- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1691

JS Global Lifestyle Company Limited (HKG:1691) Consensus Forecasts Have Become A Little Darker Since Its Latest Report

It's been a pretty great week for JS Global Lifestyle Company Limited (HKG:1691) shareholders, with its shares surging 16% to HK$9.33 in the week since its latest half-yearly results. Results were roughly in line with estimates, with revenues of US$2.2b and statutory earnings per share of US$0.12. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

Check out our latest analysis for JS Global Lifestyle

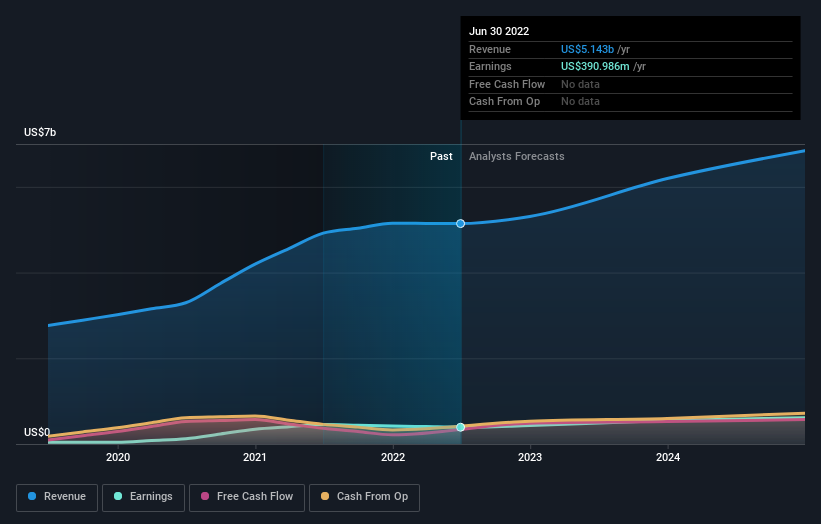

Taking into account the latest results, the most recent consensus for JS Global Lifestyle from 18 analysts is for revenues of US$5.31b in 2022 which, if met, would be a reasonable 3.2% increase on its sales over the past 12 months. Statutory earnings per share are predicted to climb 11% to US$0.13. Before this earnings report, the analysts had been forecasting revenues of US$5.62b and earnings per share (EPS) of US$0.14 in 2022. It's pretty clear that pessimism has reared its head after the latest results, leading to a weaker revenue outlook and a small dip in earnings per share estimates.

Despite the cuts to forecast earnings, there was no real change to the HK$12.03 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on JS Global Lifestyle, with the most bullish analyst valuing it at HK$16.07 and the most bearish at HK$5.50 per share. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely different views on what kind of performance this business can generate. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that JS Global Lifestyle's revenue growth is expected to slow, with the forecast 6.5% annualised growth rate until the end of 2022 being well below the historical 24% p.a. growth over the last three years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 12% per year. Factoring in the forecast slowdown in growth, it seems obvious that JS Global Lifestyle is also expected to grow slower than other industry participants.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for JS Global Lifestyle. On the negative side, they also downgraded their revenue estimates, and forecasts imply revenues will perform worse than the wider industry. The consensus price target held steady at HK$12.03, with the latest estimates not enough to have an impact on their price targets.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have estimates - from multiple JS Global Lifestyle analysts - going out to 2024, and you can see them free on our platform here.

And what about risks? Every company has them, and we've spotted 1 warning sign for JS Global Lifestyle you should know about.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1691

JS Global Lifestyle

Engages in the design, manufacture, marketing, distribution, and export of small kitchen electrical appliances in Mainland China, Japan, Australia, New Zealand, and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)