EVA Precision Industrial Holdings (HKG:838) Ticks All The Boxes When It Comes To Earnings Growth

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like EVA Precision Industrial Holdings (HKG:838). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for EVA Precision Industrial Holdings

How Fast Is EVA Precision Industrial Holdings Growing Its Earnings Per Share?

In the last three years EVA Precision Industrial Holdings' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. EVA Precision Industrial Holdings' EPS has risen over the last 12 months, growing from HK$0.11 to HK$0.13. That's a 19% gain; respectable growth in the broader scheme of things.

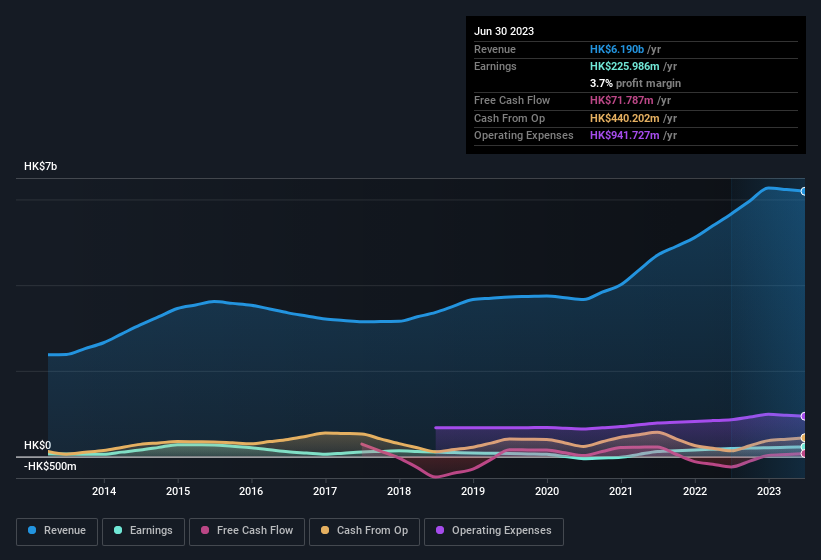

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While we note EVA Precision Industrial Holdings achieved similar EBIT margins to last year, revenue grew by a solid 9.3% to HK$6.2b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since EVA Precision Industrial Holdings is no giant, with a market capitalisation of HK$1.3b, you should definitely check its cash and debt before getting too excited about its prospects.

Are EVA Precision Industrial Holdings Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

The good news is that EVA Precision Industrial Holdings insiders spent a whopping HK$7.6m on stock in just one year, without so much as a single sale. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. We also note that it was the Co-Founder, Yaohua Zhang, who made the biggest single acquisition, paying HK$1.7m for shares at about HK$0.78 each.

On top of the insider buying, we can also see that EVA Precision Industrial Holdings insiders own a large chunk of the company. Owning 43% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. In terms of absolute value, insiders have HK$580m invested in the business, at the current share price. So there's plenty there to keep them focused!

Does EVA Precision Industrial Holdings Deserve A Spot On Your Watchlist?

One positive for EVA Precision Industrial Holdings is that it is growing EPS. That's nice to see. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for EVA Precision Industrial Holdings that you should be aware of.

The good news is that EVA Precision Industrial Holdings is not the only growth stock with insider buying. Here's a list of growth-focused companies in HK with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if EVA Precision Industrial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:838

EVA Precision Industrial Holdings

An investment holding company, provides precision manufacturing services in the People’s Republic of China, Vietnam, and Mexico.

Excellent balance sheet, good value and pays a dividend.