As global markets navigate a landscape marked by easing trade tensions and mixed economic signals, Asia's financial scene remains an area of keen interest for investors seeking stability and growth. In this context, dividend stocks in the region offer a compelling option for those looking to enhance their portfolios with steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.89% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.85% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.19% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.17% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.51% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.50% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.12% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.39% | ★★★★★★ |

Click here to see the full list of 1238 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

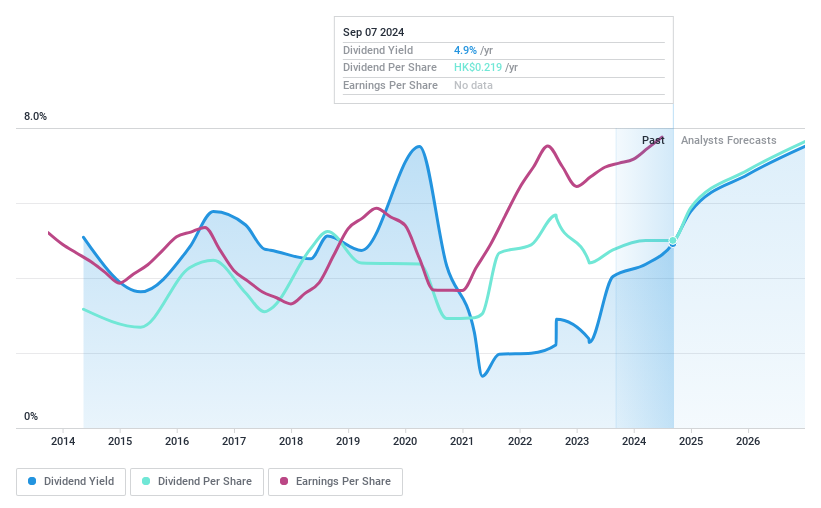

Xtep International Holdings (SEHK:1368)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Xtep International Holdings Limited designs, develops, manufactures, markets, and sells sports footwear, apparel, and accessories for adults and children in Mainland China with a market cap of HK$14.92 billion.

Operations: Xtep International Holdings Limited generates revenue from two main segments: Mass Market, contributing CN¥12.33 billion, and Professional Sports, contributing CN¥1.25 billion.

Dividend Yield: 4.4%

Xtep International Holdings recently announced a final dividend of HK$0.095 per share, with a scrip option, approved at their AGM. Despite a volatile dividend history over the past decade, recent earnings growth and coverage by both cash flow and earnings suggest sustainability. However, its dividend yield remains below top-tier levels in Hong Kong. The company's financial health is bolstered by growing profits and successful bond offerings, but investors should note the historical volatility in dividends.

- Click here to discover the nuances of Xtep International Holdings with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Xtep International Holdings' share price might be too optimistic.

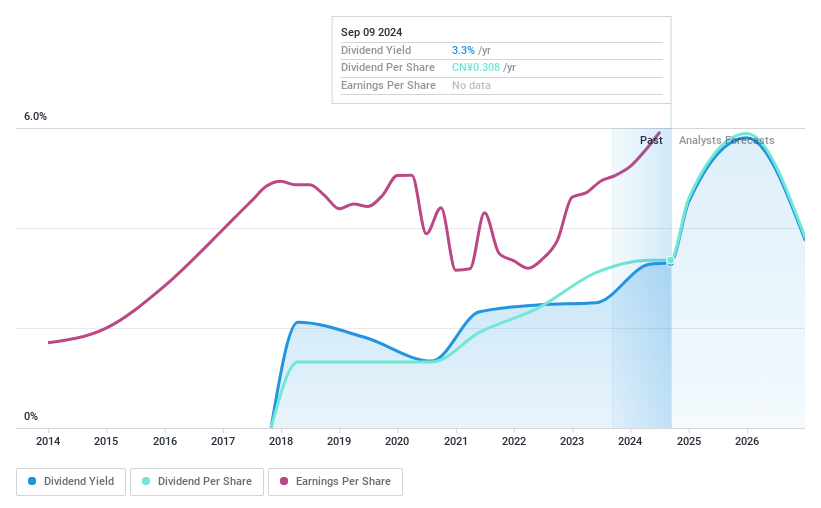

Shanghai Daimay Automotive Interior (SHSE:603730)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd is engaged in the research, development, production, and sale of passenger car components for OEMs and automakers both in China and internationally, with a market cap of CN¥13.55 billion.

Operations: Shanghai Daimay Automotive Interior Co., Ltd generates revenue through the research, development, production, and sale of passenger car components for original equipment manufacturers (OEMs) and automakers globally.

Dividend Yield: 4.3%

Shanghai Daimay Automotive Interior's dividend yield of 4.27% places it among the top 25% in China's market, supported by a payout ratio of 70%. Though dividends have been stable and growing, they have only been issued for seven years. The company's recent earnings growth and solid cash flow coverage (89.4%) suggest sustainability, while its price-to-earnings ratio of 16.6x indicates good value compared to the broader market.

- Get an in-depth perspective on Shanghai Daimay Automotive Interior's performance by reading our dividend report here.

- The analysis detailed in our Shanghai Daimay Automotive Interior valuation report hints at an deflated share price compared to its estimated value.

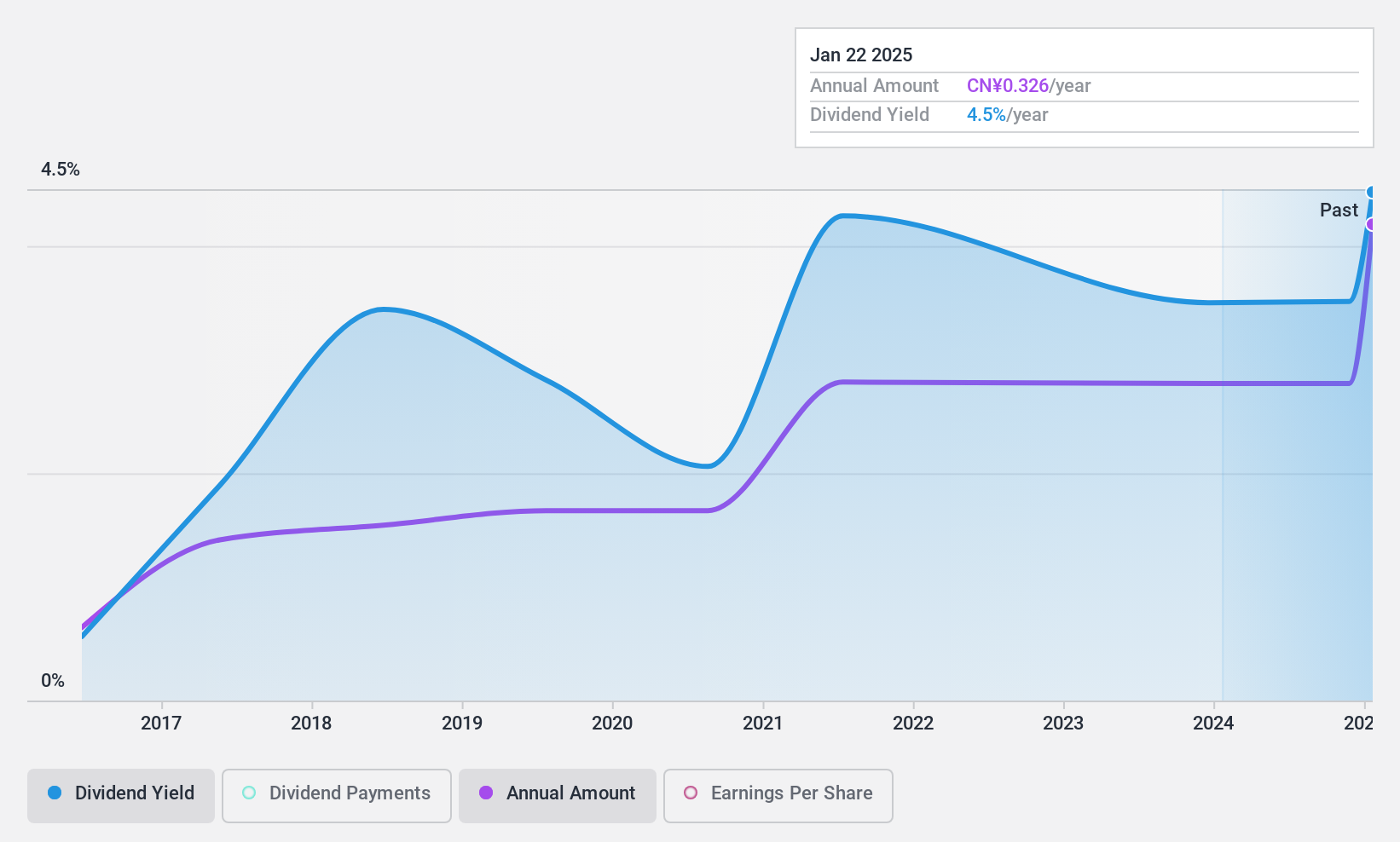

Jiangnan Mould & Plastic Technology (SZSE:000700)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jiangnan Mould & Plastic Technology Co., Ltd. operates in the manufacturing sector, focusing on mould and plastic products, with a market cap of CN¥6.80 billion.

Operations: The revenue segments for Jiangnan Mould & Plastic Technology Co., Ltd. are currently not specified in the provided text.

Dividend Yield: 4.4%

Jiangnan Mould & Plastic Technology offers a dividend yield of 4.4%, placing it in the top 25% of China's market. The dividends are well-covered by earnings and cash flows, with payout ratios of 52.1% and 33.1%, respectively. However, the dividend history has been volatile over the past decade despite recent growth in payments. Recent earnings reports show stable net income growth, which could support future payouts amidst declining sales figures for both quarterly and annual periods.

- Click here and access our complete dividend analysis report to understand the dynamics of Jiangnan Mould & Plastic Technology.

- Our comprehensive valuation report raises the possibility that Jiangnan Mould & Plastic Technology is priced lower than what may be justified by its financials.

Next Steps

- Gain an insight into the universe of 1238 Top Asian Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1368

Xtep International Holdings

Designs, develops, manufactures, markets, and sells sports footwear, apparel, and accessories for adults and children in Mainland China.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives