- Hong Kong

- /

- Electrical

- /

- SEHK:8328

Xinyi Electric Storage Holdings Limited's (HKG:8328) 26% Cheaper Price Remains In Tune With Earnings

Xinyi Electric Storage Holdings Limited (HKG:8328) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

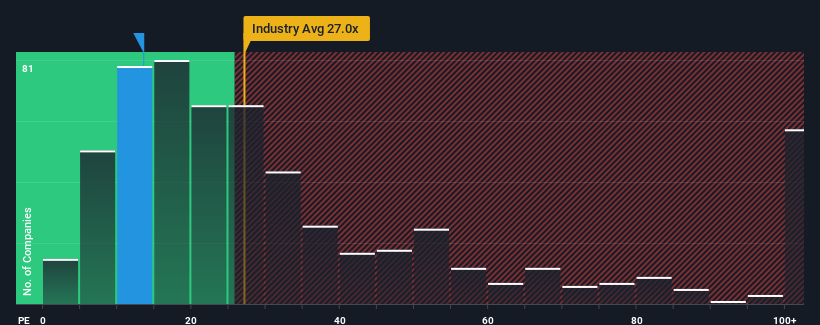

Even after such a large drop in price, Xinyi Electric Storage Holdings' price-to-earnings (or "P/E") ratio of 13.5x might still make it look like a sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Xinyi Electric Storage Holdings as its earnings have been rising very briskly. The P/E is probably high because investors think this strong earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

See our latest analysis for Xinyi Electric Storage Holdings

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Xinyi Electric Storage Holdings' is when the company's growth is on track to outshine the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 72% last year. The latest three year period has also seen an excellent 244% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Xinyi Electric Storage Holdings is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Despite the recent share price weakness, Xinyi Electric Storage Holdings' P/E remains higher than most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Xinyi Electric Storage Holdings revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Xinyi Electric Storage Holdings with six simple checks.

If these risks are making you reconsider your opinion on Xinyi Electric Storage Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8328

Xinyi Electric Storage Holdings

An investment holding company, engages in the energy storage, EPC services, automobile glass repair and replacement services, photovoltaic (PV) films, and other businesses in the People’s Republic of China, Hong Kong, Canada, Malaysia, and internationally.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives