Cabbeen Fashion (HKG:2030) Will Pay A Smaller Dividend Than Last Year

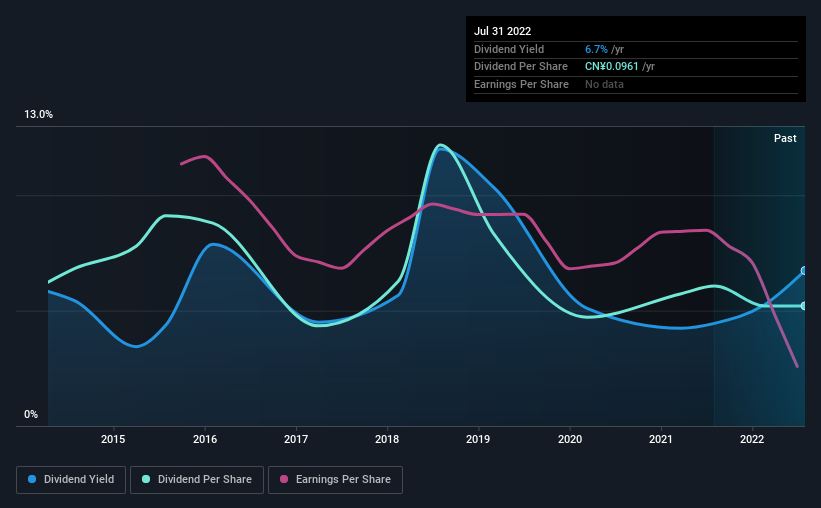

Cabbeen Fashion Limited's (HKG:2030) dividend is being reduced from last year's payment covering the same period to CN¥0.01 on the 26th of August. This means the annual payment is 6.7% of the current stock price, which is above the average for the industry.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. Cabbeen Fashion's stock price has reduced by 37% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

See our latest analysis for Cabbeen Fashion

Cabbeen Fashion's Payment Has Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Cabbeen Fashion is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Unless the company can turn things around, EPS could fall by 17.7% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could be 54%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Cabbeen Fashion's Dividend Has Lacked Consistency

It's comforting to see that Cabbeen Fashion has been paying a dividend for a number of years now, however it has been cut at least once in that time. This makes us cautious about the consistency of the dividend over a full economic cycle. Since 2014, the dividend has gone from CN¥0.115 total annually to CN¥0.0961. The dividend has shrunk at around 2.2% a year during that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Cabbeen Fashion's EPS has declined at around 18% a year. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough.

The Dividend Could Prove To Be Unreliable

In summary, dividends being cut isn't ideal, however it can bring the payment into a more sustainable range. While Cabbeen Fashion is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Just as an example, we've come across 3 warning signs for Cabbeen Fashion you should be aware of, and 1 of them is concerning. Is Cabbeen Fashion not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2030

Cabbeen Fashion

A fashion casual menswear company, designs and retails apparel, shoes, and accessories for men, women, and kids under the Cabbeen, Cabbeen Lifestyle, Cabbeen Urban, Cabbeen Love, and 2AM brands in the People’s Republic of China.

Flawless balance sheet with proven track record.