- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1198

Royale Furniture Holdings' (HKG:1198) Wonderful 313% Share Price Increase Shows How Capitalism Can Build Wealth

Long term investing can be life changing when you buy and hold the truly great businesses. And we've seen some truly amazing gains over the years. Just think about the savvy investors who held Royale Furniture Holdings Limited (HKG:1198) shares for the last five years, while they gained 313%. This just goes to show the value creation that some businesses can achieve. In contrast, the stock has fallen 8.1% in the last 30 days. This could be related to the soft market, with stocks down around 0.3% in the last month.

Check out our latest analysis for Royale Furniture Holdings

Royale Furniture Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Royale Furniture Holdings can boast revenue growth at a rate of 1.7% per year. Put simply, that growth rate fails to impress. So shareholders should be pretty elated with the 33% increase per year, in that time. We don't think the growth over the period is that great, but it could be that faster growth appears to some to be on the horizon. Having said that, a closer look at the numbers might surface good reasons to believe that profits will gush in the future.

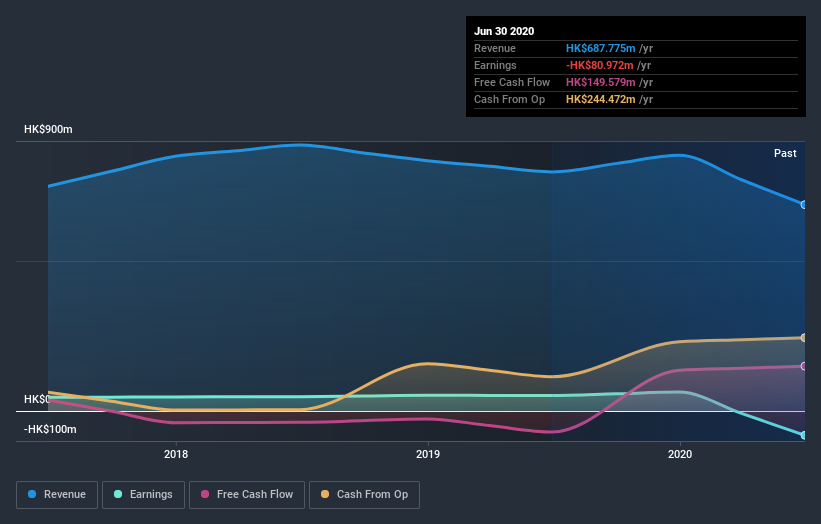

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Royale Furniture Holdings' earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Royale Furniture Holdings shareholders are up 3.3% for the year. But that return falls short of the market. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 33% over five years. Maybe the share price is just taking a breather while the business executes on its growth strategy. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade Royale Furniture Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1198

Royale Home Holdings

An investment holding company, engages in the manufacture and sale of home furniture in the People’s Republic of China.

Low and overvalued.