- Hong Kong

- /

- Real Estate

- /

- SEHK:982

Update: HJ Capital (International) Holdings (HKG:982) Stock Gained 43% In The Last Three Years

One simple way to benefit from the stock market is to buy an index fund. But if you choose individual stocks with prowess, you can make superior returns. For example, HJ Capital (International) Holdings Company Limited (HKG:982) shareholders have seen the share price rise 43% over three years, well in excess of the market decline (3.6%, not including dividends). On the other hand, the returns haven't been quite so good recently, with shareholders up just 29%.

View our latest analysis for HJ Capital (International) Holdings

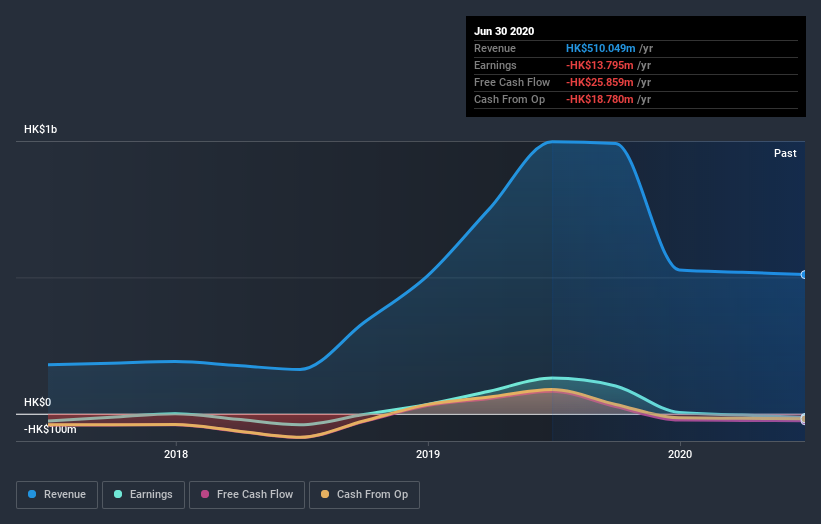

HJ Capital (International) Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

HJ Capital (International) Holdings' revenue trended up 45% each year over three years. That's well above most pre-profit companies. The share price rise of 13% per year throughout that time is nice to see, and given the revenue growth, that gain seems somewhat justified. So now might be the perfect time to put HJ Capital (International) Holdings on your radar. A window of opportunity may reveal itself with time, if the business can trend to profitability.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on HJ Capital (International) Holdings' earnings, revenue and cash flow.

A Different Perspective

HJ Capital (International) Holdings provided a TSR of 29% over the year. That's fairly close to the broader market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 5% per year. Even if the share price growth slows down from here, there's a good chance that this is business worth watching in the long term. It's always interesting to track share price performance over the longer term. But to understand HJ Capital (International) Holdings better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with HJ Capital (International) Holdings (including 1 which is potentially serious) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading HJ Capital (International) Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Huafa Property Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:982

Huafa Property Services Group

An investment holding company, provides property management services in Hong Kong and Mainland China.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives