- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1478

Q Technology (Group) Company Limited (HKG:1478) Analysts Just Slashed This Year's Estimates

The analysts covering Q Technology (Group) Company Limited (HKG:1478) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business.

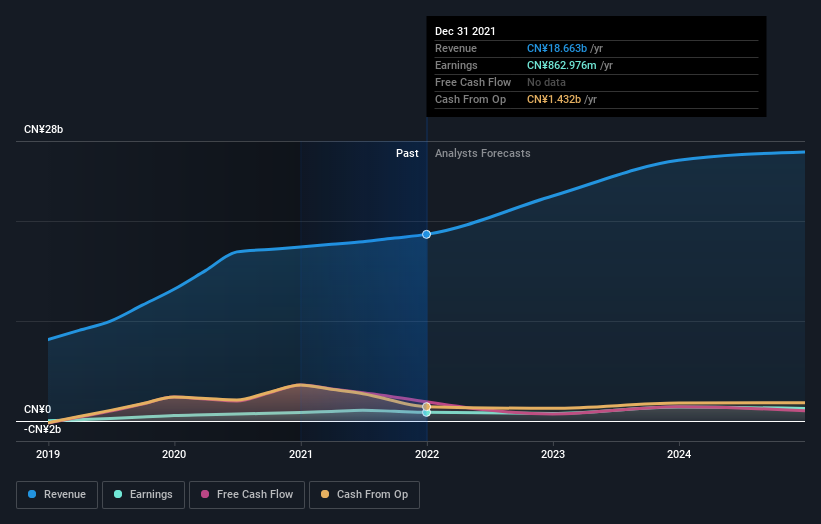

After this downgrade, Q Technology (Group)'s 14 analysts are now forecasting revenues of CN¥21b in 2022. This would be a solid 15% improvement in sales compared to the last 12 months. Statutory earnings per share are supposed to shrink 7.0% to CN¥0.68 in the same period. Previously, the analysts had been modelling revenues of CN¥24b and earnings per share (EPS) of CN¥1.21 in 2022. Indeed, we can see that the analysts are a lot more bearish about Q Technology (Group)'s prospects, administering a measurable cut to revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Q Technology (Group)

The consensus price target fell 35% to CN¥9.55, with the weaker earnings outlook clearly leading analyst valuation estimates. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. Currently, the most bullish analyst values Q Technology (Group) at CN¥24.80 per share, while the most bearish prices it at CN¥6.60. With such a wide range in price targets, the analysts are almost certainly betting on widely diverse outcomes for the underlying business. With this in mind, we wouldn't rely too heavily on the consensus price target, as it is just an average and analysts clearly have some deeply divergent views on the business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We would highlight that Q Technology (Group)'s revenue growth is expected to slow, with the forecast 15% annualised growth rate until the end of 2022 being well below the historical 26% p.a. growth over the last five years. Compare this to the 42 other companies in this industry with analyst coverage, which are forecast to grow their revenue at 17% per year. So it's pretty clear that, while Q Technology (Group)'s revenue growth is expected to slow, it's expected to grow roughly in line with the industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. There was also a drop in their revenue estimates, although as we saw earlier, forecast growth is only expected to be about the same as the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Q Technology (Group).

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Q Technology (Group) analysts - going out to 2024, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Q Technology (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1478

Q Technology (Group)

An investment holding company, engages in the design, research and development, manufacturing, and sale of camera and fingerprint recognition modules in the Mainland of China, Hong Kong, India, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026