- Hong Kong

- /

- Professional Services

- /

- SEHK:2225

Investors Appear Satisfied With Jinhai Medical Technology Limited's (HKG:2225) Prospects As Shares Rocket 26%

Jinhai Medical Technology Limited (HKG:2225) shares have continued their recent momentum with a 26% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 100% in the last year.

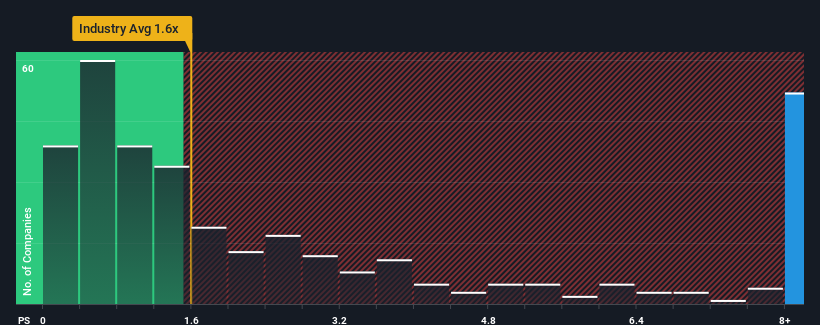

Since its price has surged higher, you could be forgiven for thinking Jinhai Medical Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 24x, considering almost half the companies in Hong Kong's Professional Services industry have P/S ratios below 0.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Jinhai Medical Technology

What Does Jinhai Medical Technology's P/S Mean For Shareholders?

Recent times have been quite advantageous for Jinhai Medical Technology as its revenue has been rising very briskly. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jinhai Medical Technology will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Jinhai Medical Technology would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 105% last year. Pleasingly, revenue has also lifted 103% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 12% shows it's noticeably more attractive.

In light of this, it's understandable that Jinhai Medical Technology's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Final Word

The strong share price surge has lead to Jinhai Medical Technology's P/S soaring as well. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Jinhai Medical Technology revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You always need to take note of risks, for example - Jinhai Medical Technology has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Jinhai Medical Technology, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2225

Jinhai Medical Technology

An investment holding company, primarily engages in the provision of manpower outsourcing and ancillary services to building and construction contractors in Singapore.

Excellent balance sheet minimal.

Market Insights

Community Narratives