- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2127

Investors one-year losses continue as Huisen Household International Group (HKG:2127) dips a further 13% this week, earnings continue to decline

As every investor would know, you don't hit a homerun every time you swing. But it's not unreasonable to try to avoid truly shocking capital losses. So we hope that those who held Huisen Household International Group Limited (HKG:2127) during the last year don't lose the lesson, in addition to the 76% hit to the value of their shares. That'd be a striking reminder about the importance of diversification. Huisen Household International Group may have better days ahead, of course; we've only looked at a one year period. The falls have accelerated recently, with the share price down 19% in the last three months.

Since Huisen Household International Group has shed HK$138m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Huisen Household International Group

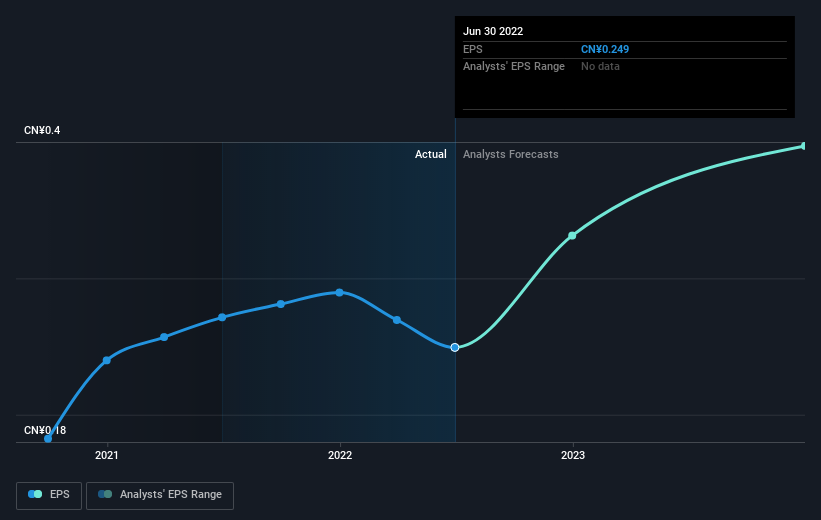

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Unfortunately Huisen Household International Group reported an EPS drop of 8.1% for the last year. This reduction in EPS is not as bad as the 76% share price fall. So it seems the market was too confident about the business, a year ago. The P/E ratio of 1.10 also points to the negative market sentiment.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It might be well worthwhile taking a look at our free report on Huisen Household International Group's earnings, revenue and cash flow.

A Different Perspective

We doubt Huisen Household International Group shareholders are happy with the loss of 76% over twelve months. That falls short of the market, which lost 9.1%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 19% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Huisen Shares Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2127

Huisen Shares Group

Designs, manufactures, develops, and sells furniture products in the United States, the People’s Republic of China, Singapore, Malaysia, Vietnam, Canada, and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives