- Hong Kong

- /

- Real Estate

- /

- SEHK:674

Should You Be Adding China Tangshang Holdings (HKG:674) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in China Tangshang Holdings (HKG:674). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for China Tangshang Holdings

How Fast Is China Tangshang Holdings Growing Its Earnings Per Share?

China Tangshang Holdings has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Outstandingly, China Tangshang Holdings' EPS shot from HK$0.0035 to HK$0.0089, over the last year. It's a rarity to see 155% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

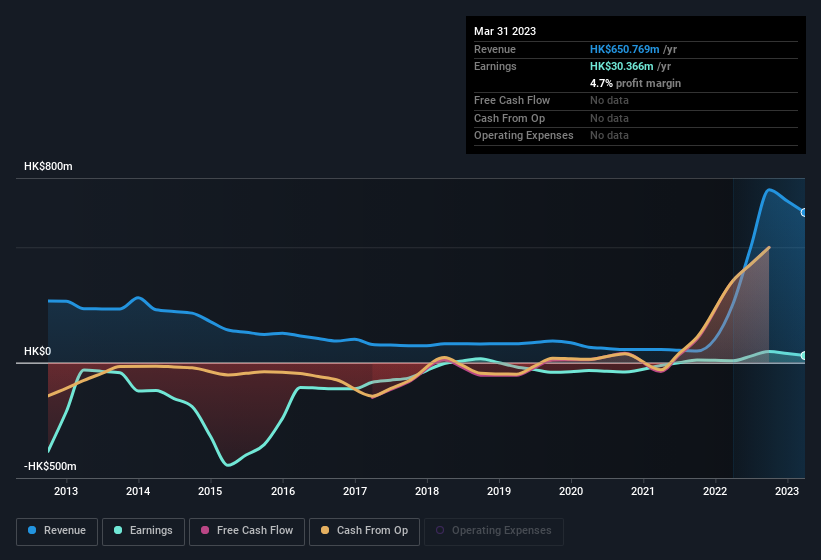

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, China Tangshang Holdings' EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Since China Tangshang Holdings is no giant, with a market capitalisation of HK$415m, you should definitely check its cash and debt before getting too excited about its prospects.

Are China Tangshang Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for China Tangshang Holdings is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. Indeed, Executive Chairman Weiwu Chen has accumulated shares over the last year, paying a total of HK$107m at an average price of about HK$0.20. Big insider buys like that are a rarity and should prompt discussion on the merits of the business.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for China Tangshang Holdings will reveal that insiders own a significant piece of the pie. Indeed, with a collective holding of 58%, company insiders are in control and have plenty of capital behind the venture. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. With that sort of holding, insiders have about HK$240m riding on the stock, at current prices. That's nothing to sneeze at!

Does China Tangshang Holdings Deserve A Spot On Your Watchlist?

China Tangshang Holdings' earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest China Tangshang Holdings belongs near the top of your watchlist. Even so, be aware that China Tangshang Holdings is showing 3 warning signs in our investment analysis , you should know about...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of China Tangshang Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:674

China Tangshang Holdings

An investment holding company, engages in the property investment, development, and sub-leasing activities in Hong Kong and the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives