- Hong Kong

- /

- Consumer Durables

- /

- SEHK:1070

Could TCL Electronics Holdings’ (SEHK:1070) Call of Duty Partnership Redefine Its Brand Strategy Among Gamers?

Reviewed by Sasha Jovanovic

- Earlier this week, TCL announced its entry into the U.S. gaming monitor market and an expanded partnership as the Official TV, Sound Bar, and now Gaming Monitor partner of Call of Duty during the rollout of Black Ops 7 Beta.

- This collaboration marks TCL's first foray into the U.S. gaming monitor market and leverages the exposure of one of the most popular video game franchises to advance its brand among dedicated gamers.

- We'll now consider how TCL's push into advanced gaming monitors through a key franchise partnership may influence its broader investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is TCL Electronics Holdings' Investment Narrative?

Investors considering TCL Electronics need to believe in the company’s ability to expand beyond its established TV and appliance markets, capitalizing on new growth areas such as gaming and advanced display technology. The recent announcement of TCL’s entry into the U.S. gaming monitor business, through a prominent partnership with Call of Duty, signals a fresh revenue stream and a bid to raise brand visibility among a highly engaged tech-savvy audience. This move taps into the fast-evolving gaming hardware segment and could accelerate sales momentum in the near term if adoption rates prove strong. However, TCL’s valuation is already above industry multiples, which could heighten expectations and the risk of near-term volatility if these launches do not meet market hopes. The key risk now shifts to whether TCL can translate this gaming push into lasting gains, while maintaining profit margins and avoiding overextension in competitive international markets. In contrast, heightened competition in the U.S. gaming display market remains a real concern that investors should be aware of.

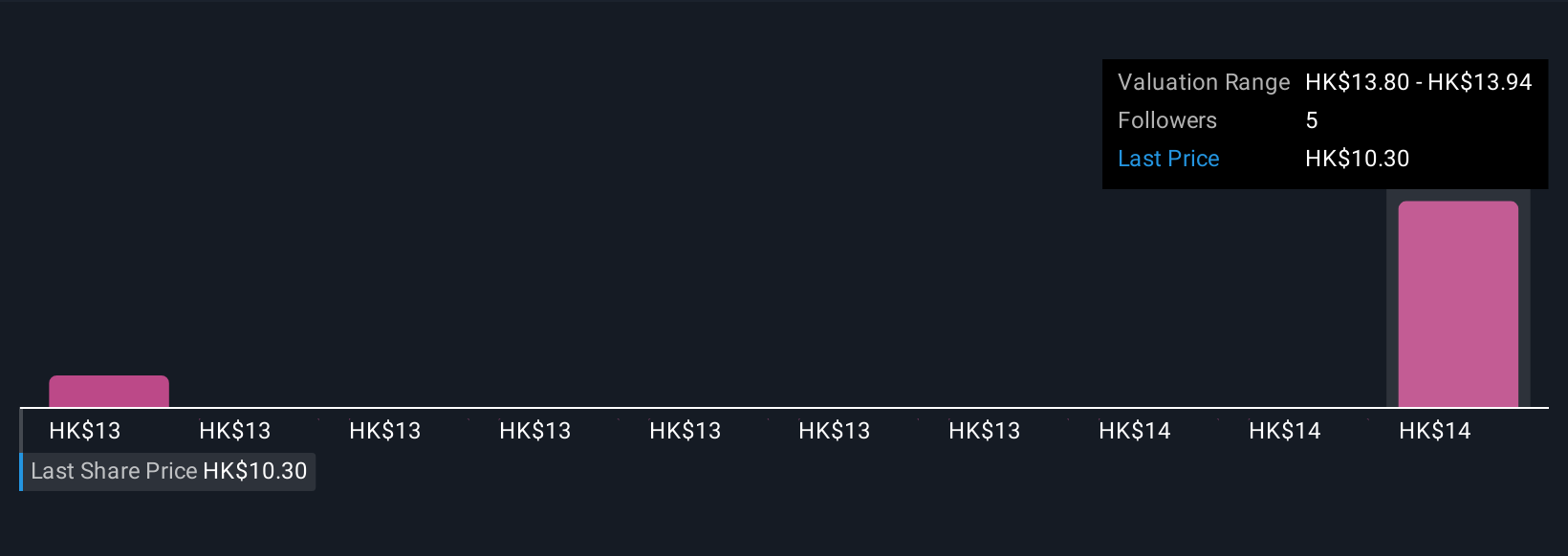

TCL Electronics Holdings' shares have been on the rise but are still potentially undervalued by 19%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on TCL Electronics Holdings - why the stock might be worth as much as 24% more than the current price!

Build Your Own TCL Electronics Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TCL Electronics Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TCL Electronics Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TCL Electronics Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TCL Electronics Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1070

TCL Electronics Holdings

An investment holding company, operates as a consumer electronics company in Mainland China, Europe, North America, and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion