If EPS Growth Is Important To You, Xinyi Glass Holdings (HKG:868) Presents An Opportunity

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Xinyi Glass Holdings (HKG:868). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Xinyi Glass Holdings

Xinyi Glass Holdings' Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Xinyi Glass Holdings' shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 40%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

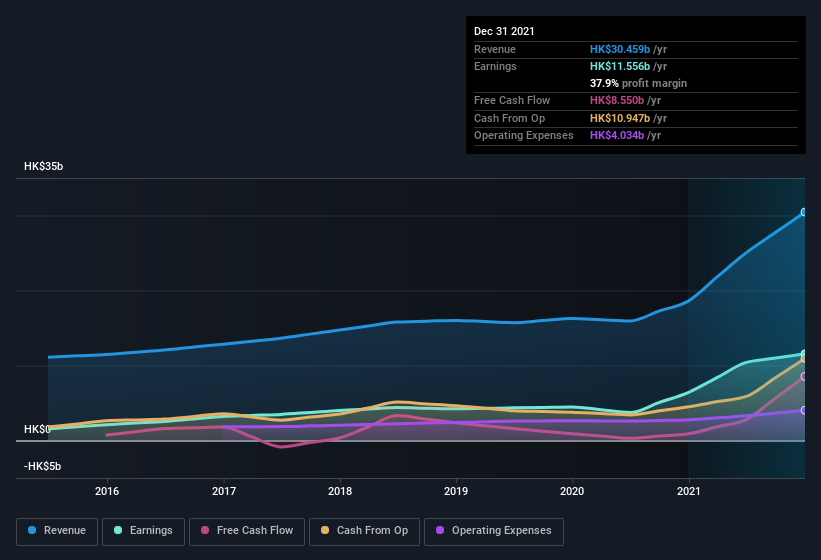

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Xinyi Glass Holdings shareholders can take confidence from the fact that EBIT margins are up from 29% to 40%, and revenue is growing. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Xinyi Glass Holdings.

Are Xinyi Glass Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth HK$1.8b) this was overshadowed by a mountain of buying, totalling HK$24b in just one year. This adds to the interest in Xinyi Glass Holdings because it suggests that those who understand the company best, are optimistic. It is also worth noting that it was CEO & Executive Director Ching Sai Tung who made the biggest single purchase, worth HK$22b, paying HK$20.68 per share.

On top of the insider buying, we can also see that Xinyi Glass Holdings insiders own a large chunk of the company. In fact, they own 59% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. HK$43b That means they have plenty of their own capital riding on the performance of the business!

Is Xinyi Glass Holdings Worth Keeping An Eye On?

Xinyi Glass Holdings' earnings per share growth have been climbing higher at an appreciable rate. To make matters even better, the company insiders who know the company best have put their faith in the its future and have been buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Xinyi Glass Holdings belongs near the top of your watchlist. Still, you should learn about the 2 warning signs we've spotted with Xinyi Glass Holdings (including 1 which is a bit unpleasant).

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Xinyi Glass Holdings, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:868

Xinyi Glass Holdings

An investment holding company, produces and sells automobile, construction, float, and other glass products for commercial and industrial applications.

Flawless balance sheet, undervalued and pays a dividend.