- Hong Kong

- /

- Professional Services

- /

- SEHK:2180

ManpowerGroup Greater China (HKG:2180) Will Pay A Larger Dividend Than Last Year At HK$0.37

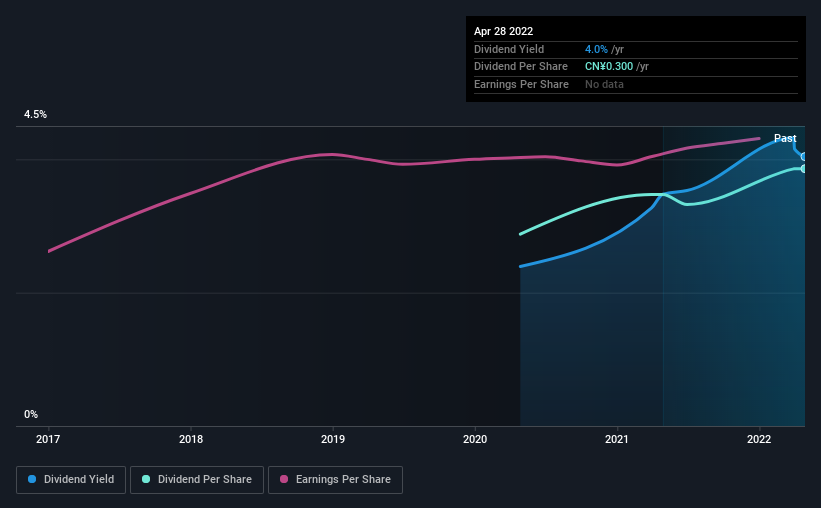

The board of ManpowerGroup Greater China Limited (HKG:2180) has announced that it will be increasing its dividend on the 20th of July to HK$0.37. This will take the dividend yield from 4.0% to 4.2%, providing a nice boost to shareholder returns.

Check out our latest analysis for ManpowerGroup Greater China

ManpowerGroup Greater China's Payment Has Solid Earnings Coverage

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. ManpowerGroup Greater China was earning enough to cover the previous dividend, but it was paying out quite a large proportion of its free cash flows. By paying out so much of its cash flows, this could indicate that the company has limited opportunities for investment and growth.

Looking forward, earnings per share could rise by 10.5% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 50%, which is in the range that makes us comfortable with the sustainability of the dividend.

ManpowerGroup Greater China Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. Since 2020, the dividend has gone from CN¥0.22 to CN¥0.30. This works out to be a compound annual growth rate (CAGR) of approximately 16% a year over that time. The dividend has been growing rapidly, however with such a short payment history we can't know for sure if payment can continue to grow over the long term, so caution may be warranted.

The Dividend Looks Likely To Grow

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see ManpowerGroup Greater China has been growing its earnings per share at 10% a year over the past five years. Since earnings per share is growing at an acceptable rate, and the payout policy is balanced, we think the company is positioning itself well to grow earnings and dividends in the future.

Our Thoughts On ManpowerGroup Greater China's Dividend

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. While ManpowerGroup Greater China is earning enough to cover the dividend, we are generally unimpressed with its future prospects. We don't think ManpowerGroup Greater China is a great stock to add to your portfolio if income is your focus.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 2 warning signs for ManpowerGroup Greater China you should be aware of, and 1 of them is potentially serious. Is ManpowerGroup Greater China not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2180

ManpowerGroup Greater China

An investment holding company, provides workforce solutions and services in the People’s Republic of China, Hong Kong, Macau, and Taiwan.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)