- Hong Kong

- /

- Communications

- /

- SEHK:303

Discovering None's 3 Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As the global markets navigate a landscape marked by fluctuating consumer confidence and mixed economic indicators, small-cap stocks have shown resilience despite recent challenges. With major indices like the S&P 600 reflecting moderate gains, investors are increasingly on the lookout for overlooked opportunities that possess strong fundamentals and potential for growth. In this context, identifying stocks with solid financial health and innovative strategies can be key to uncovering hidden gems in today's market environment.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Vtech Holdings (SEHK:303)

Simply Wall St Value Rating: ★★★★★★

Overview: Vtech Holdings Limited, along with its subsidiaries, is engaged in the design, manufacture, and distribution of electronic products across Hong Kong, North America, Europe, the Asia Pacific, and other international markets with a market capitalization of approximately HK$13.23 billion.

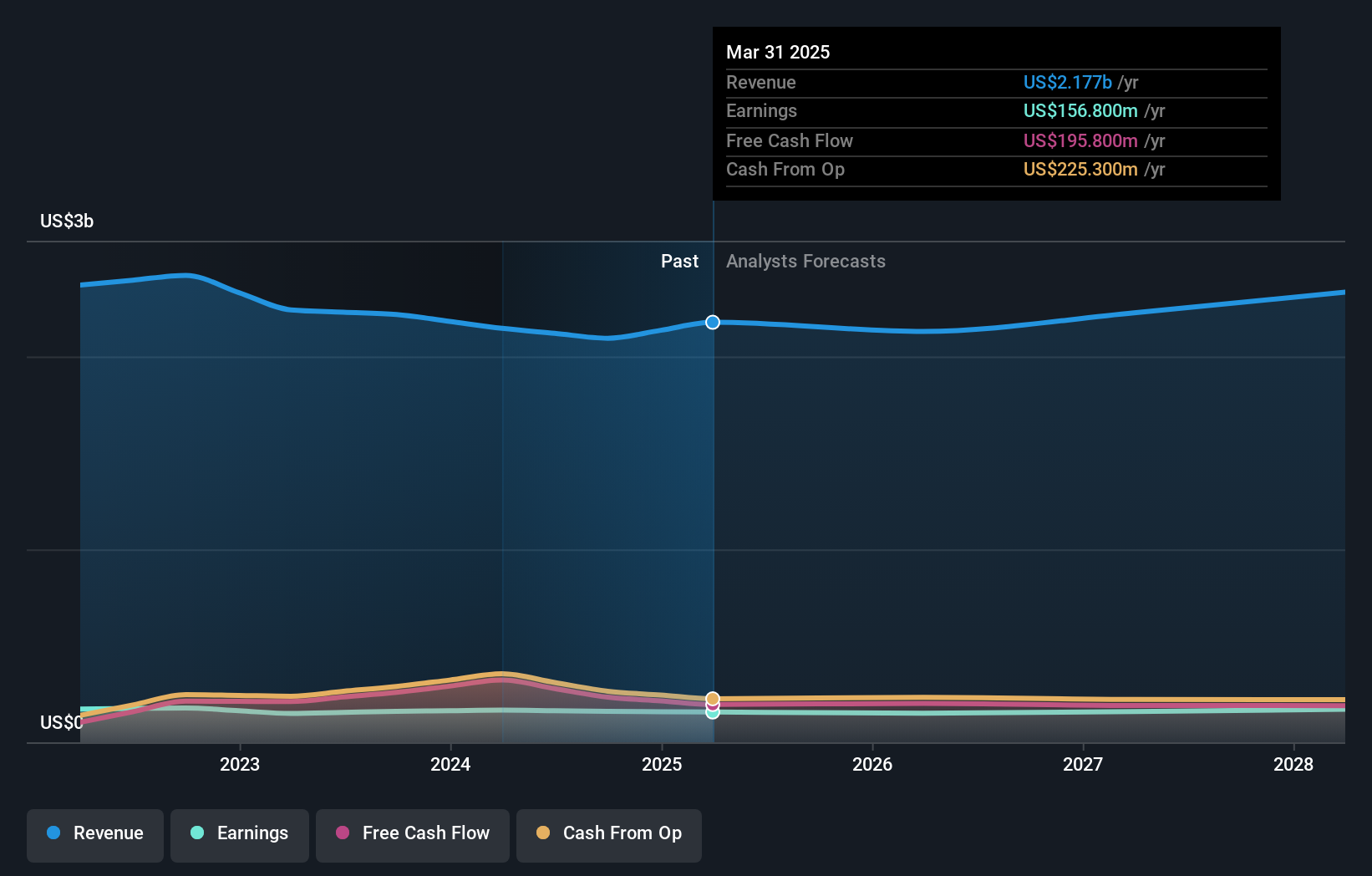

Operations: Vtech generates revenue primarily through the design, manufacture, and distribution of consumer electronic products, amounting to $2.09 billion.

Vtech Holdings, a prominent player in the communications sector, is currently trading at 57.8% below its estimated fair value, presenting an intriguing opportunity for investors. Despite a 5.9% annual decline in earnings over the past five years, Vtech remains debt-free and boasts high-quality past earnings. Recent reports indicate sales of US$1.09 billion for the half-year ended September 2024, with net income reaching US$87.4 million compared to US$93.6 million previously. The company anticipates improved profitability driven by increased U.S. ELPs sales and TEL product revenue following Gigaset's integration into their operations.

Jiangsu Seagull Cooling TowerLtd (SHSE:603269)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangsu Seagull Cooling Tower Co., Ltd. specializes in the design, research and development, manufacturing, and installation of cooling towers both domestically in China and internationally, with a market capitalization of approximately CN¥2.41 billion.

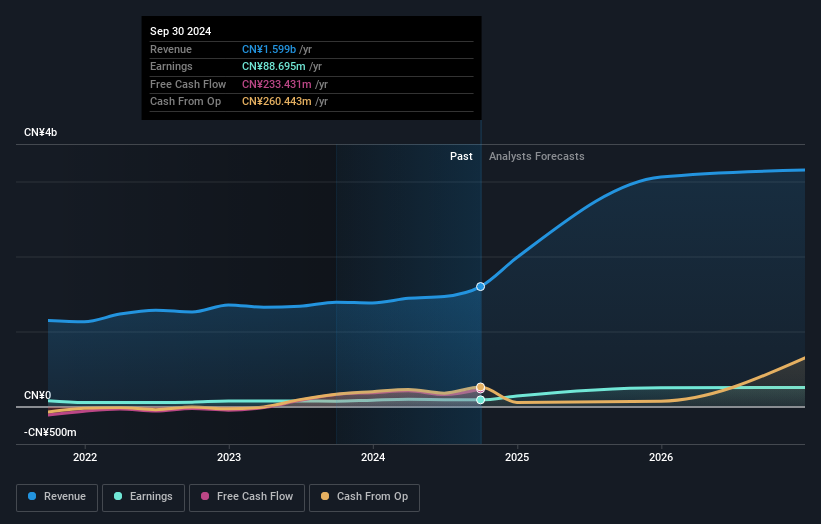

Operations: Seagull Cooling Tower generates revenue primarily from its general equipment manufacturing segment, amounting to CN¥1.60 billion. The company's financial performance is influenced by its ability to manage costs within this segment effectively.

Jiangsu Seagull Cooling Tower Ltd. stands out with a notable earnings growth of 24% over the past year, outperforming the construction industry's -3.9%. Trading at a significant discount of 74% below its estimated fair value, it presents an intriguing opportunity for investors. The company's financial health is underscored by its ability to cover interest payments comfortably, with EBIT covering interest expenses 8 times over. However, the debt-to-equity ratio has risen from 35% to 49% in five years, which could be a point of concern despite having more cash than total debt. A one-off gain of CN¥34 million also influenced recent results significantly.

Astarta Holding (WSE:AST)

Simply Wall St Value Rating: ★★★★★★

Overview: ASTARTA Holding N.V. operates in sugar production, crop growing, soybean processing, and cattle farming across Ukraine and internationally, with a market capitalization of PLN1.05 billion.

