- Taiwan

- /

- Semiconductors

- /

- TPEX:6147

3 Top Dividend Stocks Including Geumhwa Plant Service & Construction

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by accelerating inflation and near-record highs in U.S. stock indexes, investors are increasingly seeking stability through dividend stocks. In this context, identifying companies with strong fundamentals and consistent dividend payouts can be particularly appealing for those looking to mitigate volatility while still participating in market growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.42% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.29% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.43% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

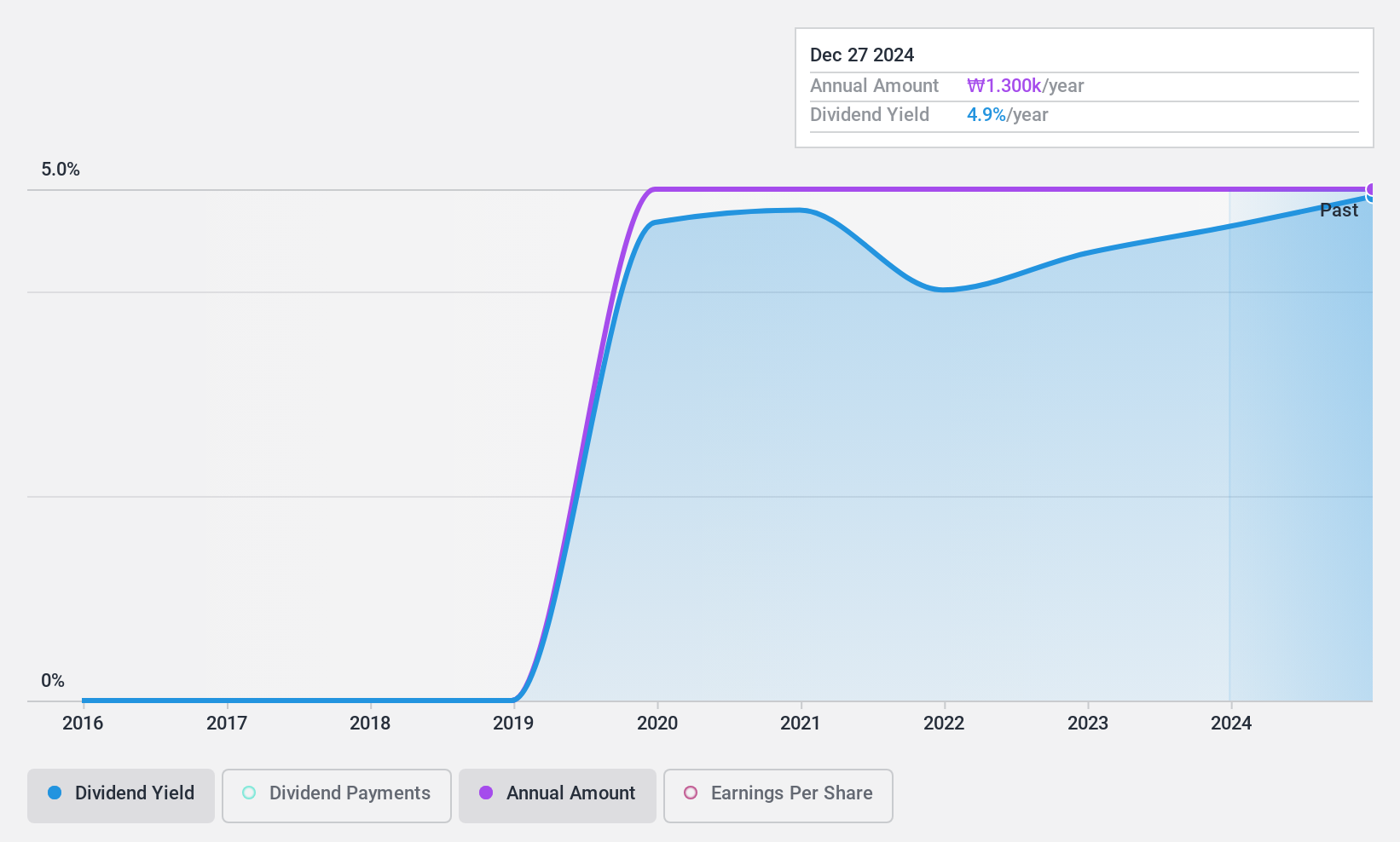

Geumhwa Plant Service & Construction (KOSDAQ:A036190)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Geumhwa Plant Service & Construction Co., Ltd. operates in the construction and plant service industry with a market cap of ₩148.53 billion.

Operations: Geumhwa Plant Service & Construction Co., Ltd. generates revenue from three main segments: Power Plant Construction (₩283.12 billion), Water Treatment Facilities (₩45.97 billion), and Automotive Parts Manufacturing (₩4.66 billion).

Dividend Yield: 5.2%

Geumhwa Plant Service & Construction's dividend payments are well-supported by both earnings and cash flows, with a low payout ratio of 17.5%. Despite a strong dividend yield of 5.17%, ranking in the top 25% within the KR market, its dividends have been unreliable over six years without growth and stability. The stock trades significantly below its estimated fair value, suggesting potential undervaluation for investors seeking income opportunities.

- Get an in-depth perspective on Geumhwa Plant Service & Construction's performance by reading our dividend report here.

- Our expertly prepared valuation report Geumhwa Plant Service & Construction implies its share price may be lower than expected.

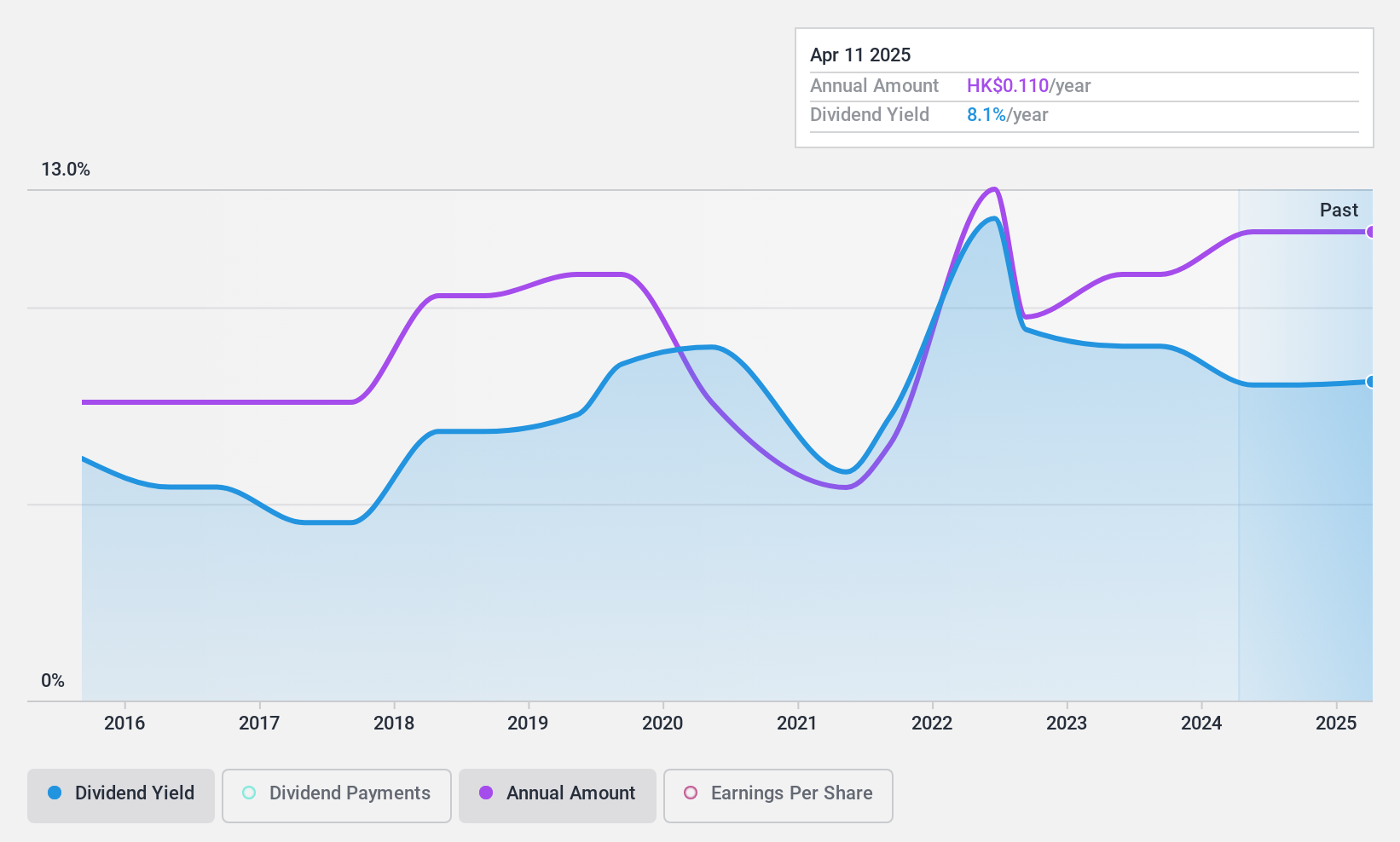

Lion Rock Group (SEHK:1127)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lion Rock Group Limited is an investment holding company that offers printing services to international book publishers and print media companies, with a market cap of HK$985.60 million.

Operations: Lion Rock Group Limited generates revenue through its printing segment, which accounts for HK$1.84 billion, and its publishing segment, contributing HK$931.82 million.

Dividend Yield: 8.6%

Lion Rock Group's dividends are well-supported by earnings and cash flows, with payout ratios of 42.5% and 38.7%, respectively. The dividend yield of 8.59% ranks in the top 25% of Hong Kong payers, but payments have been volatile over the past decade despite some growth. Trading at a significant discount to estimated fair value, Lion Rock may appeal to income-focused investors mindful of its unstable dividend history.

- Delve into the full analysis dividend report here for a deeper understanding of Lion Rock Group.

- In light of our recent valuation report, it seems possible that Lion Rock Group is trading behind its estimated value.

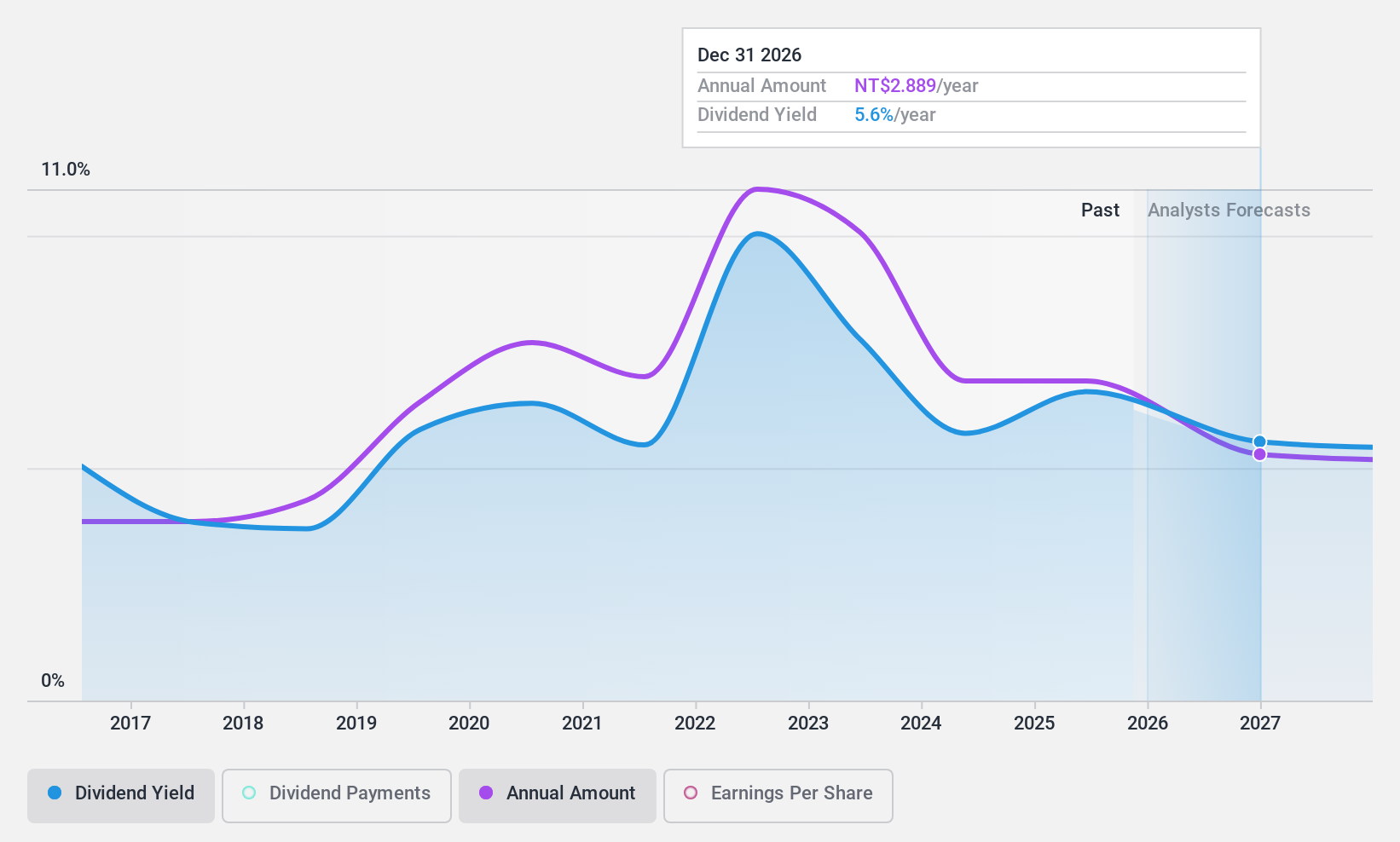

Chipbond Technology (TPEX:6147)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chipbond Technology Corporation, with a market cap of NT$48.85 billion, operates in Taiwan and Mainland China, focusing on the research, development, manufacture, and sale of driver IC and non-driver IC packaging and testing services.

Operations: Chipbond Technology Corporation generates revenue from its semiconductors segment, amounting to NT$19.79 billion.

Dividend Yield: 5.7%

Chipbond Technology offers a dividend yield of 5.72%, placing it in the top 25% of Taiwan's market payers. The payout is covered by earnings and cash flows, with ratios at 70% and 78.1%. Despite trading at a significant discount to estimated fair value, its dividend history has been volatile over the past decade, raising concerns about reliability despite some growth. Recent presentations may influence investor perception but don't alter its fundamental dividend profile.

- Navigate through the intricacies of Chipbond Technology with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Chipbond Technology's share price might be too pessimistic.

Summing It All Up

- Delve into our full catalog of 1985 Top Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6147

Chipbond Technology

Engages in the research, development, manufacture, and sale of driver IC and non-driver IC packaging and testing services in Taiwan and Mainland China.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives