- Hong Kong

- /

- Trade Distributors

- /

- SEHK:997

It's Unlikely That Chinlink International Holdings Limited's (HKG:997) CEO Will See A Huge Pay Rise This Year

Key Insights

- Chinlink International Holdings will host its Annual General Meeting on 27th of September

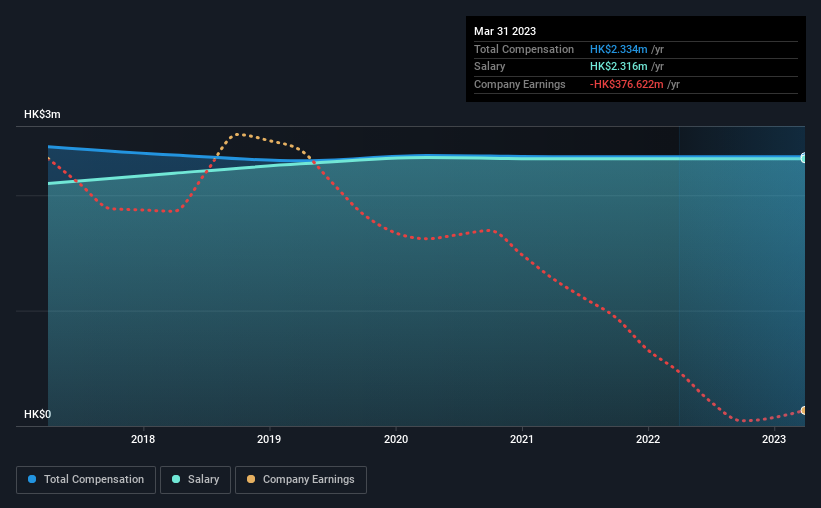

- Total pay for CEO Weibin Li includes HK$2.32m salary

- The total compensation is 50% higher than the average for the industry

- Chinlink International Holdings' three-year loss to shareholders was 94% while its EPS grew by 13% over the past three years

Shareholders of Chinlink International Holdings Limited (HKG:997) will have been dismayed by the negative share price return over the last three years. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. The AGM coming up on the 27th of September could be an opportunity for shareholders to bring these concerns to the board's attention. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

See our latest analysis for Chinlink International Holdings

How Does Total Compensation For Weibin Li Compare With Other Companies In The Industry?

At the time of writing, our data shows that Chinlink International Holdings Limited has a market capitalization of HK$32m, and reported total annual CEO compensation of HK$2.3m for the year to March 2023. There was no change in the compensation compared to last year. Notably, the salary which is HK$2.32m, represents most of the total compensation being paid.

On comparing similar-sized companies in the Hong Kong Trade Distributors industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.6m. Accordingly, our analysis reveals that Chinlink International Holdings Limited pays Weibin Li north of the industry median. Moreover, Weibin Li also holds HK$19m worth of Chinlink International Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$2.3m | HK$2.3m | 99% |

| Other | HK$18k | HK$18k | 1% |

| Total Compensation | HK$2.3m | HK$2.3m | 100% |

Talking in terms of the industry, salary represented approximately 93% of total compensation out of all the companies we analyzed, while other remuneration made up 7% of the pie. Investors will find it interesting that Chinlink International Holdings pays the bulk of its rewards through a traditional salary, instead of non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Chinlink International Holdings Limited's Growth

Chinlink International Holdings Limited's earnings per share (EPS) grew 13% per year over the last three years. It saw its revenue drop 20% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's always a tough situation when revenues are not growing, but ultimately profits are more important. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Chinlink International Holdings Limited Been A Good Investment?

With a total shareholder return of -94% over three years, Chinlink International Holdings Limited shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Chinlink International Holdings pays its CEO a majority of compensation through a salary. The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 3 warning signs (and 2 which are a bit unpleasant) in Chinlink International Holdings we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking to trade Chinlink International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:997

Chinlink International Holdings

An investment holding company, provides property investment services in the People’s Republic of China and Hong Kong.

Slight and slightly overvalued.

Market Insights

Community Narratives