- Hong Kong

- /

- Industrials

- /

- SEHK:656

Does Fosun International’s Streamlining Strategy Make Its Low Valuation Look More Appealing in 2025?

Reviewed by Bailey Pemberton

- Wondering if Fosun International at HK$4.97 is quietly turning into a value opportunity, or just another value trap in Hong Kong stocks.

- The share price is up 0.6% over the last week, 1.2% over the past month, and 12.7% year to date, yet anyone who has held for 3 or 5 years is still looking at -16.2% and -51.5% respectively.

- Recent headlines have focused on Fosun International streamlining its portfolio and deleveraging its balance sheet, as the group continues to refocus on core businesses and reduce complexity. That shift in strategy is helping to reshape market expectations around both growth potential and financial risk. This partly explains the improving share price momentum.

- Right now, Fosun International scores a 5/6 valuation check score, suggesting it screens as undervalued on most of our metrics. Next, we will walk through those valuation methods in detail and then finish with a more intuitive way to tie them all together.

Find out why Fosun International's 16.4% return over the last year is lagging behind its peers.

Approach 1: Fosun International Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to a present value. For Fosun International, we use a 2 stage Free Cash Flow to Equity approach based on its CN¥ cash flows.

The group generated roughly CN¥20.4 billion in free cash flow over the last twelve months. Analyst forecasts and Simply Wall St extrapolations suggest this could rise to around CN¥219.6 billion by 2035, with growth strongest in the early years and then gradually slowing as the business matures.

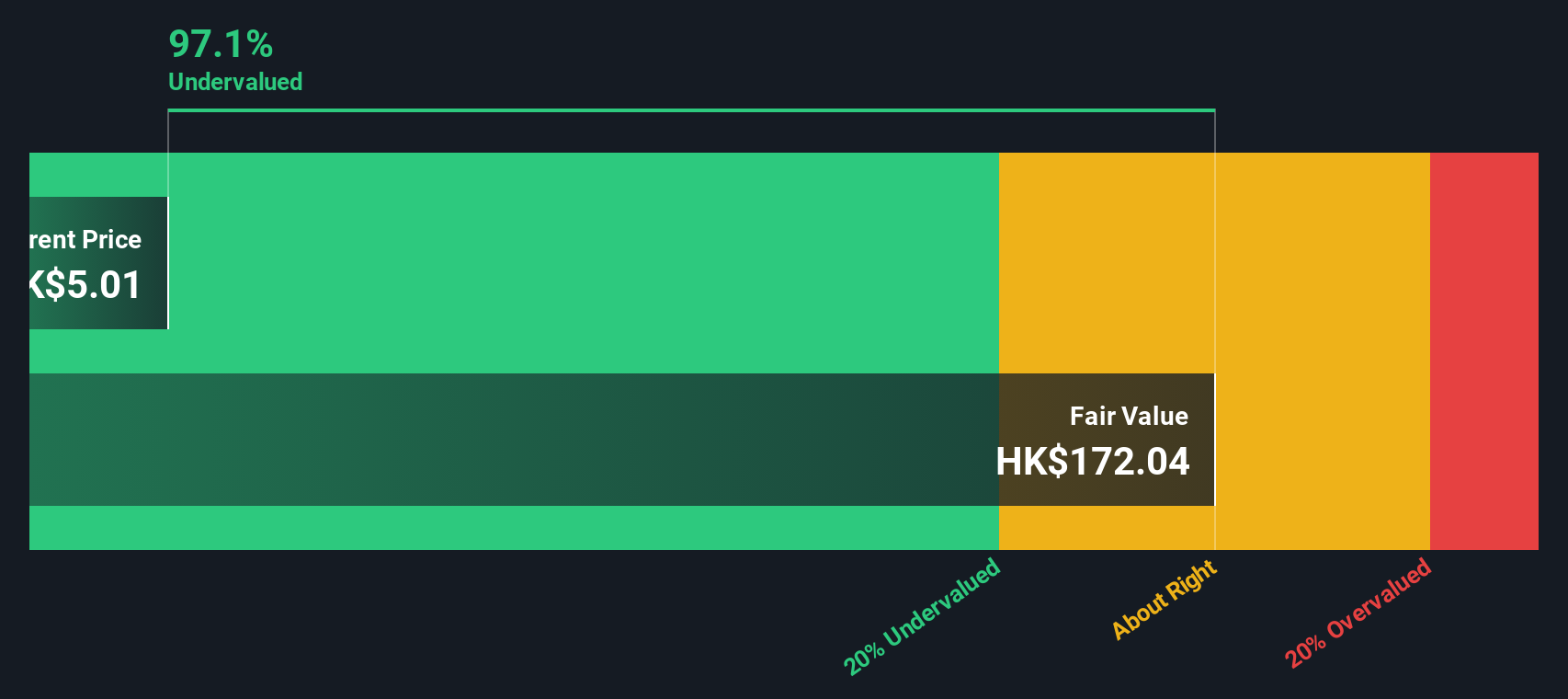

When these future cash flows are discounted back to today, the model points to an intrinsic value of about HK$173.48 per share. Compared with the current share price near HK$4.97, the DCF implies Fosun International is trading at roughly a 97.1% discount to its estimated fair value, which may indicate a substantial margin of safety if the projections prove realistic.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fosun International is undervalued by 97.1%. Track this in your watchlist or portfolio, or discover 925 more undervalued stocks based on cash flows.

Approach 2: Fosun International Price vs Sales

For a conglomerate like Fosun International, where earnings can be volatile or distorted by one off items, the price to sales (P/S) ratio is often a cleaner way to judge valuation. It looks at how much investors are paying for each dollar of revenue, which tends to be more stable than earnings and is useful when profits are cycling up and down. In general, higher growth, higher margins and lower risk justify a higher P/S multiple. In contrast, slower growth or elevated leverage usually cap what the market is willing to pay.

Fosun International currently trades on a P/S of about 0.20x, compared with roughly 0.84x for the wider Industrials sector and around 1.02x for its peers. Simply Wall St also calculates a Fair Ratio for each company, which is a proprietary view of what the P/S should be given factors like growth prospects, profitability, balance sheet risk, industry and market capitalization. This tends to be more informative than a simple peer comparison because it adjusts for company specific strengths and weaknesses. Fosun International’s Fair Ratio is estimated at 0.85x, well above its current 0.20x, which indicates the shares still look materially undervalued on a sales based lens.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fosun International Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers you think it can deliver in future revenue, earnings and margins. A Narrative is your own storyline for Fosun International that links what you believe about its strategy, risks and opportunities to a concrete financial forecast and, ultimately, to a fair value estimate. On Simply Wall St, Narratives are built and shared by millions of investors on the Community page, making them an easy, accessible tool to sanity check your thinking and see how others are joining the dots from story to valuation. Once you have a Narrative, you can use it to decide how you want to act by continuously comparing your Fair Value to the current share price. Because Narratives update dynamically when new information like earnings or news arrives, they stay relevant rather than going stale. For Fosun International, one Narrative might justify a fair value near HK$6.51 while another, more cautious view, may see closer to HK$4.68 as reasonable.

Do you think there's more to the story for Fosun International? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:656

Fosun International

Operates in the health, happiness, wealth, and intelligent manufacturing sectors in Mainland China, Portugal, and internationally.

Undervalued with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026