Prada (SEHK:1913): Exploring Valuation After Latest Share Price Dip in Luxury Sector

Reviewed by Kshitija Bhandaru

See our latest analysis for Prada.

Prada’s share price has struggled to build positive momentum this year, with the stock currently trading at HK$46.9 and recording a year-to-date decline. While luxury stocks have faced bouts of volatility as investor sentiment shifts, Prada’s one-year total shareholder return of -15.2% highlights the ongoing challenge. However, longer-term holders have still comfortably outperformed cash by sticking with the brand.

If today’s move in Prada has you rethinking your strategy, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst targets and value metrics suggesting a potential discount, investors are left to ponder whether Prada is undervalued at current levels or if the market is already factoring in its future prospects.

Most Popular Narrative: 25% Undervalued

Prada's most followed valuation narrative sees the fair value at HK$62.78, a substantial premium to the last close of HK$46.90. This gap spotlights key business drivers and strategic pivots that analysts view as potential value catalysts.

*Prada's ongoing investment in new product collections, broadening price points and enhancing personalization (such as make-to-measure and bespoke in flagship stores), positions the group to capture growth from both affluent core clients and younger, aspirational demographics globally. This supports long-term revenue and gross margin expansion.*

Want to know what numbers justify this upside? The narrative’s case is built on aggressive profit forecasts and a bold earnings multiple. Discover the financial leap that pushes this valuation far beyond today’s market price.

Result: Fair Value of $62.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in global tourism patterns or slower gains in retail culture could undermine Prada’s premium positioning and disrupt its path to sustained growth.

Find out about the key risks to this Prada narrative.

Another View: The Market Multiple Perspective

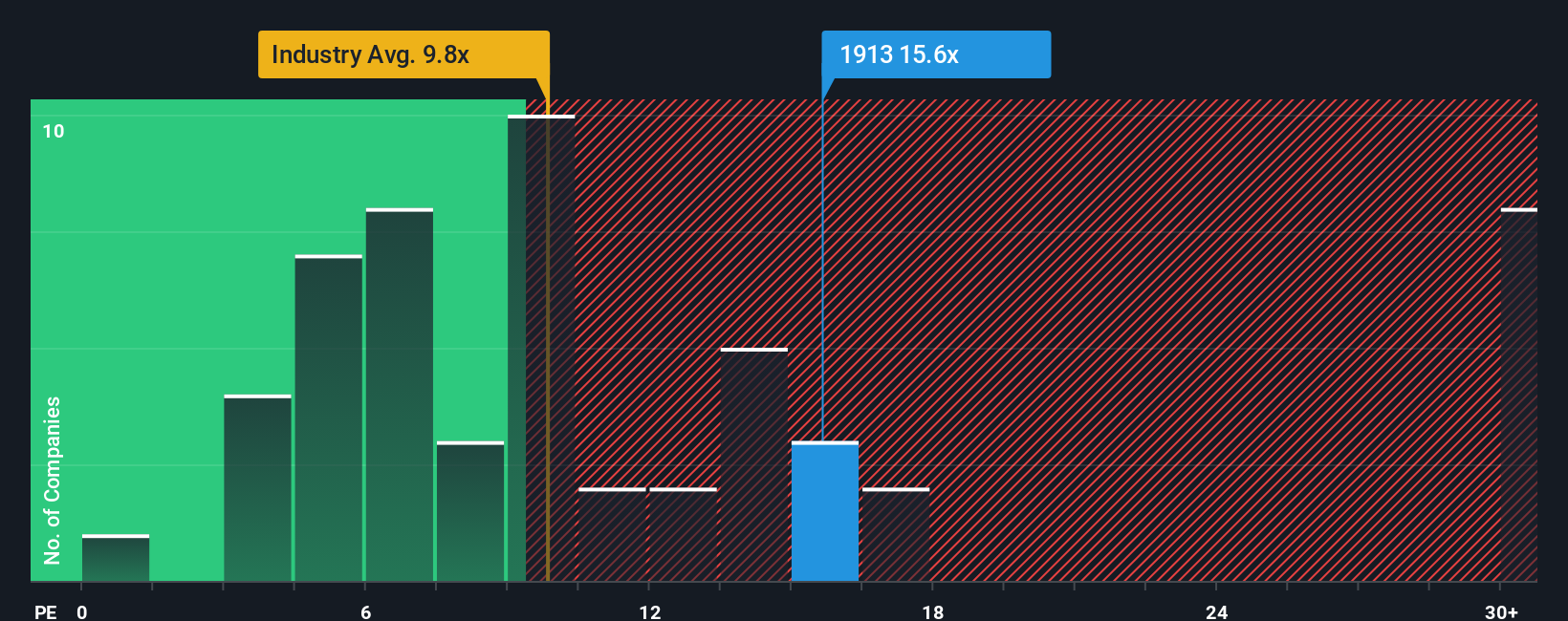

While analyst narratives see upside, the current market pricing tells a different story. Prada trades at a price-to-earnings ratio of 15.6x, which is higher than both the Hong Kong luxury industry average of 9.7x and the fair ratio estimate of 11.7x. This gap could suggest investors are paying a premium for future hopes, not today's fundamentals. Is the market's optimism justified, or is there more risk than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prada Narrative

If you see things differently or want to form your own conclusion, you can dig into the numbers and craft a narrative in just a few minutes. Do it your way

A great starting point for your Prada research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the pack and uncover opportunities that others might miss. Boost your portfolio with smart choices using these tailored investment screens today.

- Capitalize on untapped gains by sifting through these 900 undervalued stocks based on cash flows to spot overlooked companies with genuine upside potential.

- Grow your wealth with stable income and protection against market swings by adding these 19 dividend stocks with yields > 3% offering yields above 3% to your watchlist.

- Get in early on tomorrow’s innovations as you check out these 24 AI penny stocks riding the wave of artificial intelligence breakthroughs and rapid industry adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1913

Prada

Produces and distributes leather goods, footwear, and ready to wear products worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives