- Thailand

- /

- Capital Markets

- /

- SET:AIRA

Asian Market Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As global markets react to recent economic shifts, including the Federal Reserve's decision to cut interest rates for the first time this year, attention turns to how these changes impact various sectors. Penny stocks, despite their somewhat outdated moniker, continue to capture investor interest due to their potential for high returns and accessibility. By focusing on companies with strong financial foundations and growth potential, investors can uncover valuable opportunities within this segment of the market.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB3.86 | THB3.81B | ✅ 4 ⚠️ 0 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$3.00 | HK$2.44B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.41 | HK$2B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.03 | SGD417.45M | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.74 | THB2.84B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.31 | SGD13.03B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.86 | THB9.82B | ✅ 3 ⚠️ 3 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.435 | SGD162.96M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 988 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Changhong Jiahua Holdings (SEHK:3991)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Changhong Jiahua Holdings Limited is an investment holding company that distributes ICT consumer and corporate products in China and internationally, with a market cap of HK$2.93 billion.

Operations: The company generates revenue from its ICT Consumer Products segment, which accounts for HK$17.84 billion, and its ICT Corporate Products segment, contributing HK$15.77 billion.

Market Cap: HK$2.93B

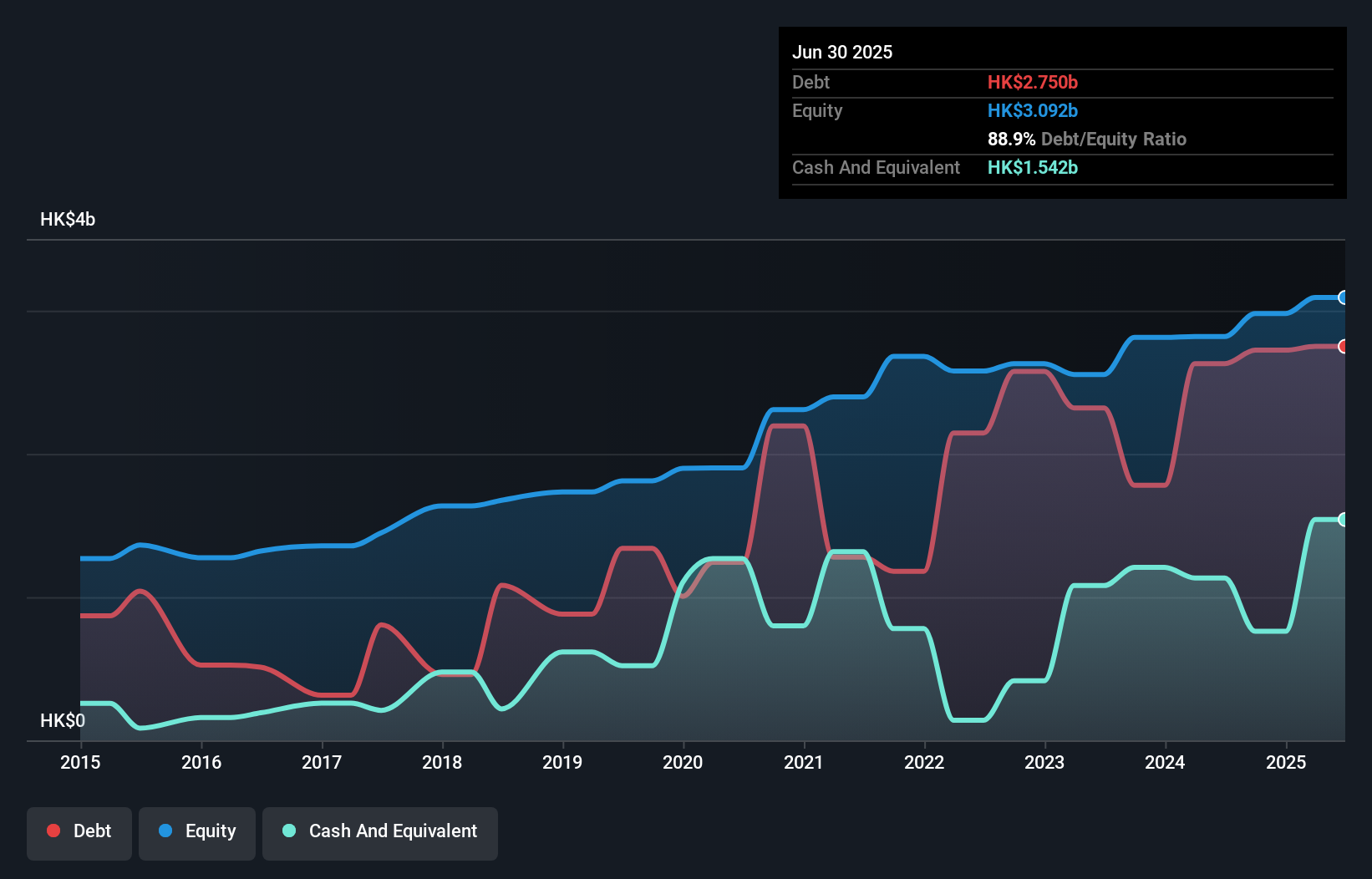

Changhong Jiahua Holdings Limited, with a market cap of HK$2.93 billion, has shown stable weekly volatility and improved net profit margins over the past year. The company's earnings growth of 9.8% surpasses its five-year average and the electronic industry benchmark. Despite a low return on equity at 12.8%, it maintains satisfactory debt levels with short-term assets exceeding liabilities by HK$3 billion and interest payments well-covered by EBIT. However, negative operating cash flow raises concerns about debt coverage, while recent legal disputes may impact future profits despite a favorable court ruling in September 2025 affirming an earlier judgment in their favor.

- Take a closer look at Changhong Jiahua Holdings' potential here in our financial health report.

- Gain insights into Changhong Jiahua Holdings' past trends and performance with our report on the company's historical track record.

IPE Group (SEHK:929)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IPE Group Limited is an investment holding company that manufactures, sells, and trades precision metal components and assembled parts for various industries including automotive, hydraulic equipment, and electronics; it has a market cap of HK$915.46 million.

Operations: The company generates revenue primarily from three segments: Automotive Components (HK$434.34 million), Hydraulic Equipment Components (HK$488.54 million), and Electronic Equipment Components (HK$25.06 million).

Market Cap: HK$915.46M

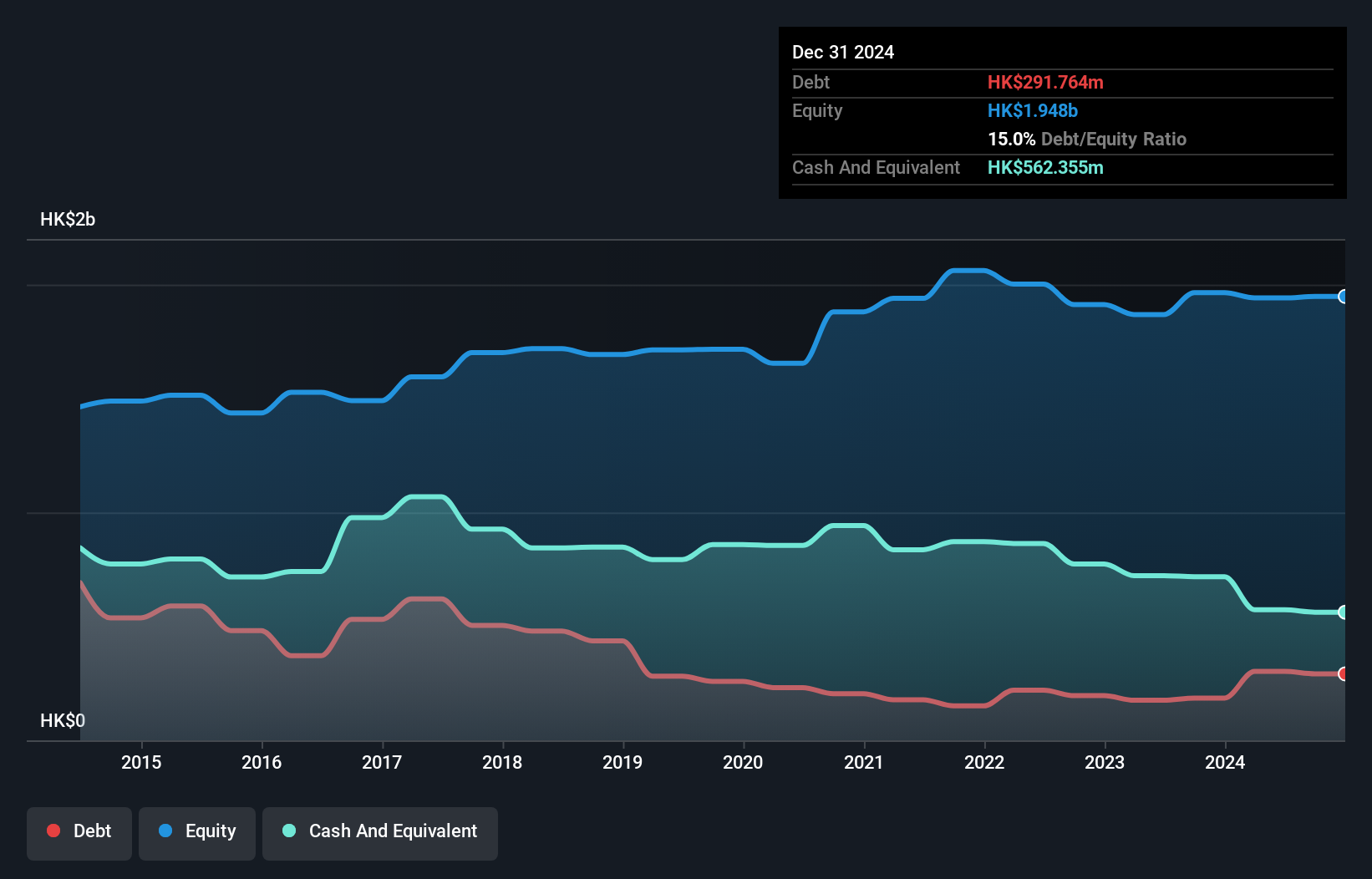

IPE Group Limited, with a market cap of HK$915.46 million, has experienced recent earnings growth of 12.2% over the past year, outperforming its five-year decline average. Despite this improvement, revenue for the first half of 2025 slightly decreased to HK$487.74 million from HK$502.15 million in the previous year. The company's financial stability is supported by short-term assets exceeding liabilities and a debt level well-covered by operating cash flow and EBIT interest coverage at 7.7x. However, its return on equity remains low at 1.5%, and share price volatility has increased recently, adding potential risk considerations for investors in penny stocks.

- Click to explore a detailed breakdown of our findings in IPE Group's financial health report.

- Gain insights into IPE Group's historical outcomes by reviewing our past performance report.

AIRA Capital (SET:AIRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: AIRA Capital Public Company Limited, with a market cap of THB7.33 billion, operates in Thailand through investment and financial advisory services alongside its subsidiaries.

Operations: AIRA Capital generates revenue from several segments including Factoring (THB132 million), Property Development (THB288 million), Advisory and Investment Banking (THB11 million), Securities and Investment Business (THB354 million), and Rental and Service Business excluding Property Development (THB54 million).

Market Cap: THB7.33B

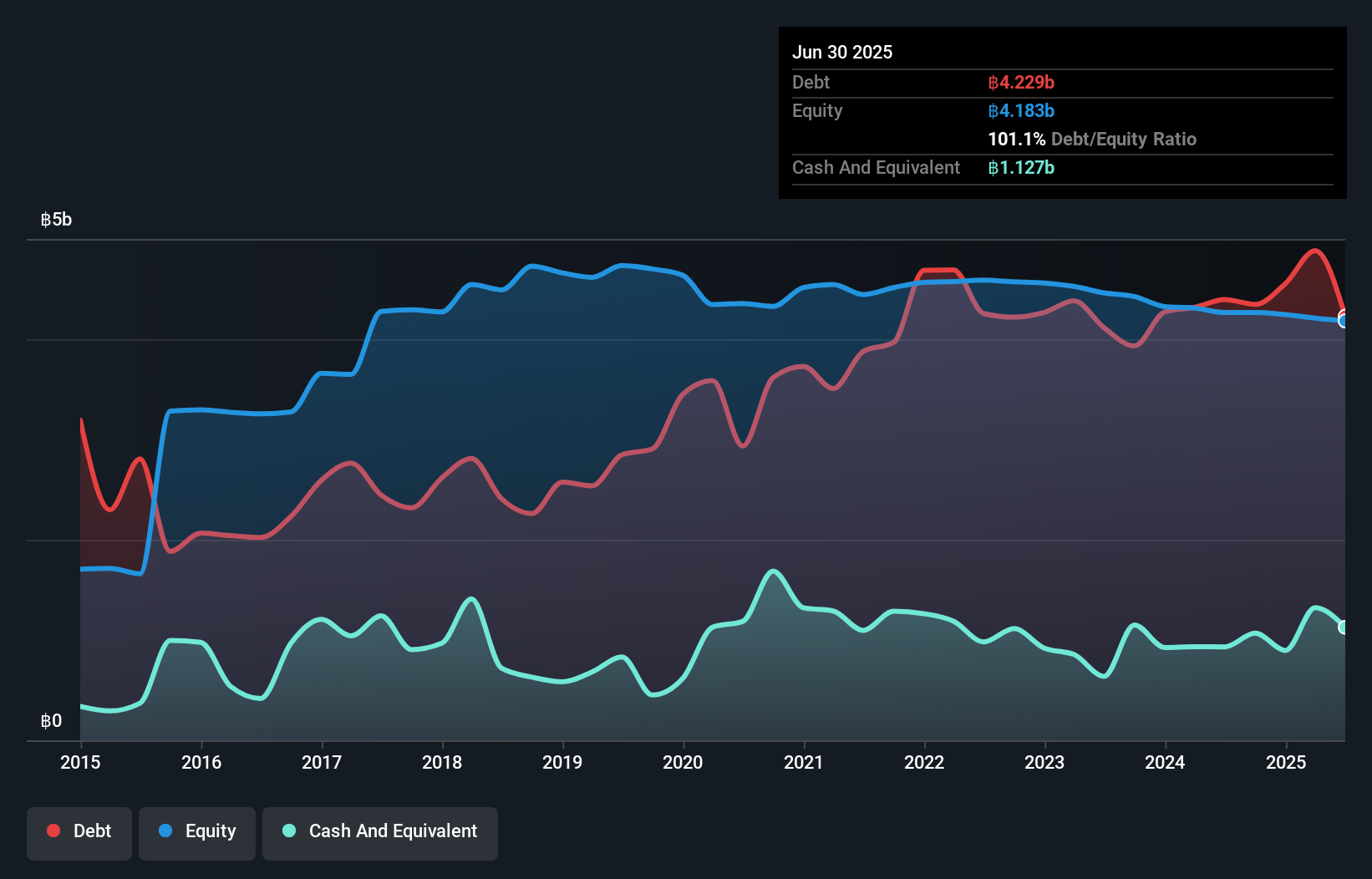

AIRA Capital, with a market cap of THB7.33 billion, operates in Thailand and faces challenges typical of penny stocks. Despite generating revenue from diverse segments like securities and property development, it remains unprofitable with a net loss for the first half of 2025 at THB70.75 million. The company has sufficient short-term assets to cover both short- and long-term liabilities but carries high debt levels with a net debt to equity ratio of 74.2%. AIRA's cash runway is robust for over three years due to positive free cash flow growth, yet its share price remains highly volatile amidst executive changes in its finance leadership team.

- Get an in-depth perspective on AIRA Capital's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into AIRA Capital's track record.

Turning Ideas Into Actions

- Jump into our full catalog of 988 Asian Penny Stocks here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:AIRA

AIRA Capital

Engages in the investment and financial advisory activities in Thailand.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives