We Think Samsonite International (HKG:1910) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Samsonite International S.A. (HKG:1910) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Samsonite International

What Is Samsonite International's Net Debt?

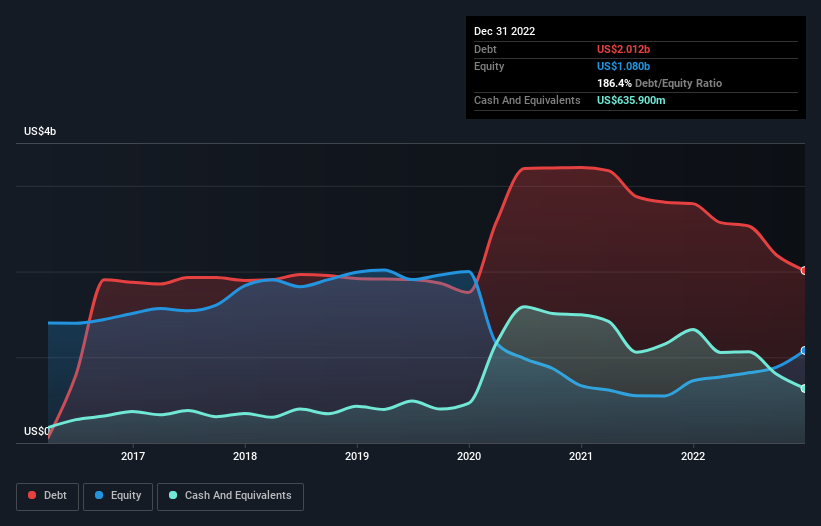

As you can see below, Samsonite International had US$2.01b of debt at December 2022, down from US$2.79b a year prior. However, it also had US$635.9m in cash, and so its net debt is US$1.38b.

How Strong Is Samsonite International's Balance Sheet?

The latest balance sheet data shows that Samsonite International had liabilities of US$1.21b due within a year, and liabilities of US$2.43b falling due after that. Offsetting this, it had US$635.9m in cash and US$290.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$2.71b.

This deficit is considerable relative to its market capitalization of US$4.45b, so it does suggest shareholders should keep an eye on Samsonite International's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Samsonite International's debt is 2.9 times its EBITDA, and its EBIT cover its interest expense 4.0 times over. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. However, it should be some comfort for shareholders to recall that Samsonite International actually grew its EBIT by a hefty 250%, over the last 12 months. If it can keep walking that path it will be in a position to shed its debt with relative ease. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Samsonite International's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last two years, Samsonite International actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

The good news is that Samsonite International's demonstrated ability to convert EBIT to free cash flow delights us like a fluffy puppy does a toddler. But truth be told we feel its interest cover does undermine this impression a bit. Looking at all the aforementioned factors together, it strikes us that Samsonite International can handle its debt fairly comfortably. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Samsonite International you should be aware of, and 1 of them is potentially serious.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1910

Samsonite Group

Engages in the design, manufacture, sourcing, and distribution of luggage, business and computer bags, outdoor and casual bags, and travel accessories in Asia, North America, Europe, and Latin America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives