- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1692

With EPS Growth And More, Town Ray Holdings (HKG:1692) Is Interesting

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

So if you're like me, you might be more interested in profitable, growing companies, like Town Ray Holdings (HKG:1692). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

See our latest analysis for Town Ray Holdings

How Fast Is Town Ray Holdings Growing Its Earnings Per Share?

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's no surprise that some investors are more inclined to invest in profitable businesses. Like a wedge-tailed eagle on the wind, Town Ray Holdings's EPS soared from HK$0.19 to HK$0.28, in just one year. That's a impressive gain of 44%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Town Ray Holdings shareholders can take confidence from the fact that EBIT margins are up from 16% to 21%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

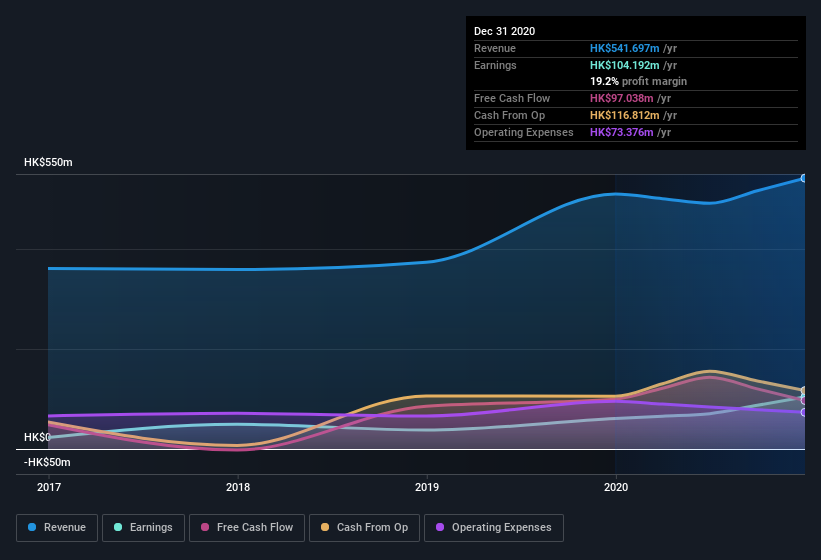

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Town Ray Holdings isn't a huge company, given its market capitalization of HK$865m. That makes it extra important to check on its balance sheet strength.

Are Town Ray Holdings Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The first bit of good news is that no Town Ray Holdings insiders reported share sales in the last twelve months. Even better, though, is that the Co-founder & Non-Executive Director, Yuk Sim Cheng, bought a whopping HK$3.0m worth of shares, paying about HK$0.77 per share, on average. To me that means at least one insider thinks that the company is doing well - and they are backing that view with cash.

The good news, alongside the insider buying, for Town Ray Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have HK$188m worth of shares. That's a lot of money, and no small incentive to work hard. Those holdings account for over 22% of the company; visible skin in the game.

Is Town Ray Holdings Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about Town Ray Holdings's strong EPS growth. The cranberry sauce on the turkey is that insiders own a bunch of shares, and one has been buying more. So I do think this is one stock worth watching. You should always think about risks though. Case in point, we've spotted 2 warning signs for Town Ray Holdings you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Town Ray Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Town Ray Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Town Ray Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1692

Town Ray Holdings

Manufactures and sells electrothermic household appliances in Europe, Asia, the United States, and internationally.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives