The Returns At Xinyi Glass Holdings (HKG:868) Aren't Growing

If we want to find a potential multi-bagger, often there are underlying trends that can provide clues. Amongst other things, we'll want to see two things; firstly, a growing return on capital employed (ROCE) and secondly, an expansion in the company's amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So, when we ran our eye over Xinyi Glass Holdings' (HKG:868) trend of ROCE, we liked what we saw.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. The formula for this calculation on Xinyi Glass Holdings is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = HK$5.6b ÷ (HK$51b - HK$11b) (Based on the trailing twelve months to December 2023).

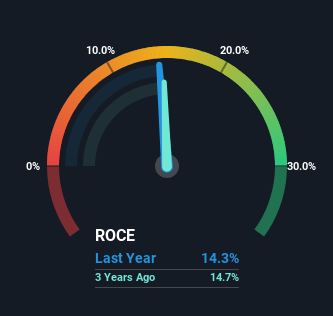

So, Xinyi Glass Holdings has an ROCE of 14%. That's a relatively normal return on capital, and it's around the 13% generated by the Building industry.

Check out our latest analysis for Xinyi Glass Holdings

Above you can see how the current ROCE for Xinyi Glass Holdings compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Xinyi Glass Holdings .

What Can We Tell From Xinyi Glass Holdings' ROCE Trend?

While the current returns on capital are decent, they haven't changed much. The company has employed 51% more capital in the last five years, and the returns on that capital have remained stable at 14%. Since 14% is a moderate ROCE though, it's good to see a business can continue to reinvest at these decent rates of return. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

Our Take On Xinyi Glass Holdings' ROCE

To sum it up, Xinyi Glass Holdings has simply been reinvesting capital steadily, at those decent rates of return. And given the stock has only risen 36% over the last five years, we'd suspect the market is beginning to recognize these trends. So to determine if Xinyi Glass Holdings is a multi-bagger going forward, we'd suggest digging deeper into the company's other fundamentals.

Like most companies, Xinyi Glass Holdings does come with some risks, and we've found 2 warning signs that you should be aware of.

If you want to search for solid companies with great earnings, check out this free list of companies with good balance sheets and impressive returns on equity.

If you're looking to trade Xinyi Glass Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:868

Xinyi Glass Holdings

An investment holding company, produces and sells automobile, construction, float, and other glass products for commercial and industrial applications.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives