- Hong Kong

- /

- Commercial Services

- /

- SEHK:1253

China Greenland Broad Greenstate Group (HKG:1253) Share Prices Have Dropped 81% In The Last Five Years

China Greenland Broad Greenstate Group Company Limited (HKG:1253) shareholders should be happy to see the share price up 15% in the last month. But spare a thought for the long term holders, who have held the stock as it bled value over the last five years. Indeed, the share price is down a whopping 81% in that time. While the recent increase might be a green shoot, we're certainly hesitant to rejoice. The real question is whether the business can leave its past behind and improve itself over the years ahead.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

See our latest analysis for China Greenland Broad Greenstate Group

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

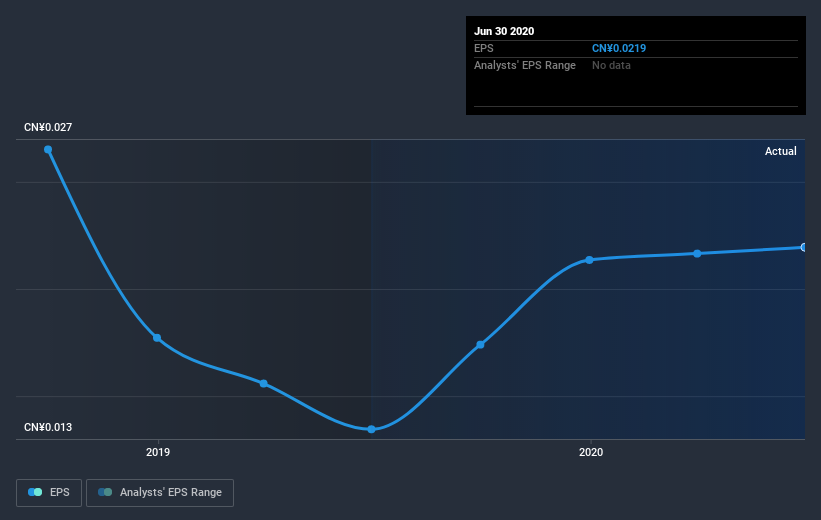

During the five years over which the share price declined, China Greenland Broad Greenstate Group's earnings per share (EPS) dropped by 13% each year. Readers should note that the share price has fallen faster than the EPS, at a rate of 28% per year, over the period. This implies that the market is more cautious about the business these days.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. It might be well worthwhile taking a look at our free report on China Greenland Broad Greenstate Group's earnings, revenue and cash flow.

A Different Perspective

Investors in China Greenland Broad Greenstate Group had a tough year, with a total loss of 49%, against a market gain of about 35%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 3 warning signs for China Greenland Broad Greenstate Group (2 are significant!) that you should be aware of before investing here.

But note: China Greenland Broad Greenstate Group may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you decide to trade China Greenland Broad Greenstate Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1253

China Greenland Broad Greenstate Group

An investment holding company, provides landscape design, gardening, project management, and related services in the People’s Republic of China.

Slight with mediocre balance sheet.