CHTC Fong's International Company Limited's (HKG:641) 25% Dip In Price Shows Sentiment Is Matching Revenues

To the annoyance of some shareholders, CHTC Fong's International Company Limited (HKG:641) shares are down a considerable 25% in the last month, which continues a horrid run for the company. Longer-term shareholders would now have taken a real hit with the stock declining 6.4% in the last year.

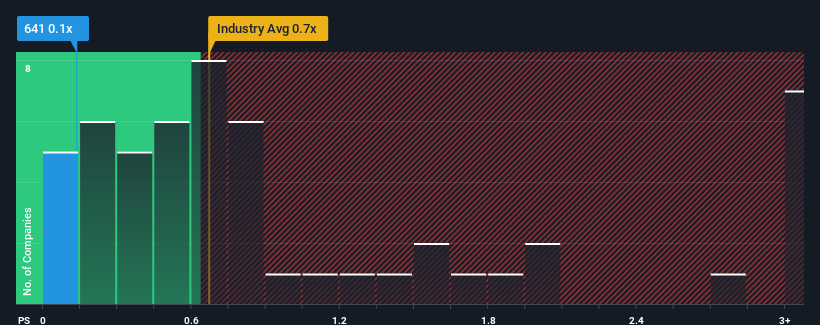

Following the heavy fall in price, when close to half the companies operating in Hong Kong's Machinery industry have price-to-sales ratios (or "P/S") above 0.7x, you may consider CHTC Fong's International as an enticing stock to check out with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for CHTC Fong's International

How Has CHTC Fong's International Performed Recently?

For instance, CHTC Fong's International's receding revenue in recent times would have to be some food for thought. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on CHTC Fong's International will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, CHTC Fong's International would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. As a result, revenue from three years ago have also fallen 27% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 13% shows it's an unpleasant look.

With this information, we are not surprised that CHTC Fong's International is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does CHTC Fong's International's P/S Mean For Investors?

CHTC Fong's International's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of CHTC Fong's International revealed its shrinking revenue over the medium-term is contributing to its low P/S, given the industry is set to grow. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for CHTC Fong's International (2 can't be ignored!) that you should be aware of.

If these risks are making you reconsider your opinion on CHTC Fong's International, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:641

CHTC Fong's International

An investment holding company, manufactures and sells dyeing and finishing machines.

Good value slight.

Market Insights

Community Narratives