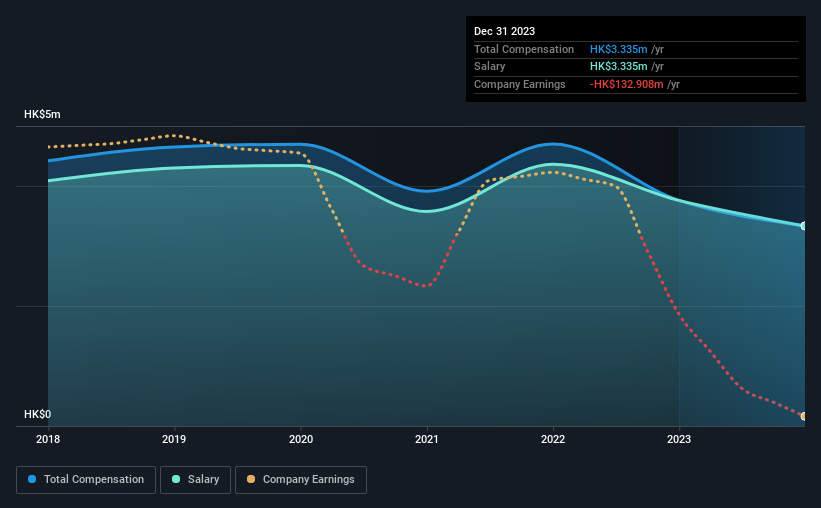

According to our data, Kam Hing International Holdings Limited has a market capitalization of HK$164m, and paid its CEO total annual compensation worth HK$3.3m over the year to December 2023. We note that's a decrease of 11% compared to last year. Notably, the salary of HK$3.3m is the entirety of the CEO compensation.

In comparison with other companies in the Hong Kong Luxury industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.9m. This suggests that Chin Wen Tai is paid more than the median for the industry. Furthermore, Chin Wen Tai directly owns HK$18m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$3.3m | HK$3.8m | 100% |

| Other | - | - | - |

| Total Compensation | HK$3.3m | HK$3.8m | 100% |

On an industry level, around 94% of total compensation represents salary and 6% is other remuneration. Speaking on a company level, Kam Hing International Holdings prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Kam Hing International Holdings Limited's Growth Numbers

Over the last three years, Kam Hing International Holdings Limited has shrunk its earnings per share by 91% per year. In the last year, its revenue is down 12%.

Few shareholders would be pleased to read that EPS have declined. This is compounded by the fact revenue is actually down on last year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Kam Hing International Holdings Limited Been A Good Investment?

With a total shareholder return of -50% over three years, Kam Hing International Holdings Limited shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Kam Hing International Holdings pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. That's why we did our research, and identified 2 warning signs for Kam Hing International Holdings (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Kam Hing International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2307

Kam Hing International Holdings

An investment holding company, engages in the production and sale of knitted fabrics and dyed yarns in Hong Kong, Mainland China, Korea, Taiwan, Singapore, the United Kingdom, the United States, Vietnam, and internationally.

Adequate balance sheet slight.

Market Insights

Community Narratives