- Hong Kong

- /

- Electrical

- /

- SEHK:658

Is Now The Time To Put China High Speed Transmission Equipment Group (HKG:658) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in China High Speed Transmission Equipment Group (HKG:658). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for China High Speed Transmission Equipment Group

How Quickly Is China High Speed Transmission Equipment Group Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, China High Speed Transmission Equipment Group's EPS has grown 26% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

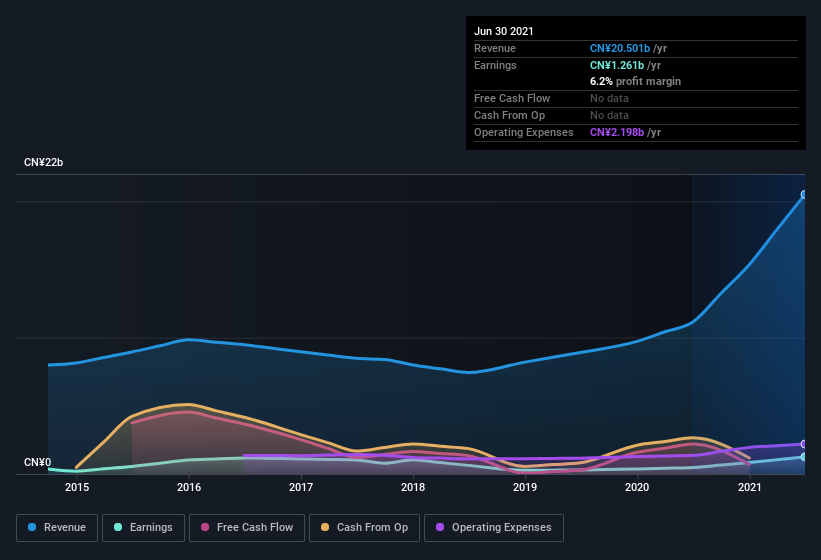

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. China High Speed Transmission Equipment Group maintained stable EBIT margins over the last year, all while growing revenue 84% to CN¥21b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are China High Speed Transmission Equipment Group Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. I discovered that the median total compensation for the CEOs of companies like China High Speed Transmission Equipment Group with market caps between CN¥6.5b and CN¥21b is about CN¥4.1m.

The China High Speed Transmission Equipment Group CEO received CN¥2.5m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is China High Speed Transmission Equipment Group Worth Keeping An Eye On?

Given my belief that share price follows earnings per share you can easily imagine how I feel about China High Speed Transmission Equipment Group's strong EPS growth. The fast growth bodes well while the very reasonable CEO pay assists builds some confidence in the board. So I'd argue this is the kind of stock worth watching, even if it isn't great value today. Still, you should learn about the 2 warning signs we've spotted with China High Speed Transmission Equipment Group (including 1 which is a bit unpleasant) .

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade China High Speed Transmission Equipment Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:658

China High Speed Transmission Equipment Group

Engages in the research, design, development, manufacture, and sale of various mechanical transmission equipment in the People’s Republic of China, the United States, Europe, and internationally.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives