- Hong Kong

- /

- Professional Services

- /

- SEHK:2250

Market Participants Recognise B.Duck Semk Holdings International Limited's (HKG:2250) Earnings

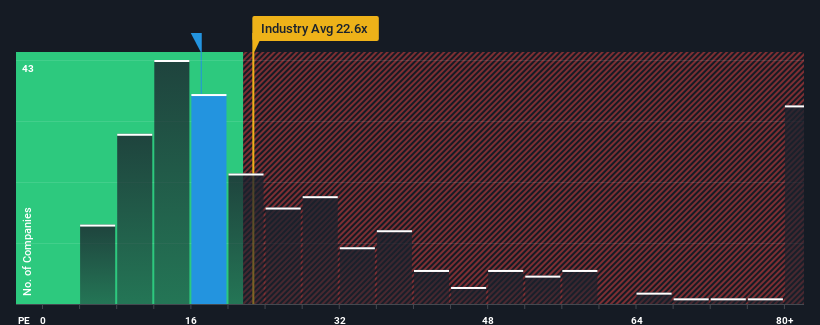

With a price-to-earnings (or "P/E") ratio of 17x B.Duck Semk Holdings International Limited (HKG:2250) may be sending very bearish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios under 9x and even P/E's lower than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

B.Duck Semk Holdings International certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for B.Duck Semk Holdings International

Is There Enough Growth For B.Duck Semk Holdings International?

The only time you'd be truly comfortable seeing a P/E as steep as B.Duck Semk Holdings International's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 5.0% last year. Pleasingly, EPS has also lifted 171% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the sole analyst watching the company. With the market only predicted to deliver 17% per year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that B.Duck Semk Holdings International's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of B.Duck Semk Holdings International's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with B.Duck Semk Holdings International, and understanding should be part of your investment process.

If you're unsure about the strength of B.Duck Semk Holdings International's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade B.Duck Semk Holdings International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if B.Duck Semk Holdings International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2250

B.Duck Semk Holdings International

An investment holding company, provides licensing and design consultation services in Hong Kong, Mainland China, Taiwan, Southeast Asia, Brazil, Latin America, and internationally.

Adequate balance sheet minimal.

Similar Companies

Market Insights

Community Narratives