- Hong Kong

- /

- Professional Services

- /

- SEHK:2225

Investors might be losing patience for Jinhai Medical Technology's (HKG:2225) increasing losses, as stock sheds 7.6% over the past week

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the Jinhai Medical Technology Limited (HKG:2225) share price. It's 435% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. It's also good to see the share price up 75% over the last quarter.

Although Jinhai Medical Technology has shed HK$905m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for Jinhai Medical Technology

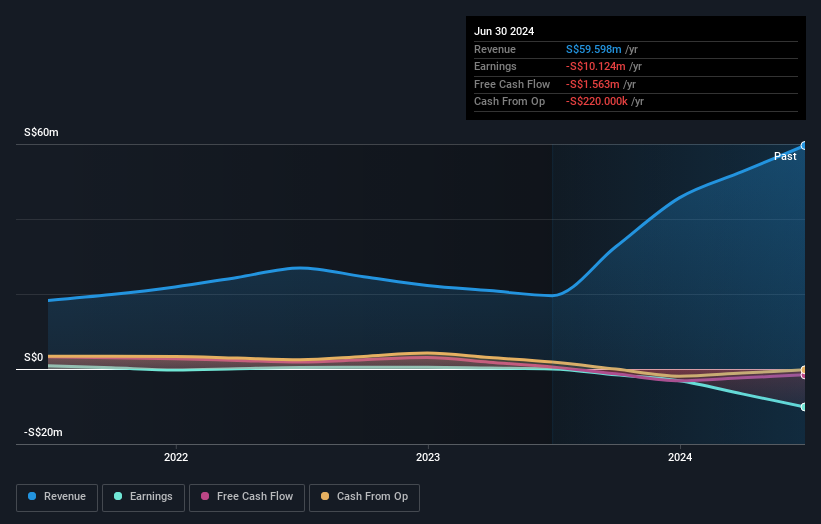

Given that Jinhai Medical Technology didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last half decade Jinhai Medical Technology's revenue has actually been trending down at about 2.9% per year. So it's pretty surprising to see that the share price is up 40% per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. I think it's fair to say there is probably a fair bit of excitement in the price.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Jinhai Medical Technology's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Jinhai Medical Technology shareholders have received a total shareholder return of 240% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 40% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Jinhai Medical Technology better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Jinhai Medical Technology you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2225

Jinhai Medical Technology

An investment holding company, primarily engages in the provision of manpower outsourcing and ancillary services to building and construction contractors in Singapore.

Mediocre balance sheet minimal.