- Hong Kong

- /

- Commercial Services

- /

- SEHK:1417

Riverine China Holdings Limited's (HKG:1417) 30% Cheaper Price Remains In Tune With Revenues

The Riverine China Holdings Limited (HKG:1417) share price has fared very poorly over the last month, falling by a substantial 30%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 46% in that time.

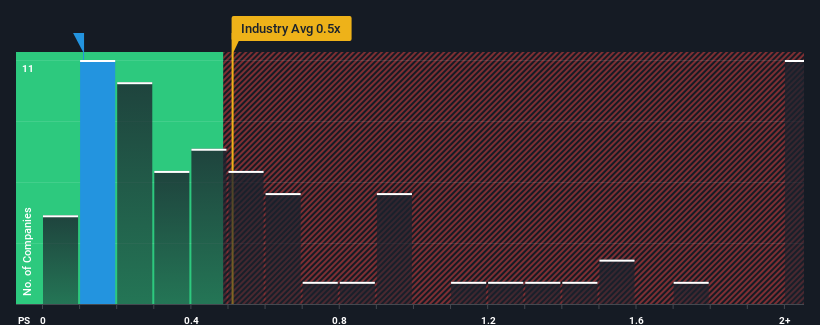

Even after such a large drop in price, it's still not a stretch to say that Riverine China Holdings' price-to-sales (or "P/S") ratio of 0.1x right now seems quite "middle-of-the-road" compared to the Commercial Services industry in Hong Kong, where the median P/S ratio is around 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Riverine China Holdings

What Does Riverine China Holdings' P/S Mean For Shareholders?

For example, consider that Riverine China Holdings' financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is moderate because investors think this benign revenue growth rate might not be enough to outperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Riverine China Holdings' earnings, revenue and cash flow.How Is Riverine China Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Riverine China Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 20% overall rise in revenue. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 7.5% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we can see why Riverine China Holdings is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average growth rates continue into the future and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Following Riverine China Holdings' share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we've seen, Riverine China Holdings' three-year revenue trends seem to be contributing to its P/S, given they look similar to current industry expectations. Currently, with a past revenue trend that aligns closely wit the industry outlook, shareholders are confident the company's future revenue outlook won't contain any major surprises. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Riverine China Holdings you should be aware of, and 1 of them can't be ignored.

If these risks are making you reconsider your opinion on Riverine China Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1417

Riverine China Holdings

An investment holding company, provides property management and urban sanitary services in the People’s Republic of China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives