China Partytime Culture Holdings Limited's (HKG:1532) Share Price Is Still Matching Investor Opinion Despite 27% Slump

Unfortunately for some shareholders, the China Partytime Culture Holdings Limited (HKG:1532) share price has dived 27% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

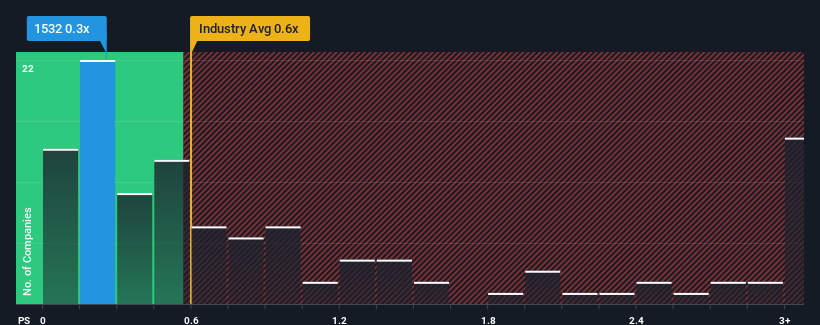

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about China Partytime Culture Holdings' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Luxury industry in Hong Kong is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for China Partytime Culture Holdings

How Has China Partytime Culture Holdings Performed Recently?

China Partytime Culture Holdings has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Partytime Culture Holdings' earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For China Partytime Culture Holdings?

The only time you'd be comfortable seeing a P/S like China Partytime Culture Holdings' is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 18% gain to the company's top line. Pleasingly, revenue has also lifted 39% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's about the same on an annualised basis.

With this information, we can see why China Partytime Culture Holdings is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What We Can Learn From China Partytime Culture Holdings' P/S?

Following China Partytime Culture Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we've seen, China Partytime Culture Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - China Partytime Culture Holdings has 4 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If these risks are making you reconsider your opinion on China Partytime Culture Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade China Partytime Culture Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1532

China Partytime Culture Holdings

An investment holding company, designs, develops, produces, markets, and sells cosplay apparels and lingerie products.

Flawless balance sheet very low.

Market Insights

Community Narratives