- Hong Kong

- /

- Consumer Durables

- /

- SEHK:2127

Huisen Household International Group Limited's (HKG:2127) Prospects Need A Boost To Lift Shares

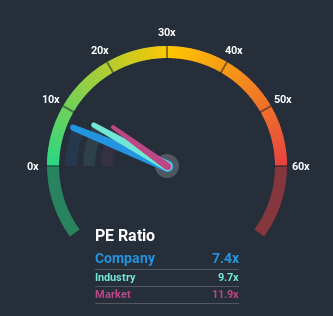

With a price-to-earnings (or "P/E") ratio of 7.4x Huisen Household International Group Limited (HKG:2127) may be sending bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 12x and even P/E's higher than 26x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Huisen Household International Group over the last year, which is not ideal at all. It might be that many expect the disappointing earnings performance to continue or accelerate, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Huisen Household International Group

How Is Huisen Household International Group's Growth Trending?

In order to justify its P/E ratio, Huisen Household International Group would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 5.0% decrease to the company's bottom line. Even so, admirably EPS has lifted 61% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 27% shows it's noticeably less attractive on an annualised basis.

With this information, we can see why Huisen Household International Group is trading at a P/E lower than the market. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Huisen Household International Group's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Huisen Household International Group maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 2 warning signs for Huisen Household International Group that you should be aware of.

If you're unsure about the strength of Huisen Household International Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

When trading Huisen Household International Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Huisen Shares Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2127

Huisen Shares Group

Designs, manufactures, develops, and sells furniture products in the United States, the People’s Republic of China, Singapore, Malaysia, Vietnam, Canada, and internationally.

Adequate balance sheet low.

Market Insights

Community Narratives