There's Reason For Concern Over China Partytime Culture Holdings Limited's (HKG:1532) Massive 44% Price Jump

China Partytime Culture Holdings Limited (HKG:1532) shares have had a really impressive month, gaining 44% after a shaky period beforehand. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

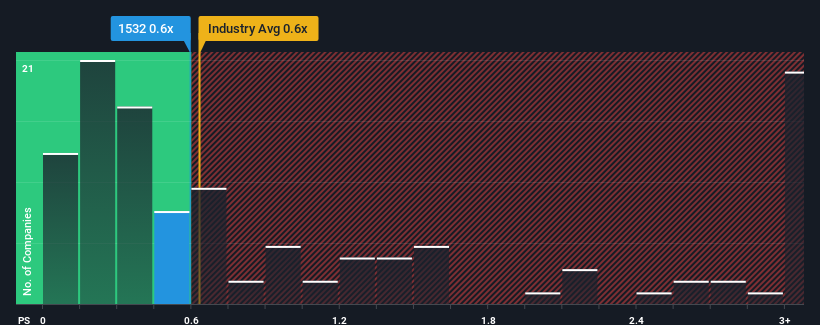

Even after such a large jump in price, it's still not a stretch to say that China Partytime Culture Holdings' price-to-sales (or "P/S") ratio of 0.6x right now seems quite "middle-of-the-road" compared to the Luxury industry in Hong Kong, seeing as it matches the P/S ratio of the wider industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for China Partytime Culture Holdings

What Does China Partytime Culture Holdings' P/S Mean For Shareholders?

For example, consider that China Partytime Culture Holdings' financial performance has been pretty ordinary lately as revenue growth is non-existent. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Although there are no analyst estimates available for China Partytime Culture Holdings, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, China Partytime Culture Holdings would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 37% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that to the industry, which is predicted to deliver 14% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it intriguing that China Partytime Culture Holdings' P/S is comparable to that of its industry peers. Apparently many investors in the company are less bearish than recent times would indicate and aren't willing to let go of their stock right now. They may be setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

The Bottom Line On China Partytime Culture Holdings' P/S

China Partytime Culture Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China Partytime Culture Holdings' average P/S is a bit surprising since its recent three-year growth is lower than the wider industry forecast. When we see weak revenue with slower than industry growth, we suspect the share price is at risk of declining, bringing the P/S back in line with expectations. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

There are also other vital risk factors to consider and we've discovered 4 warning signs for China Partytime Culture Holdings (2 are concerning!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on China Partytime Culture Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade China Partytime Culture Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1532

China Partytime Culture Holdings

An investment holding company, designs, develops, produces, markets, and sells cosplay apparels and lingerie products.

Flawless balance sheet very low.

Market Insights

Community Narratives