- Hong Kong

- /

- Professional Services

- /

- SEHK:6919

Renrui Human Resources Technology Holdings Limited (HKG:6919) Stock Rockets 27% But Many Are Still Ignoring The Company

Renrui Human Resources Technology Holdings Limited (HKG:6919) shareholders have had their patience rewarded with a 27% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 11% over that time.

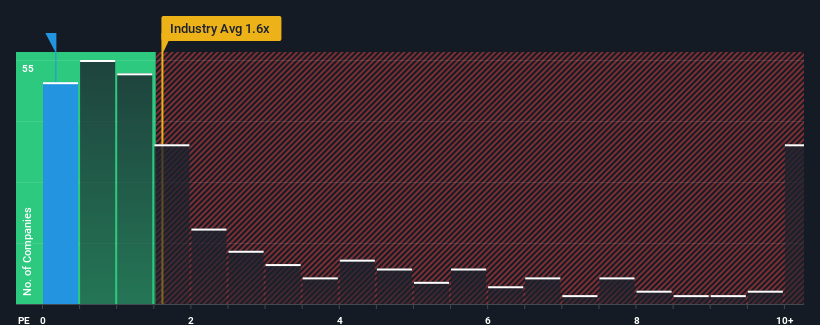

Even after such a large jump in price, Renrui Human Resources Technology Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Professional Services industry in Hong Kong have P/S ratios greater than 0.7x and even P/S higher than 3x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Renrui Human Resources Technology Holdings

How Has Renrui Human Resources Technology Holdings Performed Recently?

There hasn't been much to differentiate Renrui Human Resources Technology Holdings' and the industry's retreating revenue lately. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. You'd much rather the company continue improving its revenue if you still believe in the business. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Renrui Human Resources Technology Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Renrui Human Resources Technology Holdings would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 8.6%. Still, the latest three year period has seen an excellent 65% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 23% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 12%, which is noticeably less attractive.

In light of this, it's peculiar that Renrui Human Resources Technology Holdings' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Final Word

Renrui Human Resources Technology Holdings' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Renrui Human Resources Technology Holdings' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Renrui Human Resources Technology Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6919

Renrui Human Resources Technology Holdings

An investment holding company, provides human resources services in China.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.