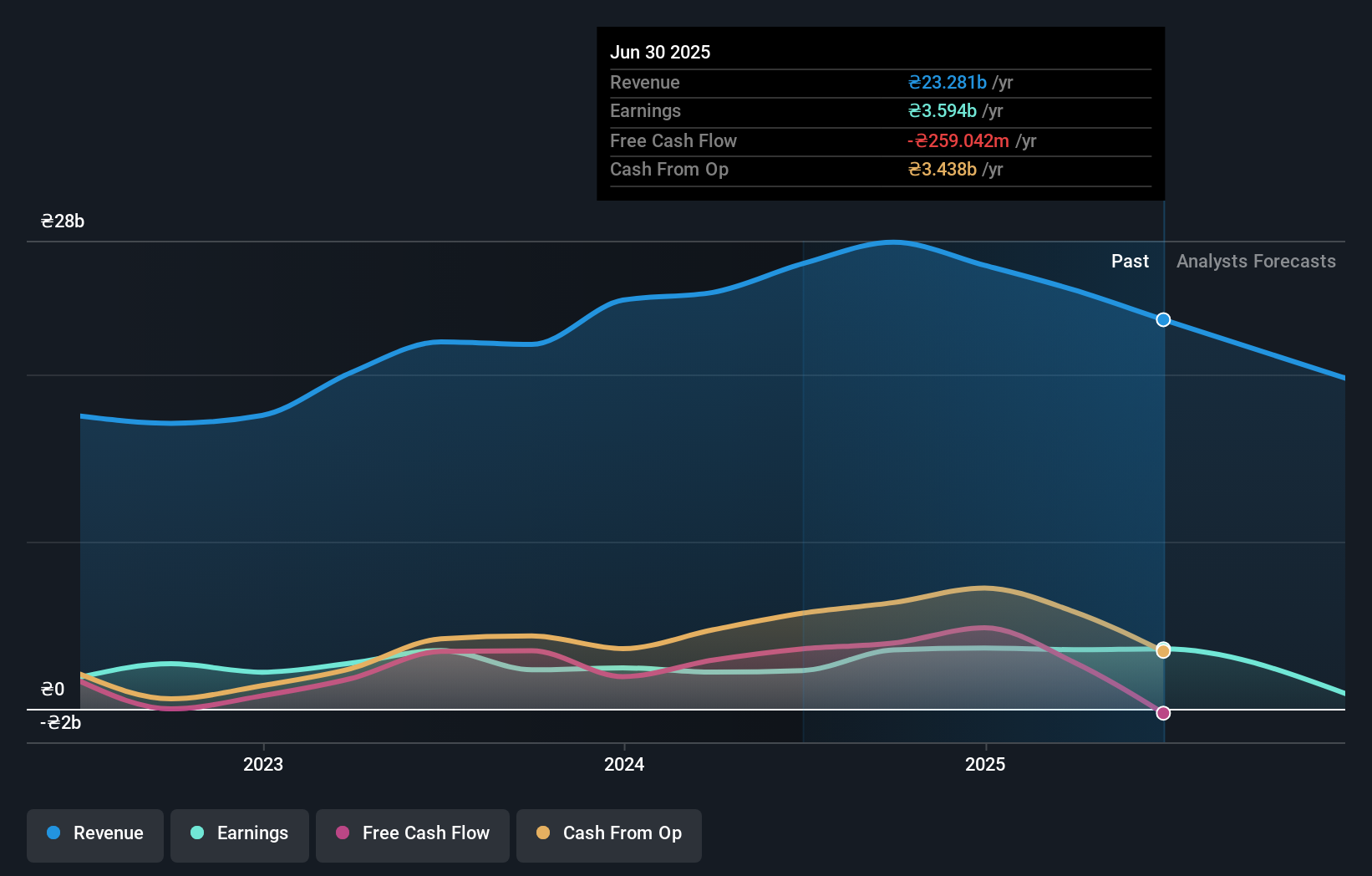

Operations: ASTARTA Holding N.V.'s primary revenue streams are agriculture (UAH17.76 billion), sugar production (UAH9.50 billion), and soybean processing (UAH4.44 billion). The company also generates revenue from cattle farming, amounting to UAH2.08 billion.

Astarta Holding, a notable player in the food industry, has demonstrated significant financial resilience. Over the past five years, its debt to equity ratio improved dramatically from 39.8% to 7.8%, indicating stronger financial health. The company's earnings surged by 50.9% last year, outpacing the industry's growth of 38.6%. Despite a large one-off gain of UAH823 million affecting recent results, Astarta remains profitable with interest payments well-covered at 4.1 times EBIT and trading significantly below estimated fair value by about 94%. Recent quarterly sales climbed to UAH5 billion from UAH4 billion year-on-year, showcasing robust performance amidst market challenges.

- Take a closer look at Astarta Holding's potential here in our health report.

Gain insights into Astarta Holding's past trends and performance with our Past report.

Seize The Opportunity

- Gain an insight into the universe of 4647 Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:303

Vtech Holdings

Designs, manufactures, and distributes electronic products in Hong Kong, North America, Europe, the Asia Pacific, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives