As global markets navigate the complexities of rate cuts by the ECB and SNB, with expectations for a similar move from the Fed, technology stocks have shown resilience, as evidenced by the Nasdaq Composite reaching a historic high. In this environment of mixed economic signals and sector performances, identifying high growth tech stocks requires careful consideration of their adaptability and potential to thrive amidst shifting macroeconomic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Karnov Group (OM:KAR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Karnov Group AB (publ) offers information products and services for legal, tax and accounting, environmental, and health and safety professionals across Denmark, Norway, France, Sweden, Portugal, and Spain with a market capitalization of approximately SEK8.74 billion.

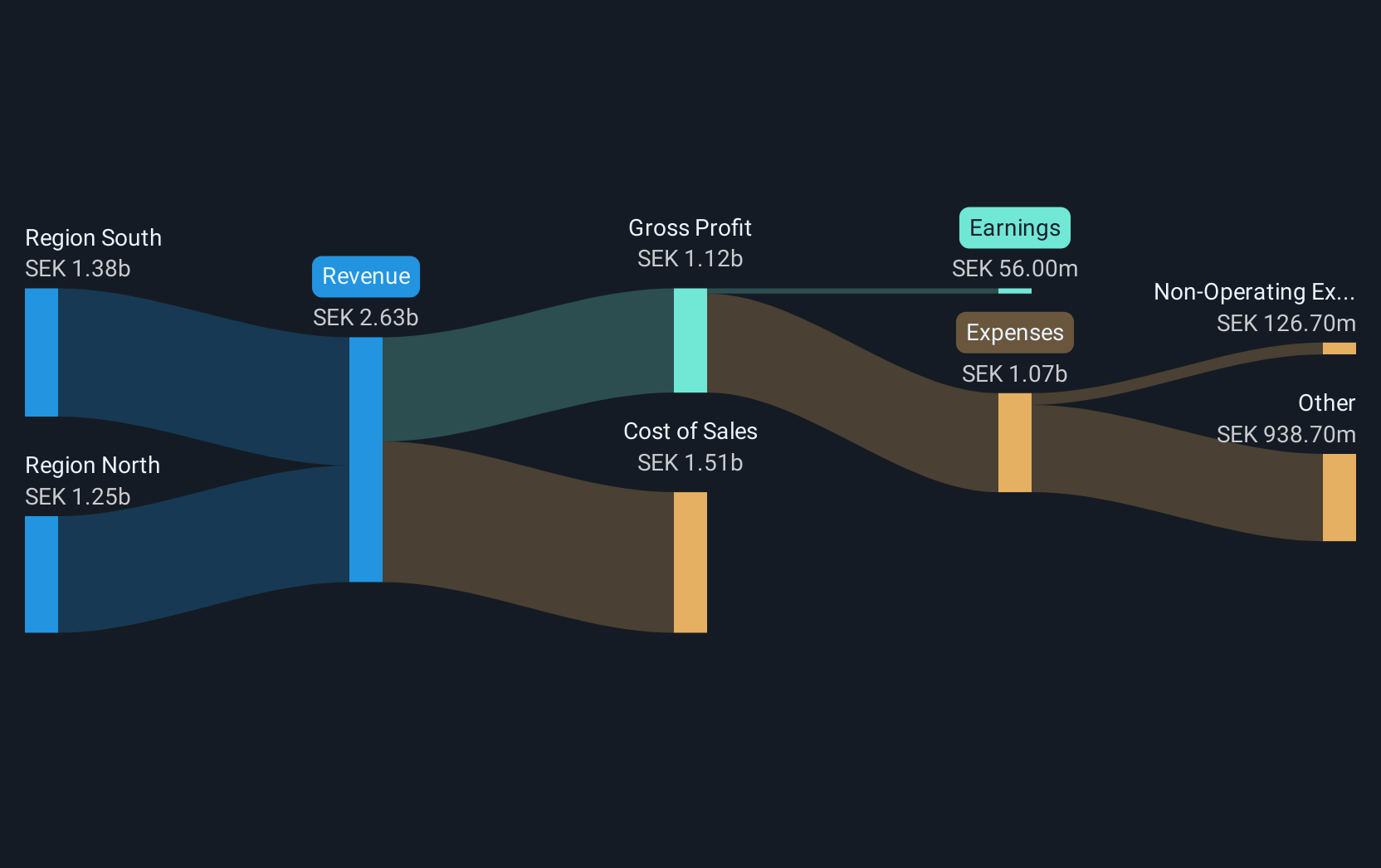

Operations: The company generates revenue from its information products and services, with SEK1.16 billion coming from Region North and SEK1.38 billion from Region South.

Karnov Group, despite a challenging quarter with a net loss of SEK 12.3 million from SEK 21 million net income year-over-year, demonstrates resilience with a revenue increase to SEK 647.7 million from SEK 618.9 million in the same period last year. This growth is modest compared to its explosive past earnings growth of 466.7%, significantly outpacing the industry's average of 30.4%. The company's commitment to innovation is evident as it navigates through market fluctuations and prepares for future opportunities by appointing a new Nomination Committee, aiming to strengthen governance and strategic oversight ahead of its next Annual General Meeting.

BOE Varitronix (SEHK:710)

Simply Wall St Growth Rating: ★★★★☆☆

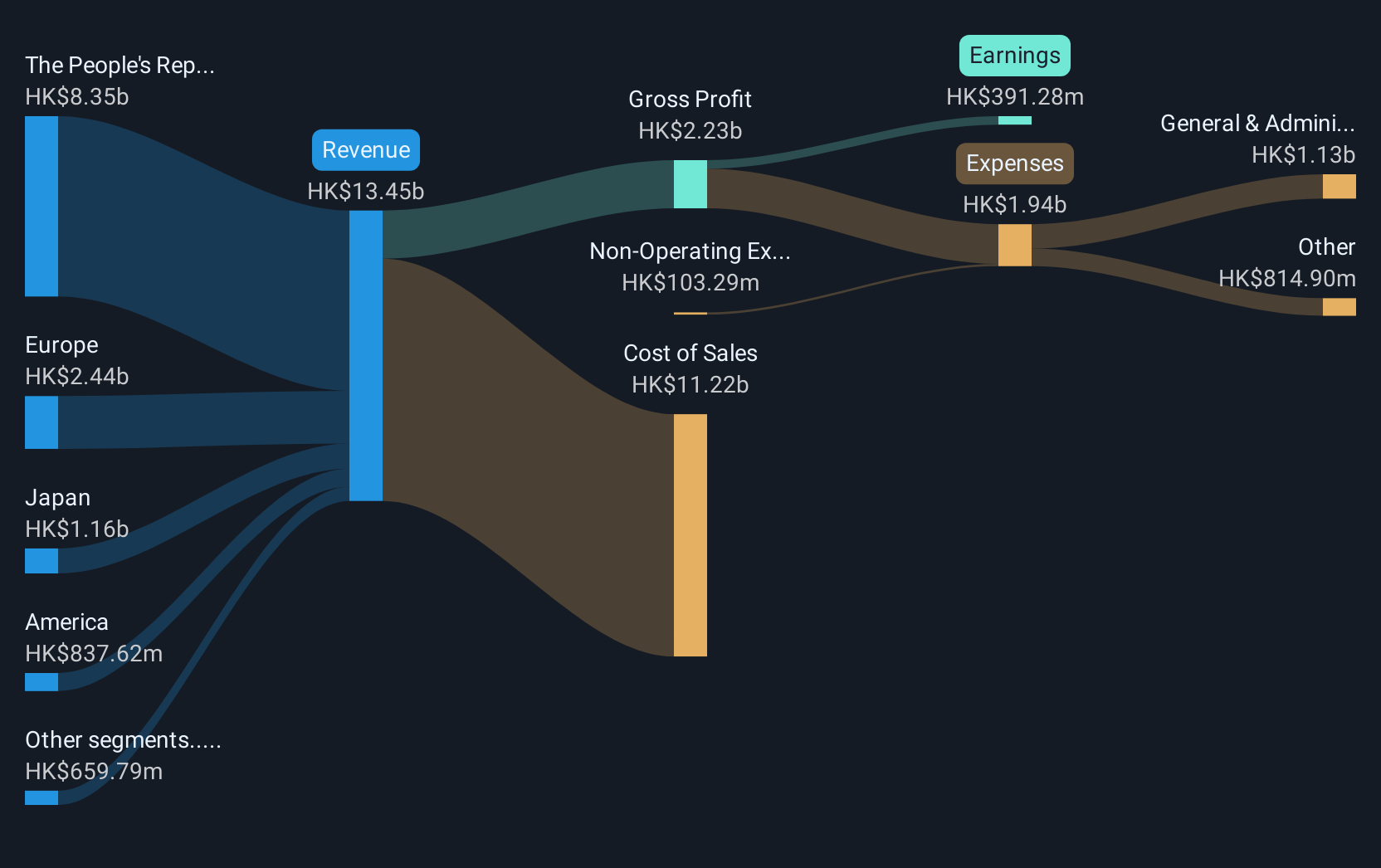

Overview: BOE Varitronix Limited is an investment holding company that specializes in the design, manufacture, and sale of liquid crystal displays and related products across various international markets, with a market cap of approximately HK$4.88 billion.

Operations: The company focuses on the design, manufacture, and sale of liquid crystal displays and related products, generating revenue primarily from this segment. With a market cap of approximately HK$4.88 billion, its operations span across China, Europe, the United States, Korea, and other international markets.

BOE Varitronix, navigating through a dynamic tech landscape, shows promising growth with a 14.2% annual revenue increase and an even more robust earnings forecast at 20.8% per year, outpacing the Hong Kong market's average of 11.6%. Despite challenges in the past year with earnings contraction by 16.7%, the company's strategic moves, including a significant agreement with BOE Technology Group, signal strong future prospects. This is underscored by their positive free cash flow status and an ongoing commitment to R&D which remains integral to their competitive edge in the electronic displays sector.

- Click here to discover the nuances of BOE Varitronix with our detailed analytical health report.

Examine BOE Varitronix's past performance report to understand how it has performed in the past.

Guangdong Senssun Weighing Apparatus Group (SZSE:002870)

Simply Wall St Growth Rating: ★★★★☆☆

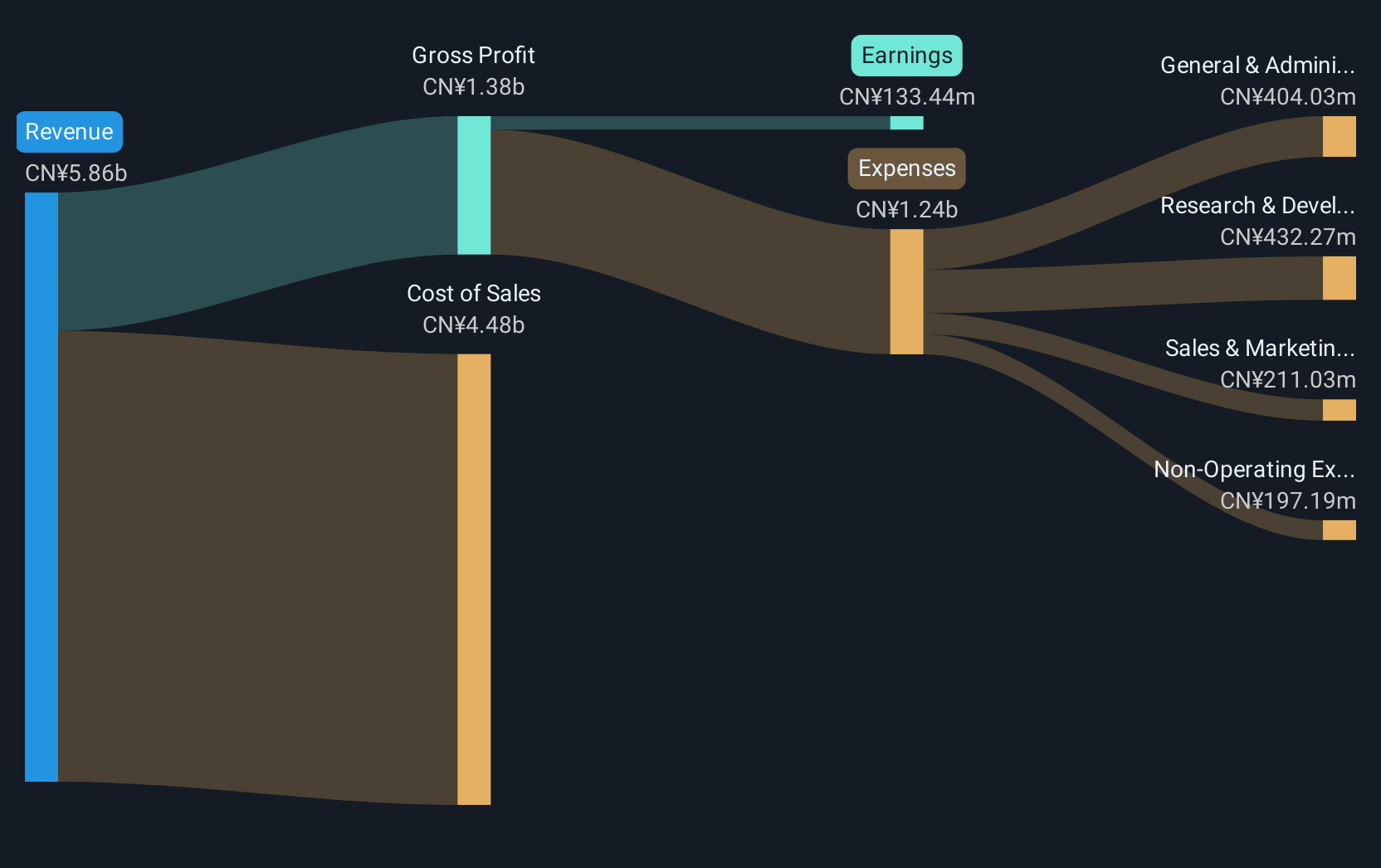

Overview: Guangdong Senssun Weighing Apparatus Group Ltd. operates in the weighing apparatus industry and has a market capitalization of CN¥4.49 billion.

Operations: Senssun Weighing Apparatus Group generates revenue primarily from the manufacturing and sale of weighing apparatus. The company focuses on innovative product development to cater to various industry needs, contributing to its financial performance.

Guangdong Senssun Weighing Apparatus Group, amidst a challenging landscape, has showcased resilience with a revenue uptick to CNY 4.4 billion, up from CNY 4.15 billion year-over-year. This growth is complemented by an aggressive R&D stance, with expenses marking a significant portion of revenue, underscoring their commitment to innovation in the weighing apparatus sector. Although net income slightly dipped to CNY 125.23 million from CNY 140.55 million, the firm's strategic decisions and recent extraordinary shareholder meetings suggest proactive governance aimed at refining operations and enhancing shareholder value.

Taking Advantage

- Click here to access our complete index of 1267 High Growth Tech and AI Stocks.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BOE Varitronix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:710

BOE Varitronix

An investment holding company, designs, manufactures, and sells liquid crystal display and related products in the People’s Republic of China, Europe, the United States, Korea, Japan, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives