- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1070

TCL Electronics Holdings (HKG:1070) Takes On Some Risk With Its Use Of Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies TCL Electronics Holdings Limited (HKG:1070) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for TCL Electronics Holdings

What Is TCL Electronics Holdings's Net Debt?

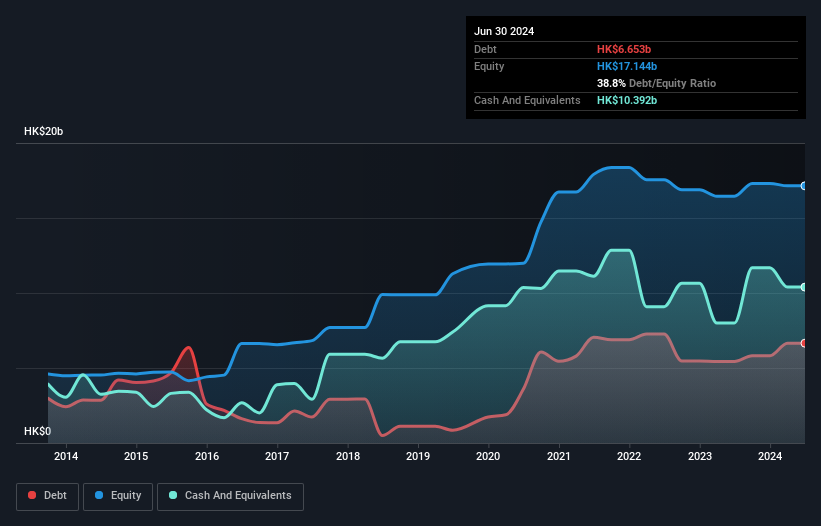

The image below, which you can click on for greater detail, shows that at June 2024 TCL Electronics Holdings had debt of HK$6.65b, up from HK$5.44b in one year. But on the other hand it also has HK$10.4b in cash, leading to a HK$3.74b net cash position.

A Look At TCL Electronics Holdings' Liabilities

The latest balance sheet data shows that TCL Electronics Holdings had liabilities of HK$52.6b due within a year, and liabilities of HK$1.51b falling due after that. On the other hand, it had cash of HK$10.4b and HK$20.1b worth of receivables due within a year. So its liabilities total HK$23.6b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the HK$12.6b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. At the end of the day, TCL Electronics Holdings would probably need a major re-capitalization if its creditors were to demand repayment. TCL Electronics Holdings boasts net cash, so it's fair to say it does not have a heavy debt load, even if it does have very significant liabilities, in total.

Notably, TCL Electronics Holdings made a loss at the EBIT level, last year, but improved that to positive EBIT of HK$691m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if TCL Electronics Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. TCL Electronics Holdings may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last year, TCL Electronics Holdings actually produced more free cash flow than EBIT. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

Although TCL Electronics Holdings's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of HK$3.74b. And it impressed us with free cash flow of HK$1.0b, being 150% of its EBIT. So although we see some areas for improvement, we're not too worried about TCL Electronics Holdings's balance sheet. Another positive for shareholders is that it pays dividends. So if you like receiving those dividend payments, check TCL Electronics Holdings's dividend history, without delay!

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TCL Electronics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1070

TCL Electronics Holdings

An investment holding company, operates as a consumer electronics company in Mainland China, Europe, North America, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion