- Hong Kong

- /

- Construction

- /

- SEHK:8059

Investors Continue Waiting On Sidelines For Glory Flame Holdings Limited (HKG:8059)

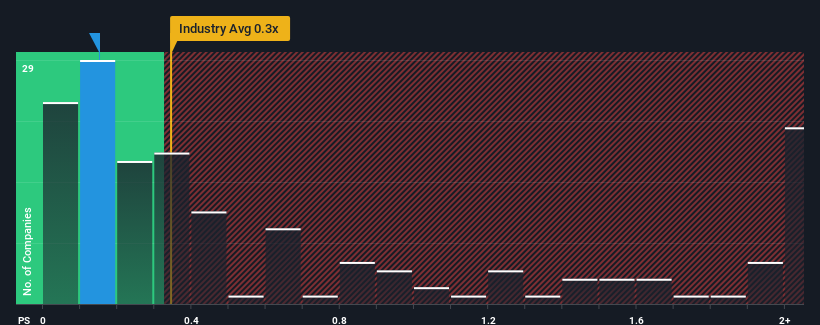

With a median price-to-sales (or "P/S") ratio of close to 0.3x in the Construction industry in Hong Kong, you could be forgiven for feeling indifferent about Glory Flame Holdings Limited's (HKG:8059) P/S ratio of 0.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Glory Flame Holdings

How Has Glory Flame Holdings Performed Recently?

The revenue growth achieved at Glory Flame Holdings over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Glory Flame Holdings will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Glory Flame Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 17%. The latest three year period has also seen an excellent 55% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 12%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's curious that Glory Flame Holdings' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

What Does Glory Flame Holdings' P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We didn't quite envision Glory Flame Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. It appears some are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Glory Flame Holdings that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8059

Glory Flame Holdings

An investment holding company, provides construction services and building materials supply activities in Hong Kong and the People’s Republic of China.

Low and slightly overvalued.

Market Insights

Community Narratives