- Hong Kong

- /

- Commercial Services

- /

- SEHK:6812

Winson Holdings Hong Kong (HKG:6812) Is Growing Earnings But Are They A Good Guide?

As a general rule, we think profitable companies are less risky than companies that lose money. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. Today we'll focus on whether this year's statutory profits are a good guide to understanding Winson Holdings Hong Kong (HKG:6812).

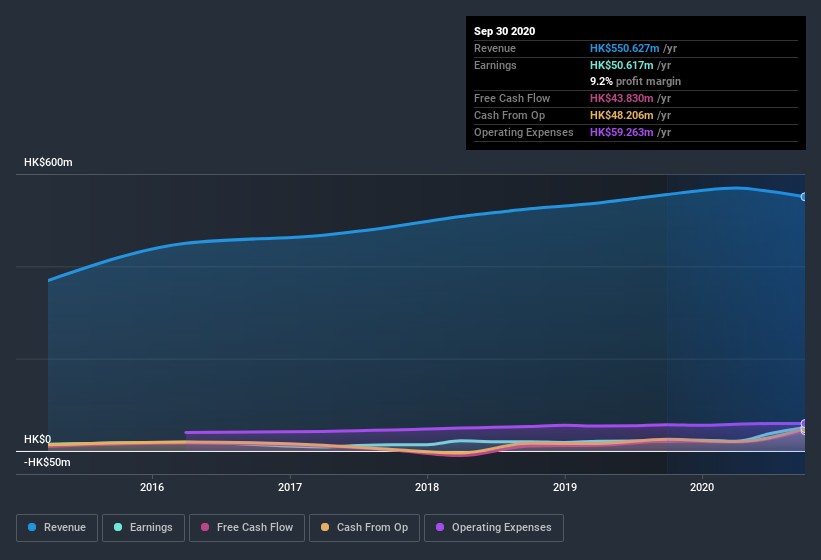

We like the fact that Winson Holdings Hong Kong made a profit of HK$50.6m on its revenue of HK$550.6m, in the last year. In the chart below, you can see that its profit and revenue have both grown over the last three years.

View our latest analysis for Winson Holdings Hong Kong

Not all profits are equal, and we can learn more about the nature of a company's past profitability by diving deeper into the financial statements. This article will discuss how unusual items have impacted Winson Holdings Hong Kong's most recent profit results. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Winson Holdings Hong Kong.

How Do Unusual Items Influence Profit?

Importantly, our data indicates that Winson Holdings Hong Kong's profit received a boost of HK$33m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. Which is hardly surprising, given the name. We can see that Winson Holdings Hong Kong's positive unusual items were quite significant relative to its profit in the year to September 2020. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Winson Holdings Hong Kong's Profit Performance

As previously mentioned, Winson Holdings Hong Kong's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. As a result, we think it may well be the case that Winson Holdings Hong Kong's underlying earnings power is lower than its statutory profit. But the good news is that its EPS growth over the last three years has been very impressive. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. In terms of investment risks, we've identified 2 warning signs with Winson Holdings Hong Kong, and understanding them should be part of your investment process.

Today we've zoomed in on a single data point to better understand the nature of Winson Holdings Hong Kong's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Winson Holdings Hong Kong or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Winson Holdings Hong Kong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:6812

Winson Holdings Hong Kong

An investment holding company, provides environmental hygiene and related, and airline catering support services in Hong Kong.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026