Should You Be Adding Herald Holdings (HKG:114) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Herald Holdings (HKG:114), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Herald Holdings

How Fast Is Herald Holdings Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Herald Holdings's EPS went from HK$0.016 to HK$0.059 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

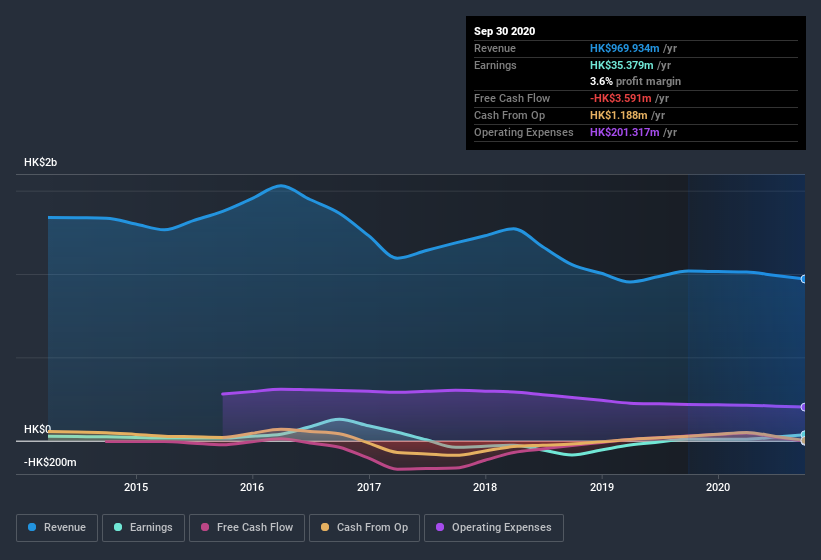

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Herald Holdings's EBIT margins have actually improved by 4.0 percentage points in the last year, to reach 2.1%, but, on the flip side, revenue was down 4.7%. That falls short of ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Since Herald Holdings is no giant, with a market capitalization of HK$417m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Herald Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Herald Holdings top brass are certainly in sync, not having sold any shares, over the last year. But the bigger deal is that the Executive Director, Tsang-Kay Cheung, paid HK$680k to buy shares at an average price of HK$0.68.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Herald Holdings insiders own more than a third of the company. Actually, with 42% of the company to their names, insiders are profoundly invested in the business. I'm reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. With that sort of holding, insiders have about HK$174m riding on the stock, at current prices. That's nothing to sneeze at!

Should You Add Herald Holdings To Your Watchlist?

Herald Holdings's earnings have taken off like any random crypto-currency did, back in 2017. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Herald Holdings deserves timely attention. You still need to take note of risks, for example - Herald Holdings has 4 warning signs (and 1 which is potentially serious) we think you should know about.

As a growth investor I do like to see insider buying. But Herald Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Herald Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Herald Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:114

Herald Holdings

Engages in the manufacture, sale, and distribution of toys, computer products, clocks, watches, and electronic and gift products.

Flawless balance sheet slight.

Market Insights

Community Narratives