- Hong Kong

- /

- Industrials

- /

- SEHK:656

Fosun International (SEHK:656) Initiates Share Buyback to Enhance Earnings and Market Positioning

Reviewed by Simply Wall St

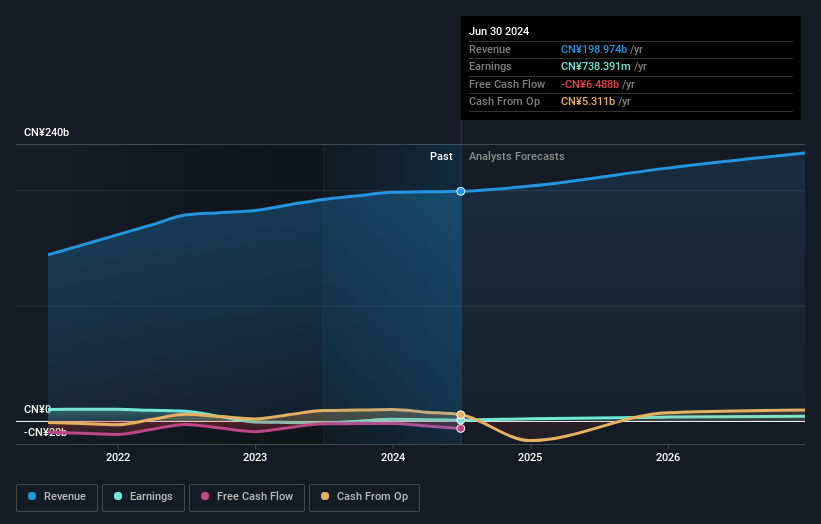

Fosun International (SEHK:656) has recently announced a share repurchase program, authorizing the buyback of up to 10% of its issued share capital, aiming to enhance net asset value per share and earnings per share. Despite reporting a decrease in net income for the first half of 2024, the company is poised for significant profit growth, projecting a 53.5% annual increase, supported by its strategic market positioning and commitment to innovation. In the following discussion, we will explore Fosun's financial performance, growth opportunities, and the challenges it faces, including its valuation metrics and external threats.

Get an in-depth perspective on Fosun International's performance by reading our analysis here.

Innovative Factors Supporting Fosun International

Fosun International's earnings are projected to grow at an impressive 53.5% annually, reflecting a promising trajectory for future profitability. The company's recent shift to profitability underscores its potential for sustained growth. With a satisfactory net debt to equity ratio of 31.1%, Fosun International demonstrates financial stability, which is crucial for supporting its ambitious growth plans. In the latest earnings call, Chen Qiyu, Executive Director and Co-CEO, emphasized their leading market position in China, highlighting solid revenue performance. This strategic market positioning is further bolstered by their commitment to innovation, as demonstrated by their long-term investment in R&D. The company's share repurchase program, authorized to buy back up to 10% of its issued share capital, aims to enhance net asset value per share and earnings per share, showcasing a proactive approach to capital management.

To gain deeper insights into Fosun International's historical performance, explore our detailed analysis of past performance.

Vulnerabilities Impacting Fosun International

Fosun International faces challenges with a low Return on Equity of 1.6%, indicating underperformance compared to industry standards. Revenue growth at 5.7% annually lags behind industry and market averages, highlighting a need for strategic initiatives to boost growth. The company's earnings have decreased by 45.3% annually over the past five years, raising concerns about its long-term financial health. Additionally, the company's valuation, with a Price-To-Earnings Ratio of 46.4x, is significantly higher than the Asian Industrials industry average of 11.4x and peer average of 7.2x, which may not align with its current financial metrics.

To learn about how Fosun International's valuation metrics are shaping its market position, check out our detailed analysis of Fosun International's Valuation.

Growth Avenues Awaiting Fosun International

Fosun International is poised for significant profit growth over the next three years, offering substantial opportunities to enhance its market position. The company's recent profitability opens new avenues for strategic expansion, particularly in international markets. Wang Qunbin, Executive Director and Co-CEO, highlighted the potential for growth beyond China, which could lead to diversification and new revenue streams. Their focus on digital transformation and proactive monitoring of regulatory changes further positions them to capitalize on emerging opportunities.

See what the latest analyst reports say about Fosun International's future prospects and potential market movements.

External Factors Threatening Fosun International

While Fosun International is navigating a promising growth path, it faces external threats such as economic headwinds and supply chain disruptions. These factors could impact business performance and operational efficiency, as noted by Xiaoliang Xu, Executive Director. Additionally, the presence of large one-off gains may obscure true financial performance, leading to uncertainty among analysts and investors. The complex regulatory environment also presents challenges that could slow product launches and strategic initiatives.

Explore the current health of Fosun International and how it reflects on its financial stability and growth potential.

Explore the current health of Fosun International and how it reflects on its financial stability and growth potential.Conclusion

Fosun International's impressive projected earnings growth of 53.5% annually and its strategic market positioning in China highlight its potential for future profitability and expansion. However, the company's low Return on Equity of 1.6% and revenue growth lagging behind industry averages suggest a need for strategic initiatives to enhance financial performance. The high Price-To-Earnings Ratio of 46.4x, significantly above industry and peer averages, raises concerns about the alignment of current financial metrics with market expectations, potentially impacting investor sentiment. Despite these challenges, Fosun's focus on innovation, international expansion, and digital transformation presents substantial opportunities for growth, provided it effectively navigates external threats like economic fluctuations and regulatory complexities.

Seize The Opportunity

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Fosun International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:656

Fosun International

Operates in the health, happiness, wealth, and intelligent manufacturing sectors in Mainland China, Portugal, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives