Here's Why Some Shareholders May Not Be Too Generous With SG Group Holdings Limited's (HKG:1657) CEO Compensation This Year

The disappointing performance at SG Group Holdings Limited (HKG:1657) will make some shareholders rather disheartened. There is an opportunity for shareholders to influence management to turn the performance around by voting on resolutions such as executive remuneration at the AGM coming up on 11 October 2021. The data we gathered below shows that CEO compensation looks acceptable for now.

View our latest analysis for SG Group Holdings

How Does Total Compensation For Charles Choi Compare With Other Companies In The Industry?

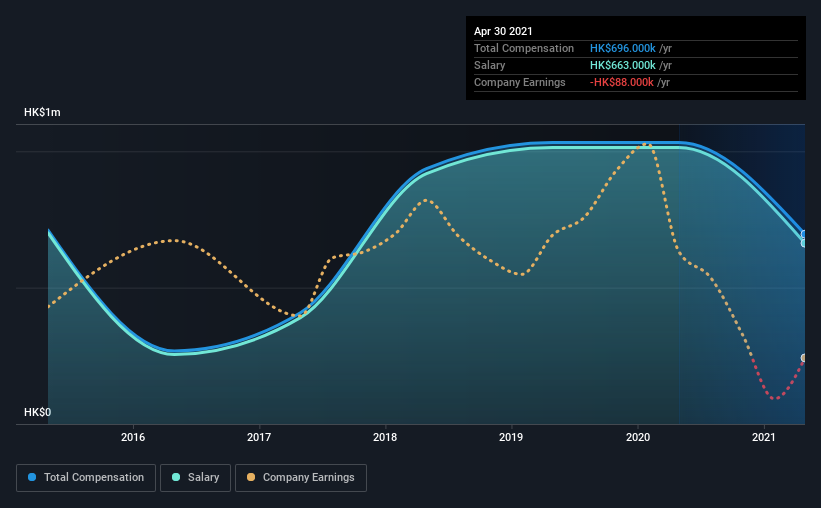

At the time of writing, our data shows that SG Group Holdings Limited has a market capitalization of HK$192m, and reported total annual CEO compensation of HK$696k for the year to April 2021. We note that's a decrease of 33% compared to last year. We note that the salary portion, which stands at HK$663.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$2.3m. Accordingly, SG Group Holdings pays its CEO under the industry median. Moreover, Charles Choi also holds HK$141m worth of SG Group Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$663k | HK$1.0m | 95% |

| Other | HK$33k | HK$18k | 5% |

| Total Compensation | HK$696k | HK$1.0m | 100% |

On an industry level, around 91% of total compensation represents salary and 9% is other remuneration. Investors will find it interesting that SG Group Holdings pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

SG Group Holdings Limited's Growth

SG Group Holdings Limited has reduced its earnings per share by 42% a year over the last three years. In the last year, its revenue is down 53%.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has SG Group Holdings Limited Been A Good Investment?

Given the total shareholder loss of 0.2% over three years, many shareholders in SG Group Holdings Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

SG Group Holdings pays its CEO a majority of compensation through a salary. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We identified 2 warning signs for SG Group Holdings (1 is a bit concerning!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1657

SG Group Holdings

An investment holding company, sells apparel products with designing and sourcing services to fashion retailers and wholesalers.

Mediocre balance sheet with very low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)